Why economists think IMF's Kenya support plan is off target

By Alfred Onyango |

Push for increased revenue mobilisation has taken a hit on Kenya, resulting in the anti-tax protests.

Since its inception in 2021, the Kenya-IMF funding programme geared towards fiscal consolidation and debt sustainability has not achieved its mandate, with few months left to its conclusion.

This is despite their ever-increasing conditions such as the push for increased revenue mobilisation that has so far taken a hit on Kenya, resulting in the June 2024 anti-tax protests that rocked most parts of the country.

Keep reading

A joint report by the Institute of Economic Affairs (IEA) and the International Development Economics Associates (IDEAs) says the initial target of the programme seems to have lost track sometime back and is way off track.

The report sought to assess the lender’s programme conditionality to the target achievements.

While presenting the report findings, Peter Doyle, a former senior economist at the International Monetary Fund (IMF) and now an economic consultant, said that Kenya did not get what it needed from such a programme.

“What was needed was a programme to deliver an immediate change in the policy mix, with a sharp front-loaded fiscal consolidation to allow a monetary policy loosening, sufficient to correct the exchange rate and inward orientation while keeping inflation on target,” he said.

Doyle added that the fiscal correction should not be at the expense of medium-term growth and that the entire package should have been resilient to further shocks.

“Regrettably from our analyses, it is clear that all the aforementioned are nothing reflective of the programme Kenya got,” he said.

The report notes that the version of the programme Kenya got misdiagnosed its alignment, thus back-loaded fiscal adjustment, and required medium-term primary fiscal balances well above global best practice at the expense of the country’s growth potential, all reflected in relentless tax increases.

“And when its conditionality on the Central Bank of Kenya turned out to be misspecified, including that in practice it treated a large non-permanent relative food price shock as a matter only of inflation, that was not corrected,” the report says.

Nevertheless, it says the programme also delivered a monetary stance that was too tight, impeding the necessary correction in the exchange rate, all at the expense of short-run growth.

“These basic failures of quality control at the IMF meant that the programme achieved neither its stated goals nor the fundamental correction that was required, hence major nationwide social unrest,” the report notes.

Further reflecting the allegedly failed programme is comparing initial projections and current outturns.

In 2024 for instance, the report says the level of global GDP prospect set in the April review is 1.6 per cent lower than what was projected at the initiation of the IMF programme. In that context, the Kenyan GDP growth prospect is set to be 2.9 per cent lower than projected.

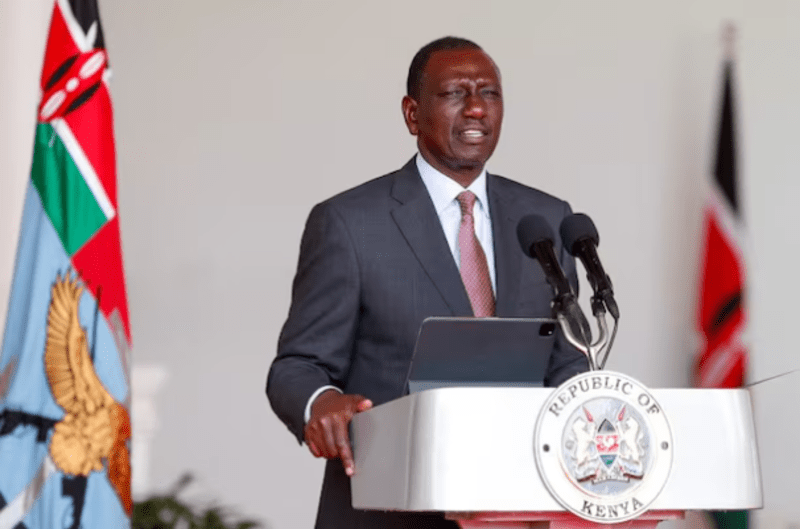

President William Ruto with Kristalina Georgieva, managing director of the International Monetary Fund (IMDF), in Sharma El-Sheikh, Egypt, on September 21, 2023. (Photo: PCS)

President William Ruto with Kristalina Georgieva, managing director of the International Monetary Fund (IMDF), in Sharma El-Sheikh, Egypt, on September 21, 2023. (Photo: PCS)

“That is a significant shortfall, given that with real annual Kenyan growth typically around five per cent, that is a projection error in just three years of over half of one year’s typical growth,” the report says.

