Banks face additional reporting rules as sector moves to spur green credit growth

The push seeks to disclose data under the International Financial Reporting Standards (IFRS) S1 and S2, steered by the Kenya Bankers Association (KBA) and the Institute of Certified Public Accountants of Kenya (ICPAK).

Days after the Central Bank of Kenya (CBK) unveiled the green finance taxonomy to steer lenders toward increased climate financing, the banking sector is contending with a fresh wave of regulations.

Aimed at bolstering sustainability and lowering the cost of green credit, the fresh reporting standards will require lenders to provide extra data on their operations and lending activities tied to environmental and climate-related risks.

More To Read

- Tax relief boost as KRA slashes fringe benefits rate for workers

- Economic hardships, not just high interest rates, driving digital loan defaults among Kenyan youth

- Central Bank of Kenya invites Kenyans to review total cost of credit website

- CBK: Gaps in digital lending sector fuel risk of money laundering, terror financing

- Kenyan shilling rallies against major world currencies

- Loan interest rates drop as CBK moves to scrap risk-based pricing

The push seeks to disclose data under the International Financial Reporting Standards (IFRS) S1 and S2, steered by the Kenya Bankers Association (KBA) and the Institute of Certified Public Accountants of Kenya (ICPAK).

Ideally, the framework is designed to bridge longstanding gaps in Kenya’s green financing landscape.

By aligning financial disclosures with global best practices, the move is expected to attract more climate-related funding and ensure lenders are better equipped to assess and price climate risks.

This could then pave the way for a more resilient and sustainable financial system in climate action.

The initiative is also set to improve loan pricing and credit flow to the private sector, an area that has seen zero growth in the past year, according to Central Bank figures.

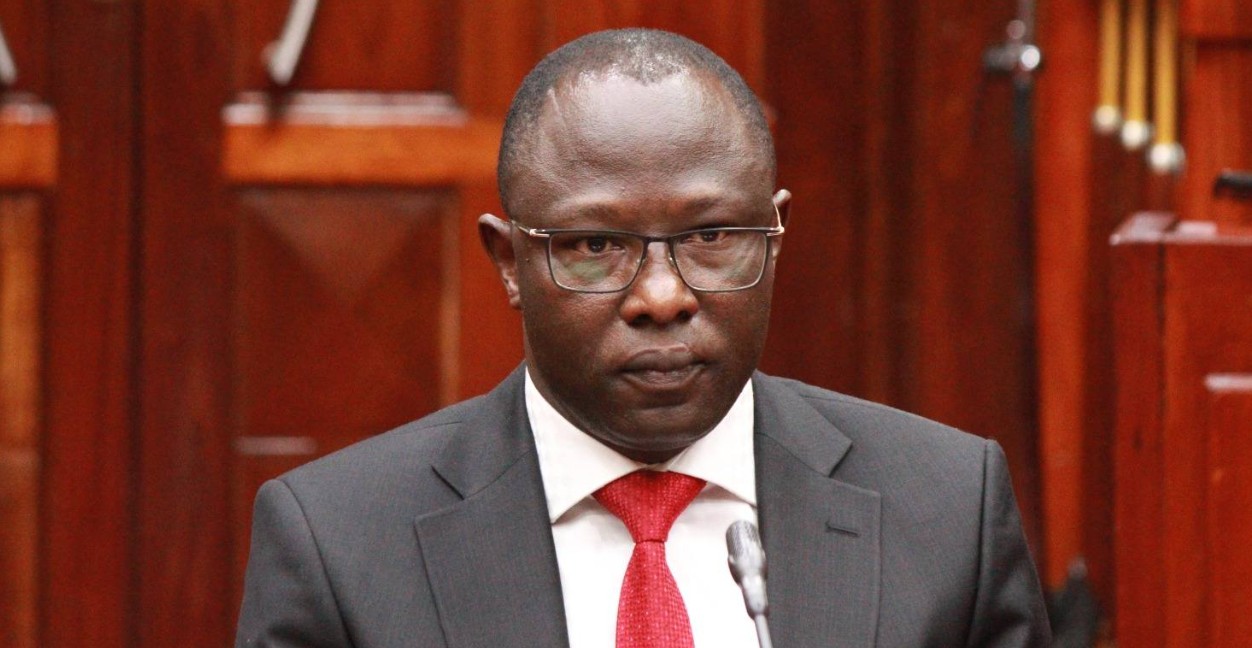

KBA CEO Raimond Molenje lauded the move, saying it will, in many ways, reduce the disjointed global sustainability reporting landscape.

“By adopting IFRS S1 & S2, we are empowering banks to lead the way in sustainability, fostering resilience, and unlocking new growth opportunities,” Molenje said.

He added that the lack of consistent data has historically held back green lending in the country and the region at large.

The new reporting template is set to fix that by equipping financial institutions to align with global benchmarks, enhance decision-making and unlock opportunities.

Notably, the template is anchored on four pillars: governance, strategy, risk management, and metrics and targets.

On her part, FSD Kenya CEO Tamara Cook, said the standards will help Kenya’s banks take a big step toward more transparent and consistent sustainability reporting.

By enabling alignment with global standards, the reporting template strengthens market confidence and opens the door for greater flows of climate finance,” Cook said.

ICPAK CEO Grace Kamau said the unveiling of the IFRS S1 and S2 disclosures template for banks is a significant stride toward enhancing consistency, comparability and credibility in sustainability-related financial disclosures.

Top Stories Today