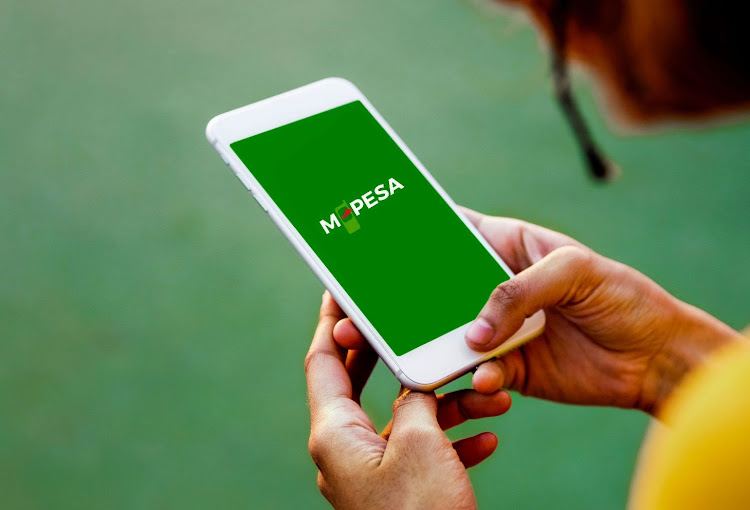

Sh3.2 billion lie dormant in M-Pesa accounts as Kenyans fail to reclaim their wealth

Dependents of deceased persons can still claim the funds if they provide proof of death and an administration letter granting them powers over the deceased’s estate.

A staggering Sh3.2 billion lies dormant in M-Pesa wallets, forcing Safaricom to hand over the funds to the Unclaimed Financial Assets Authority (UFAA). This amount represents 96.3 per cent of unclaimed billions from inactive mobile money accounts as of November 11, 2024, according to UFAA.

In addition to Safaricom’s unclaimed deposits, Airtel and Telkom Kenya subscribers have failed to reclaim Sh114.3 million and Sh7 million, respectively.

More To Read

- Safaricom data links prime suspect to Nairobi CBD on day Rex Masai was killed

- Court trims interested parties in Hustler Fund’s legality case

- M-Pesa Foundation backs ambitious restoration of Nairobi’s 63-hectare City Park

- Kenya’s banking sector at a crossroads: Economist analyses new capital rules and licensing shift

- Senators demand audit of Safaricom, Airtel over claims of data sharing with security agencies

- Safaricom enables direct PayPal withdrawals via M-Pesa app for Kenyan users

Mobile wallet accounts that have remained inactive for more than two years, often due to account holders' death, migration out of the country, or unreplaced SIM cards, are the source of these funds.

“A deposit made by a subscriber with a utility to secure provision for services or any sum paid in advance for utility services that remain unclaimed for more than two years after the termination of the services shall be presumed abandoned,” states the UFAA Act.

Mobile Network Operators (MNOs) such as Safaricom, Airtel, and Telkom are required by law to surrender such idle funds to UFAA annually by November 1.

Failure to comply could result in penalties, which range from 25 per cent of the assets held to daily fines of between Sh7,000 and Sh50,000.

Despite these measures, the sheer number of dormant accounts and the small amounts spread across millions of users make it challenging and costly for companies to track down rightful owners.

Dependents of deceased persons can still claim the funds if they provide proof of death and an administration letter granting them powers over the deceased’s estate.

The volume of unclaimed assets has surged significantly in recent years. In 2024, mobile operators surrendered Sh827.7 million in idle assets, up from Sh541.7 million in 2023.

This increase reflects a larger trend of rising unclaimed assets across various sectors. As of November, the total value of unclaimed cash, shares, and dividends surrendered to UFAA had reached Sh75.5 billion, up 21.7 per cent from Sh62 billion in June.

Among these assets are shares worth Sh39.4 billion, linked to prominent politicians, tycoons, and former government officials. This is a sharp increase from Sh30 billion in 2021 and Sh16.42 billion in 2017.

Additionally, surrendered safe deposit boxes containing jewellery, title deeds, and Treasury bills rose from 1,953 in June to 3,737 units. UFAA has also taken custody of 9.87 million unit trusts and billions in local and foreign currencies.

Unclaimed assets are not just limited to mobile wallets. They include dormant bank accounts, uncashed banker’s cheques, and abandoned safe deposit boxes. Despite these holdings, the rightful beneficiaries have only reunited with 1.9 per cent of the unclaimed assets.

UFAA’s mandate requires entities to actively search for asset owners before surrendering funds. However, the authority has urged Kenyans to take a more proactive approach in reclaiming their wealth.

Many Kenyans have shown little interest in pursuing assets legally belonging to them or their families. In some cases, inheritance disputes have delayed efforts to reunite assets with beneficiaries. Other hurdles include the secrecy surrounding the deceased’s wealth and the absence of wills.

Efforts to trace rightful owners face logistical challenges. Conventional methods such as publishing names in newspapers or on websites have proven ineffective due to the large volume of accounts and minimal individual balances.

Top Stories Today