KNCCI criticises proposed Sh2 million penalty for eTIMS non-compliance

The proposed penalty, KNCCI contends, could have dire consequences for these smaller enterprises, potentially leading to closures and significant job losses.

The Kenya National Chamber of Commerce and Industry (KNCCI) has criticised the proposed penalty of Sh2 million per month for non-compliance with the Electronic Tax Invoice Management System (eTIMS), as outlined in the Finance Bill 2024.

In an official statement, KNCCI expressed deep concern over what it perceives as an overly punitive measure, asserting that such a penalty could negatively affect the micro, small, and medium enterprises (MSMEs) that form the backbone of Kenya's economy.

More To Read

- Weak taxation of wealthy costs Kenya Sh130 billion annually, report finds

- KNCCI opposes proposed Business Council, cites overlap and lack of clarity

- Ex-Nairobi governor Sonko gets relief as Tribunal directs KRA to unfreeze his bank accounts

- Businesses granted 30-day relief on long-stay container charges at Mombasa port

- Meta to deduct 5 per cent tax on Kenyan creators’ earnings in 2026

- National Treasury says weak revenue, high debt repayments straining Kenya’s budget

"The proposed penalty could have dire consequences for these smaller enterprises, potentially leading to closures and significant job losses," KNCCI warned on Monday, May 20.

The chamber highlighted the critical role MSMEs play in driving economic growth, contributing approximately 40 per cent to the nation's GDP and employing over 80 per cent of its workforce.

KNCCI stated that the Kenya Revenue Authority (KRA) recorded only a meagre 20 per cent low registration rate on eTIMS by March 31 this year, a deadline it had set for businesses to adopt the technology.

The low compliance rate, according to KNCCI, was indicative of the widespread challenges businesses face in adopting the eTIMS system.

Furthermore, KNCCI's Quarterly Business Barometer Survey for Q2/2024 highlighted the prevalence of businesses with annual revenues below Sh1 million, indicating how harsh the economy has impacted various entrepreneurs.

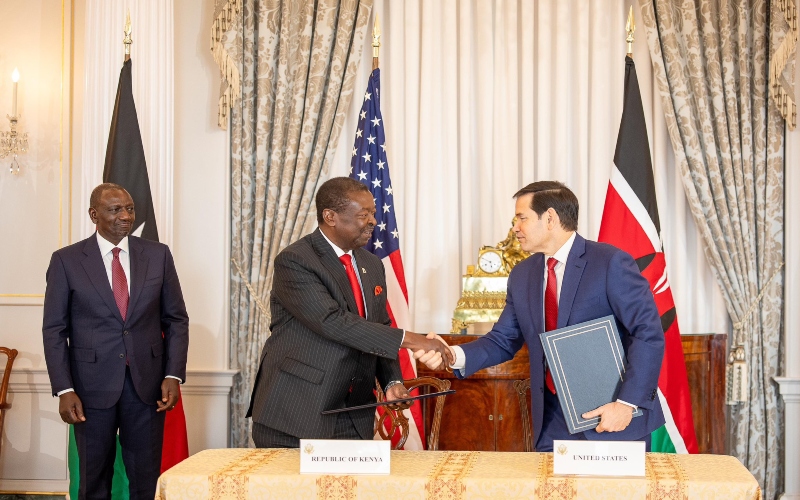

KNCCI president Erick Rutto addresses the media at a past conference. (Photo: KNCCI)

KNCCI president Erick Rutto addresses the media at a past conference. (Photo: KNCCI)KNCCI president Erick Rutto addresses the media at a past conference. (Photo: KNCCI)

"The majority of these enterprises operate in the informal economy and have neither clearly understood nor adopted eTIMS," the chamber noted.

The proposed penalty, KNCCI contends, could have dire consequences for these smaller enterprises, potentially leading to closures and significant job losses. The chamber emphasised the need for a more nuanced approach, advocating for comprehensive capacity-building programmes and accessible information dissemination to facilitate eTIMS compliance among MSMEs.

"The government should invest in comprehensive capacity-building programmes and provide clear, accessible information and training to ensure that MSMEs are well-equipped to comply with eTIMS," KNCCI urged.

In addition, KNCCI proposed a phased implementation of eTIMS, allowing businesses a grace period to adapt and suggesting a tiered penalty system that escalates gradually to mitigate the immediate burden on smaller enterprises.

Despite its criticism of the proposed penalty, KNCCI reaffirmed its commitment to collaborative efforts with the government, aiming to strike a balance between tax compliance objectives and the sustainable growth of the MSME sector.

"We urge the government to reconsider the proposed penalty and to prioritise capacity-building initiatives to ensure that MSMEs can effectively adopt and comply with eTIMS," stated KNCCI.

"Together, we can create an environment where businesses of all sizes can thrive and contribute to Kenya's economic prosperity."

Top Stories Today

Reader Comments

Trending