Kenyan developers say high cost of loans slowing down construction

The most affected are those in the government’s affordable housing scheme who rely fully on debt financing to do projects.

Developers have urged the Central Bank of Kenya to consider lowering the base lending rate or maintaining it at some consistency, to lower the cost of borrowing.

In the past year, the CBK has raised the lending rate at least three times to reduce inflation and stabilise prices. In June last year, the rate rose from 9.5 per cent to 10.5 per cent before rising to 12.5 per cent in December and 13 per cent in February this year. This has made borrowing more expensive, stifling development.

More To Read

- Proposed Bill set to mandate solar panels on new homes

- Audit exposes systemic procurement failures in stadium projects

- Nairobi property developers raise concerns over harassment in Parklands

- National Construction Authority warns landlords not to add extra floors to occupied buildings

- One dead, two injured as scaffold collapses at Eastleigh construction site

- Construction value jumps to Sh310bn as demand for housing rises

“Many customers are now paying interest rates of more than 20 per cent since banks take into account factors such as the risk of defaulting when pricing their loans,” says Daniel Ojijo, a developer.

According to data from the CBK, towards the end of 2023, the average rate of loan default was 15 per cent, the highest in two decades. This was attributed to the high cost of loans.

“Even the off-plan developers who take money from customers first, then develop have been affected because normally, you cannot raise all the money from the customer at once. You’ll raise about 60 per cent as equity then 40 per cent as debt (loans),” says Ojijo.

This has resulted in many projects stalling, with some developers now opting to put the money acquired as loans into other ventures likely to generate quicker earnings, such as retail trade.

The most affected are those in the affordable housing scheme who rely fully on debt financing to do projects, then generate a return once they sign off the building to the contractor — in this case the government.

According to the Kenya Property Developers Association, only about 50,000 housing units are being built annually, against a demand of 250,000, due to the high cost of loans.

“When the loan is expensive, the profit margin reduces. So, what we are seeing is that many developers are now shunning affordable housing, even with the incentives offered through the subsidised cost of construction materials,” says Simon Malonza, a developer in Pangani, Nairobi.

The high cost of loans has also forced landlords to raise rent for tenants to fully service their loans on time.

“If we have a slowdown in construction activities, it then means that we will have a limited number of properties for tenants to choose from, giving landlords the liberty to increase their rent as they know people would still be willing to pay,” says Malonza.

VAT

The cost of construction is likely to rise further if the proposal to introduce 16 per cent VAT on certain financial services sails through parliament, as this will significantly increase the cost of borrowing.

“The natural reaction for developers will be to park their cash equity in bonds and fixed income securities that offer up to 18 per cent returns, with very low risk, as opposed to investing in a project where they will need to borrow money at a cost that is not profitable or sustainable,” says Alex Njage, the head of construction at Bowmans Kenya.

According to auditor Mohsin Adamjee, even developers who rely on Sharia-compliant banks that do not charge interest on loans, or those who rely on crowdfunding from the diaspora, will be affected.

That is because the Finance Bill 2024 proposes to increase excise duty on fees charged for money transfer services offered by banks, money transfer agencies and other financial service providers from 15 per cent to 20 per cent.

“This means it will cost more to transfer money from the diaspora to Kenya, as well as convert money from other currency denominations to the Kenyan shilling. Even a slight change in valuation can have huge implications on the sector, which involves big money,” says Mohsin.

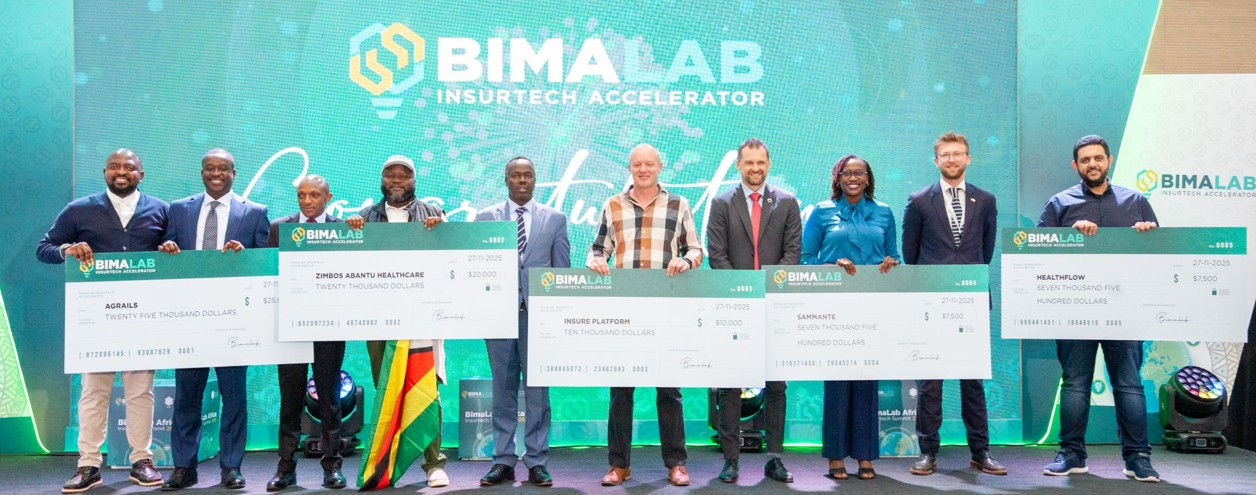

In Eastleigh, most developments are financed through money from the diaspora, with estimates indicating that between $70 million (Sh9 billion) to $100 million (Sh13 billion) is transferred back to Kenya every month for development purposes by Somalis based in the Gulf, the United States and Europe.

“The rates are already very high. No developments can be sustained if they are increased further. It is not feasible,” says Hajir Ahmed, a developer based in Eastleigh.

In addition to transfer fees, other fees which banks take into account while pricing loans, regardless of whether or not the bank in question is Sharia compliant, include legal fees, stamp duty, facility arrangement fees, insurance, and valuation fees.

Top Stories Today