Trade CS nominee Lee Kinyanjui: How I plan retain investors leaving Kenya

Kinyanjui further explained that the country’s unpredictable tax policies and changing duties were contributing to the challenges faced by investors.

Trade Cabinet Secretary nominee Lee Kinyanjui has outlined plans to tackle the issue of companies leaving Kenya and the challenges faced by local investors.

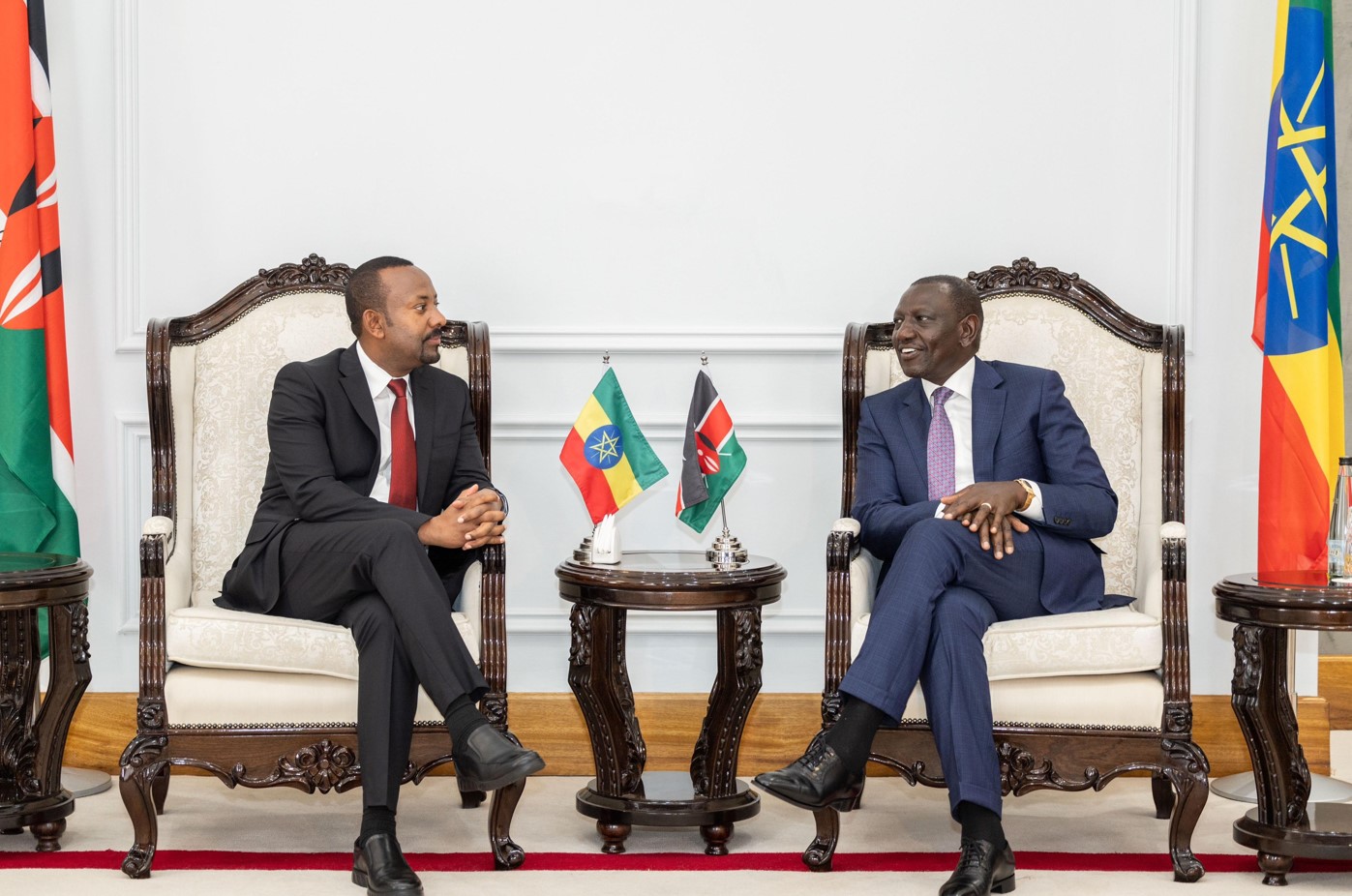

Speaking on Tuesday during his vetting, Kinyanjui emphasised that President William Ruto had already initiated efforts to understand the reasons behind the exit of some businesses, and he assured the committee that he would take immediate action to address this if confirmed.

More To Read

- Angola’s TAAG Airline launches Nairobi flights as AirAsia exits Kenya

- Kenya, Uganda sign deal to ease movement of goods and people at border points

- Kenya, US agree to initiate plans on new trade deal as AGOA winds down in September

- President Ruto courts Japan, seeks balance in uneven trade

- World trade to rebound in second half year but tariff pressures cast shadow - outlook

- SMEs see brighter outlook but struggle with market access, corruption - report

“I want to assure this house that as soon as I get the opportunity, I will investigate these issues and, where possible, reach out to companies that have not completely exited to explore how we can reverse this trend,” Kinyanjui said.

He highlighted the closure of local companies, such as Mobius, a vehicle manufacturer, which had the potential to promote national pride.

“It is also true that in recent years, we’ve had local companies, including Mobius, closing their operations, which is troubling because they represented a source of pride for Kenyans,” he said.

Kinyanjui further explained that the country’s unpredictable tax policies and changing duties were contributing to the challenges faced by investors.

He advocated for a more stable tax regime, particularly one that would guarantee a five-year period of certainty for investors.

“The current thinking is to introduce a tax regime with a minimum duration of five years so that businesses in sectors like livestock and food processing can plan and invest with greater stability,” he proposed.

He noted that many investors, especially those in the early stages, are unable to predict profitability due to external factors beyond their control.

On the subject of local investment, Kinyanjui highlighted the importance of prioritising domestic investors alongside foreign ones.

He recounted an instance where local investors struggled to secure meetings with government officials, only to be treated with urgency once they presented themselves as foreign investors.

"The first investors must be Kenyans. We should prioritise local businesses because even foreign investors will rely on local references," Kinyanjui said.

Addressing the broader economic landscape, Kinyanjui reiterated the contrasting attitudes towards investment held by Kenyans and foreigners. He acknowledged that foreign direct investments, such as the GTC complex in Nairobi, demonstrated confidence in Kenya's economy.

However, he pointed out that Kenyans often exhibit a negative outlook on their own country, which could hinder the nation's progress.

"We need to change our mindset. The jobs being created are for us, and if we continue to have a pessimistic view, we risk losing opportunities to foreign investors," he said.

Kinyanjui also stressed the need for banks to better support local businesses. He pointed out that many small businesses were struggling with a cash squeeze, as banks preferred investing in Treasury bonds and bills rather than lending to growing enterprises.

“We don’t have banks that are aligned to industry. They should allocate a certain percentage of their resources to support small businesses,” he added.

Further, the nominee addressed the issue of Kenya's economic relations with major global players, urging caution when negotiating with economic giants such as the United States. He warned that opening up too freely could threaten local industries.

"When a small country like Kenya is negotiating with economic giants, we need to be careful, because if we open all the doors, all our industries will shut down," he said.

Top Stories Today

Reader Comments

Trending