Kenyan households drowning in debt despite financial inclusion gains

Kenya’s financial inclusion has soared, yet financially healthy households have nearly halved. A new 2025–2028 national strategy aims to curb debt, gambling risks and weak consumer protection.

Kenya is witnessing a worrying decline in financial well-being, with many households struggling under rising personal debt even as access to financial services expands rapidly.

New data from the National Treasury and the Central Bank of Kenya (CBK) shows that financial inclusion jumped from 26.7 per cent in 2016 to 84.8 per cent in 2024, largely driven by mobile technology, digital financial services, and innovative payment solutions.

More To Read

- Kenyan men handled majority of mobile money deals in 2024 with Sh5.3 trillion in transactions - CBK report

- CBK proposes cap on mobile money fees to ease transfer costs

- Kenya leads in mobile money borrowing as Sub-Saharan Africa leans on informal loans - World Bank Report

- Kenya's mobile money transactions hit record Sh6.5 trillion

- Safaricom rolls out standing order feature for M-Pesa users

- Airtel removes 7-day limit for accessing money from competing networks

However, the share of Kenyans who are financially healthy, able to meet expenses, handle emergencies, and plan for the future has fallen sharply from 39.6 per cent to 18.3 per cent over the same period.

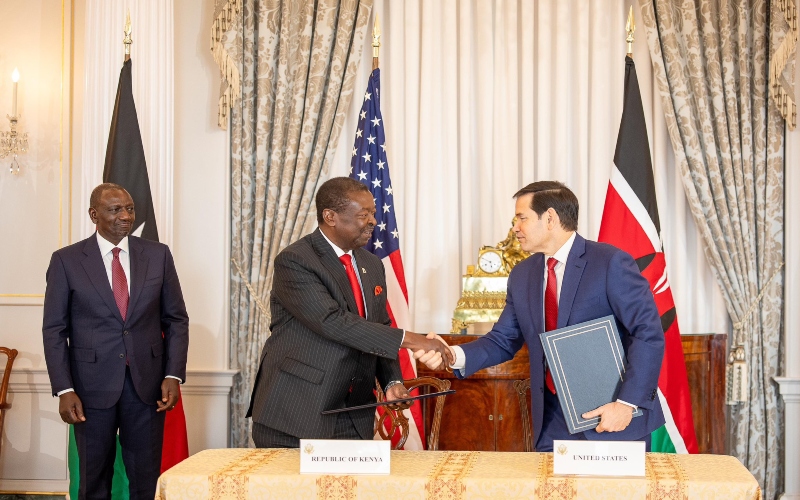

To address this worrying trend, Kenya has unveiled a new four-year National Financial Inclusion Strategy (NFIS), aimed at broadening equitable access to quality financial services while promoting responsible use.

CBK Governor Kamau Thugge described the strategy as “an urgent response to structural weaknesses that are dragging millions into financial vulnerability”. He added, “Over-indebtedness, gambling and weak consumer protection undermine financial health, especially among youth and low-income households.”

The surge in financial inclusion has been fueled primarily by mobile money, which now covers 82.3 per cent of adults.

Other drivers include digital credit, agency banking, fintech partnerships, and contactless payments. But experts warn that digital lending has made it easier to borrow quickly, often at high costs, pushing many into consumption-driven debt rather than investments.

Many borrowers now juggle multiple short-term loans without adequate repayment capacity, leading to cycles of default, blacklisting, and eventual exclusion from formal financial systems.

Gambling, particularly through instant mobile payments, has worsened the problem among young people, creating unstable household finances and erratic cash flow.

The NFIS highlights that while more Kenyans can access money than ever before, the effective use of these financial services to improve lives remains limited.

Treasury Cabinet Secretary John Mbadi said the 2025–2028 strategy will address these gaps through a “multi-stakeholder, data-driven and innovation-led approach, bringing together regulators, financial institutions, private sector innovators and development partners.”

“Only 36 per cent save through formal channels, and insurance usage remains low at 22 per cent. Many users rely heavily on mobile transfers, with limited uptake of savings, pensions, insurance or investment products designed to build resilience. Among the plans we have is to increase the levels of savings from the current,” he added.

Treasury Principal Secretary Chris Kiptoo said the NFIS will include large-scale financial literacy programs to equip households with the budget skills, manage credit, save, insure, and invest.

“Kenya’s new strategy is one of the first in Africa to explicitly make financial health, not access, the core outcome of inclusion policy. It attempts to shift the narrative from transactional access to meaningful usage, affordability, transparency and consumer empowerment,” he noted.

The success of the strategy, the officials said, will depend on strong coordination between public and private sectors, supported by policy reforms, robust regulation, digital infrastructure, reliable data systems, and comprehensive financial education.

Top Stories Today