Kenya's central bank should start cutting lending rate, finance minister says

The central bank is due to announce its next interest rate decision on Oct. 8.

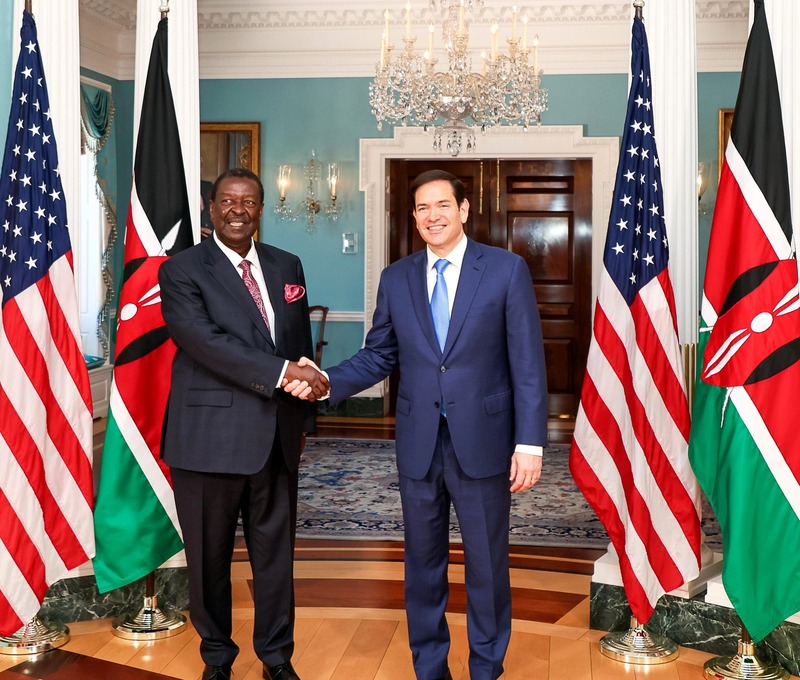

Kenya's central bank rate should start lowering its lending rate due to falling inflation in recent months, Finance Minister John Mbadi said on Wednesday.

Kenya's government targets an inflation rate of between 2.5% and 7.5% in the medium term.

More To Read

- Global food prices climb for third straight month amid soaring cereal, meat and dairy costs

- Private sector activities rise to a 27-month high in April on strong customer demand

- Why Kenyans have to wait longer to feel real benefits of strengthening shilling

- Good news for employees as state moves to increase tax exempt on allowances

- Kenyan workers observe Labour Day amid pay cut woes, job losses and inflation

- Increased food, energy costs push inflation to 4.1% in April

Inflation fell to 3.6% year-on-year in September from 4.4% a month earlier, while it stood at 4.3% in July.

"Inflation rate is firmly under control now," Mbadi said during an appearance at the Senate.

"We think now that the central bank should start lowering the interest rate so that we encourage the private sector to uptake more loans, create job opportunities."

The central bank is due to announce its next interest rate decision on Oct. 8.

It lowered its benchmark lending rate (KECBIR=ECI), opens new tab by 25 basis points in August, saying there was scope to ease policy gradually as inflation had fallen below the midpoint of its target range.

Mbadi said the effects of a strengthening shilling and the central bank's earlier tight monetary policy stance had also contributed to the falling inflation rates.

Top Stories Today