Auditor General flags Sh1.37 billion overdue payments at KenGen amid rising debts

The provision for Kenya Power’s debt alone increased by 78 per cent to Sh830.99 million, as the Sh16.65 billion owed remained largely unsettled.

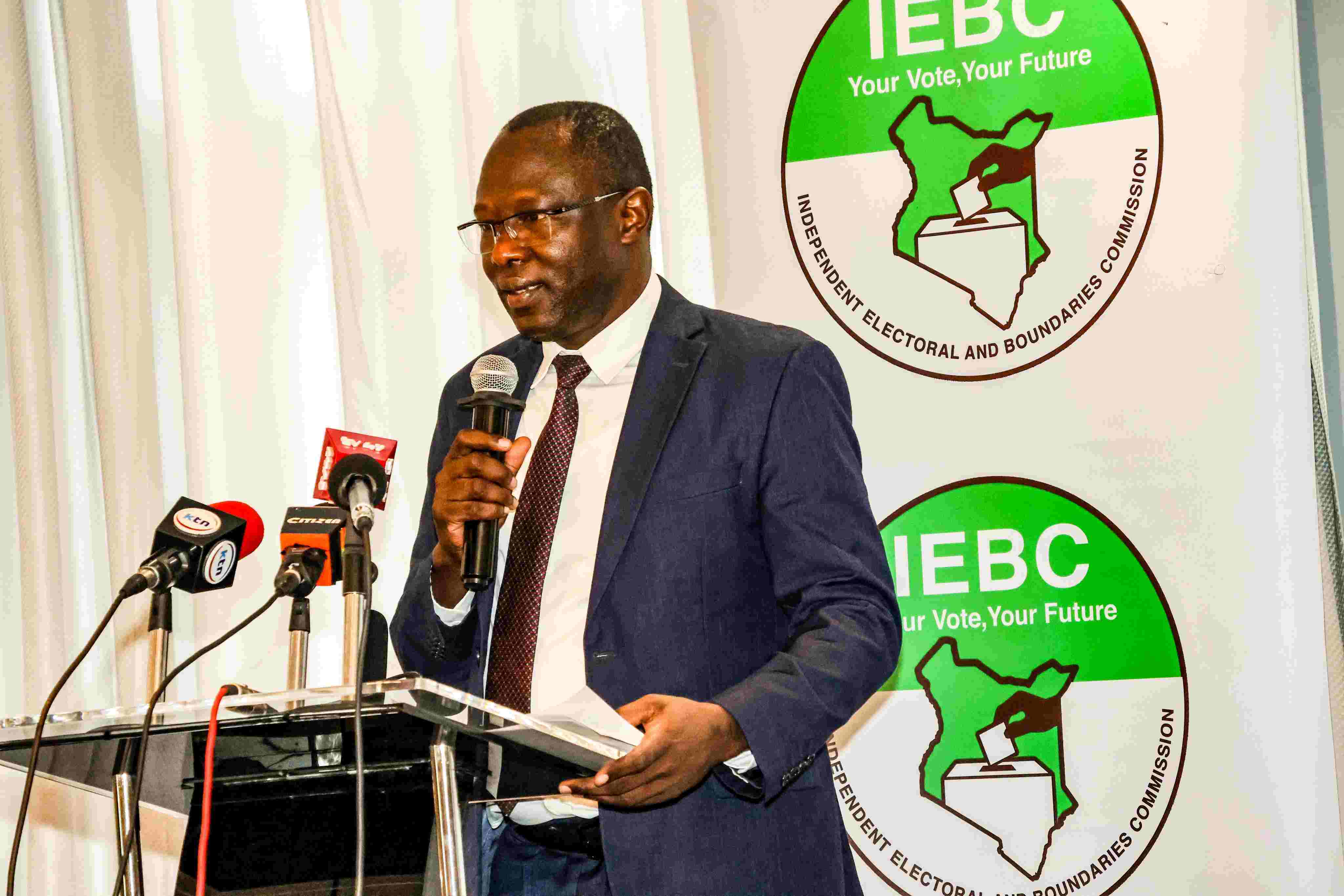

Auditor General Nancy Gathungu has raised concerns over mounting overdue payments at Kenya Electricity Generating Company (KenGen), revealing that the power producer has set aside Sh1.37 billion to cover expected defaults from suppliers, mainly Kenya Power, which owed the company Sh16.65 billion as of June 2025.

According to KenGen’s latest financial statements, the allowance for impairment rose sharply to Sh1.37 billion for the year ended June 2025, up from Sh774.71 million in the previous year, reflecting increasing debts from its main commercial customer, Kenya Power, and other non-commercial clients. The provision for Kenya Power’s debt alone increased by 78 per cent to Sh830.99 million, as the Sh16.65 billion owed remained largely unsettled.

More To Read

- Auditor General flags Kenya Power for missing 30 per cent tender quota for youth, women, and PWDs

- Kenya’s electricity demand hits all-time high of 2,439 MW, straining power generation capacity

- State agencies, counties owe Kenya Power Sh4.67 billion in unpaid bills - Auditor General

- Kenya Power ends manual applications, new connection requests exclusively via website

- Over 16,000 in the dark as Kenya Power struggles to procure essential meters, transformers

- 122 electrocuted as illegal connections, encroachment rise - Kenya Power

Non-commercial clients were allocated Sh545 million in provisions, a 76.9 per cent rise from Sh308 million the prior year. Receivables from these clients closed the year at Sh1.27 billion, up from Sh982.42 million, with two companies—including one foreign firm—accounting for Sh890 million of the overdue sum.

