Ethiopia regulates prices of commodities in economic reforms

PM Abiy also established a task force to ensure the measures put in place to cushion the vulnerable are not exploited.

The Ethiopian Ministry of Trade and Regional Integration has announced measures to regulate prices for basic goods in the wake of the recent macroeconomic reforms in the country.

These efforts seek to finance ambitious public investment programmes through directing domestic financial resources and significant external borrowing, which have a serious impact on macroeconomic imbalances, foreign exchange shortages, and the increased risk of external debt distress.

More To Read

- Ruto backs IMF partnership as key to Kenya’s debt, economic reforms

- Birr in Freefall: Ethiopia’s struggle with record currency depreciation, imported inflation risk

- Faith under fire: How social media fuels rising attacks on religions, followers in Ethiopia

- World Bank upgrades Kenya’s growth outlook to 4.9 per cent, warns of elevated risks

- Africa’s share of global extreme poverty rose by 30 per cent in 10 years - World Bank

- Revenue raise, prudent debt key to Africa’s 2026 upgraded growth prospects - IMF

Under the reforms, the government has temporarily subsidised certain essential imports by minimising the full price impact on essential items such as fuel, fertiliser, medicine, and edible oils.

For instance, 14 million litres of edible oil was purchased and is ready for distribution nationwide.

"This move aims to stabilise the market and meet the demand for this essential commodity," said Kassahun Gofe, the Minister of Trade and Regional Integration.

He further noted that goods with unjustified price increases, such as metal, cement, sheet metal, and other construction materials, should revert to their prices before the introduction of the foreign exchange adjustments and macroeconomic reform programme.

So far, the ministry has taken action against 2,202 businesses for illegal price increases and product hoarding.

Kassahun stated that 967 businesses were closed due to unjust price hikes and non-compliance, with nine licences revoked and 49 merchants arrested for not adhering to corrective measures.

"Coordinated actions against illegal trading practices will continue, with potential consequences including licence revocation for those found in violation." Said Minister Kassahun.

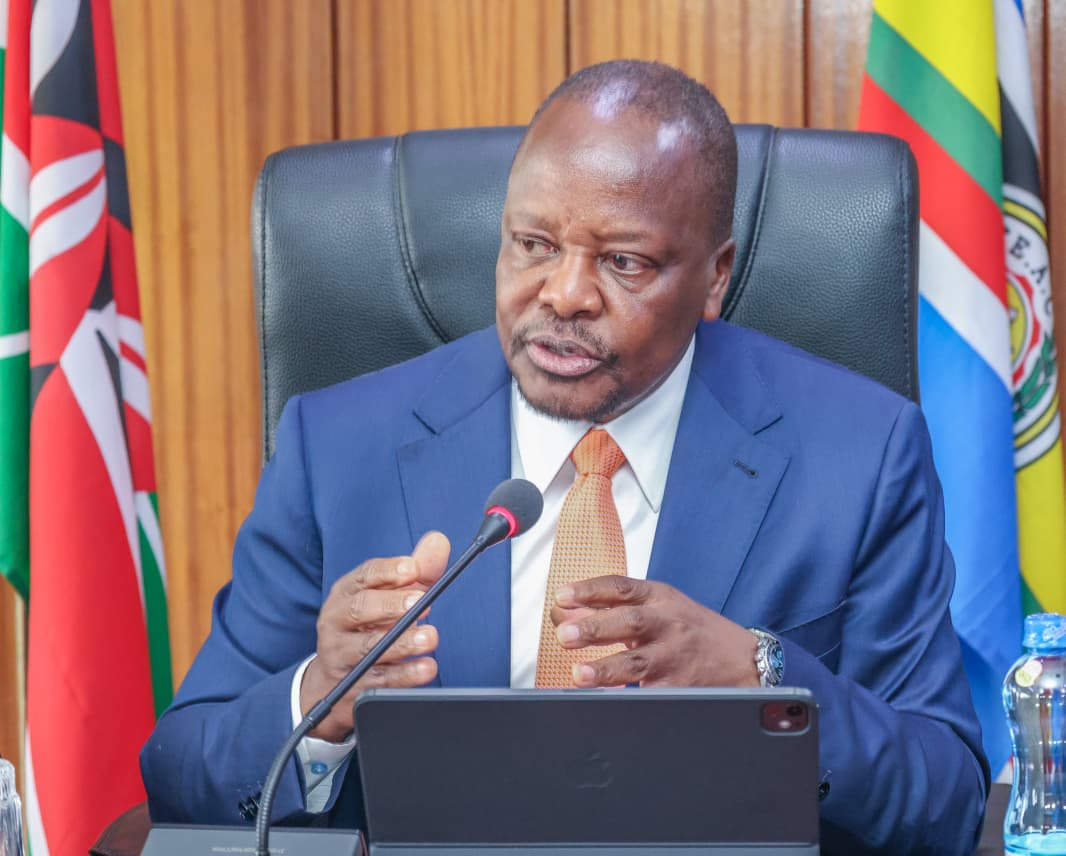

Ethiopia PM Abiy Ahmed with IMF Managing Director Kristalina Georgieva. (Photo: Office of the Prime Minister - Ethiopia)

Ethiopia PM Abiy Ahmed with IMF Managing Director Kristalina Georgieva. (Photo: Office of the Prime Minister - Ethiopia)Ethiopia PM Abiy Ahmed with IMF President Kristalina Georgieva. (Photo: Office of the Prime Minister - Ethiopia)

For financial and debt sustainability, the government has pledged to substantially reduce its near-term external debt service obligation and instead increase its development expenditure for the coming years.

Ethiopia adopted a Homegrown Economic Reform Agenda backed by the International Monetary Fund (IMF) and the World Bank to restructure its debt after it defaulted on its Eurobond payment.

Among the IMF conditions for the loan, other than adopting a floating exchange rate were combating inflation through modernising the monetary policy framework, eliminating monetary financing of the budget, and reducing financial repression.

The shift to a market-based exchange regime led to the devaluation of the Birr which was predicted to cause a rise in the cost of living.

Prime Minister Abiy Ahmed admitted that the cost of living and inflation rates will rise, but warned against exploitation and theft by unscrupulous business people.

Other Topics To Read

PM Abiy also established a task force to ensure the measures put in place to cushion the vulnerable are not exploited.

“A task force has been prepared for this, and there will be high-level oversight with necessary actions taken,” he said, emphasising the importance of strong enforcement as the government restores the economy.

The IMF already approved Ethiopia’s new four-year Sh442 billion (US$3.4 billion) loan to help the country restructure the economy in line with the reform agenda.

Top Stories Today