Misalignment problem

It adds that Kenya’s underperformance trend in manufacturing, wholesale, and retail sales relative to GDP reflects the underlying misalignment problem and household income stress, respectively.

“The consumer price level in 2024 is set to be eight per cent higher than projected by the originating programme in the context of exogenous shocks from Ukraine and droughts since 2022,” the report says.

Nevertheless, it notes that the increase in the revenue share as a percentage of the GDP is set to be 0.7 per cent this year, higher than programmed, but the increase in the spending share is set to be 1.6 per cent higher, the combination leading to an overshoot of the fiscal deficit of 0.9 per cent of GDP.

This reflects higher than programmed interest spending on loans as the primary balance (the difference between the government's revenue — what it is earning — and its non-interest expenditure — what it is spending, not including debt payments — is almost exactly on the target set in the initiating programme.

In that light, public debt ratios as of this year are said to have risen by 4.4 per cent of GDP, more than initially programmed

Notably, with the fiscal squeeze in the country, the external current account balance is at about 1.6 per cent of GDP, stronger than originally anticipated, further proving the target-outturn disparities.

The report notes that the current shortfall in Kenyan real output relative to original projections is not because global output was weaker than projected.

It says the IMF considerably overstated Kenyan output potential and ability to carry its debt burden, very much the original sin of the entire programme, by overstating its growth prospects, misreading exchange rate misalignment and hence understating its public debt stock, and imposing medium-term primary balance targets which compromise its growth potential.

The report says these errors largely reflect the IMF’s misdiagnosis of the Kenyan economy.

“These outturns relative to initiating programme projections leave a question. If a fiscal consolidation was indeed required to deliver a large exchange rate correction, why was the actual real effective exchange rate correction so modest in 2022-23 and since largely reversed in 2024, when the targeted fiscal consolidation was excessive?”

Adding his voice on the matter, IEA CEO Kwame Owino reiterated that the IMF has since the onset of the programme overburdened Kenya with conditions that kept pushing the economic prospects between a rock and a hard place.

The programme, in its initial stage, started with 26 conditions, of which a breach of any could in principle have caused disbursements to stop.

“That number had ballooned by the 6th review to 36, including those associated with borrowing under the Resilience and Sustainability Trust which began with the fifth review,” Owino said.

Kenya is now at the seventh review of the IMF’s Extended Fund Facility and Extended Credit Facility arrangements.

Last month’s staff-level agreement between the parties gave way for the disbursement of $976 million (Sh126.5 billion), now awaiting approval by the IMF's Executive Board.

However, Owino reiterates that up to the current review, the effective number of conditions is considerably higher, depicting the failure of the lender to focus on the macro-critical essentials.

“It also represents an undue intrusion into sovereignty and, in principle, it implies that immediately needed financing could be stopped given considerations arising decades away in some cases,” he said.

Partly regarding such considerations, an informal guideline was adopted by the IMF following the Asian Crisis programmes in the late 1990s, which featured similarly counterproductive excess conditionality. It stated that no more than 10 conditions should be attached to each programme.

“That guideline has been comprehensively breached in the IMF programme in Kenya, with all the attendant consequences the guideline was intended to avert.”

The economists called for a reset of the programme for 2024/25, which should be led by a big relaxation in monetary policy, leaving revenue ratio targets to the authorities, and activating a targeted programme of income support given food price shocks.

This is alongside a major retrenchment in the number of conditions and an increase in IMF transparency.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!