Auditor General Gathungu noted that most of KenGen’s receivables exceed the standard 30–90-day credit period, highlighting weaknesses in contractual terms that fail to enforce timely payments.

“The extended outstanding receivables are attributed to weak contractual terms with clients, which do not sufficiently safeguard timely payment,” Gathungu said.

“Delayed collection of receivables would negatively affect the company's cash flows and working capital position, while the prolonged outstanding balances increase the risk of bad debts, which may require additional provisions and result in financial losses. The situation could also impact the company's ability to fund operations and meet its obligations when they fall due.”

KenGen allows a credit period of 40 days for Kenya Power and 30 days for other customers. Accounts exceeding this period are considered credit-impaired and assessed for potential losses at year-end. The audit report revealed that Kenya Power’s actual payment cycle averages 113 days, forcing KenGen to increase its impairment allowance to cover the higher risk of non-payment.

The persistent delays highlight ongoing challenges in collecting dues from Kenya’s main power distributor, putting pressure on KenGen’s liquidity and operational funding.

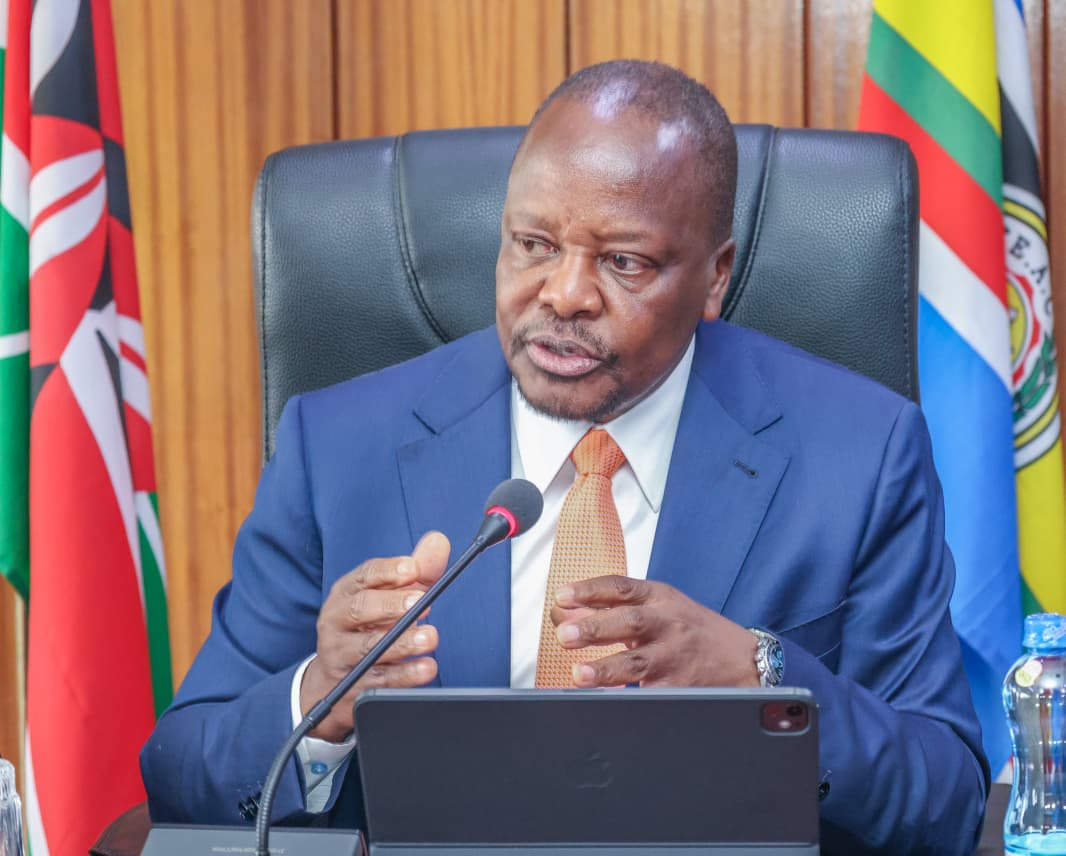

The overdue payments come amid ongoing electricity supply challenges. President William Ruto recently acknowledged that Kenya’s current energy generation is insufficient to meet demand, forcing daily load-shedding between 5:00 pm and 10:00 pm to maintain grid stability. Speaking in Doha, Qatar, during a meeting with Kenyans living abroad, the President said the country needs Sh1.2 trillion to expand power capacity to 10,000 megawatts and ease persistent shortages.

“Today in Kenya, between 5:00 pm and 10:00 pm, we have to do load-shedding. We have to shut off some areas to power other areas because our energy is insufficient,” he said.

He noted that Kenya’s current generation capacity of 2,316 megawatts is the highest in five years but still falls short of demand.

“If we have to industrialise and engage in manufacturing, we need a minimum of 10,000 MW of energy,” the president said, highlighting that a single large data centre alone could consume nearly half of the current national output.

The President said his government has launched a Sh1.2 trillion investment plan to expand energy capacity, including infrastructure projects such as the first phase of Konza City, plans for 50 mega-dams, and expanded irrigation across two million acres.

However, he acknowledged challenges including ageing hydroelectric infrastructure, costly geothermal projects, and stalled coal and nuclear projects due to environmental concerns.

The Sh200 billion Lamu coal power plant licence was revoked last year for environmental violations, while the 1,000-megawatt nuclear plant has been relocated from the coast to Lake Victoria, with completion expected in 2034.

Experts warn that unless Kenya Power clears its overdue debts promptly, KenGen’s ability to fund operations and support expansion plans could be compromised, potentially affecting electricity supply stability and tariffs for consumers across the country.

Top Stories Today