Eastleigh traders decry soaring taxes during meeting with KRA officials

Traders said delays in offloading and clearance of consignments have worsened, resulting in higher storage fees and increased costs for final consumers.

Eastleigh Business District Association (EBDA) members held a meeting on Thursday with the Kenya Revenue Authority (KRA) to raise concerns over rising tax costs and the impact on the business environment in the busy commercial hub.

The meeting, attended by top leadership of KRA led by Board Chairman Nderitu Muriithi, provided a platform for traders to share grievances on import duties, delays at ports, high operating costs, and competition from foreign retailers.

More To Read

- Nairobi County, Eastleigh Business Association agree on food safety and restaurant licensing

- Safaricom partners with Eastleigh business community to enhance network and internet connectivity

- Eastleigh traders count losses as Yusuf Haji Road remains in darkness

- Eastleigh traders accuse City Hall of inaction as unlicensed hawkers flood streets despite ban

- Eastleigh mall owners protest return of hawkers, call for county action

- Relief for Eastleigh residents as construction begins on Seventh Street after years of neglect

The traders explained that new tax measures have caused a sharp increase in the cost of importing essential goods.

Items such as clothes, shoes, curtains, carpets, aluminium products, and furniture have been affected.

According to traders, these changes have made it hard to maintain their businesses, with some traders closing their shops due to unsustainable operating costs.

This has contributed to job losses in the area.

During the meeting, EBDA representatives said the increase in import duties has disrupted the domestic market and led to changes in trade routes. Several traders are now diverting shipments to neighbouring countries, especially Tanzania, where tax rates are lower.

This shift has led to a decline in customs revenue for Kenya and a shortage of essential goods in the local market, including items such as blankets.

“The rates being paid here in Kenya are higher than those in other East African Community member countries. Getting goods through Nairobi or Mombasa is hard, so Eastleigh is now forced to import through other countries such as Tanzania,” Abdinoor Osman, a consultant for the Eastleigh business community, said.

He gave examples of rapid tax hikes. In June, traders paid Sh3 million per container of blankets. By July, the same container was being taxed at Sh7 million. Similarly, tax for shoe imports jumped from Sh2 million to Sh4 million in just one month, without any formal explanation.

Traders from Eastleigh, represented by the Eastleigh Business District Association (EBDA), during a meeting with Kenya Revenue Authority (KRA) officials to raise concerns over rising import taxes, port delays, and increased competition from foreign retailers on August 7, 2025. (Photo: Ahmed Shafat)

Traders from Eastleigh, represented by the Eastleigh Business District Association (EBDA), during a meeting with Kenya Revenue Authority (KRA) officials to raise concerns over rising import taxes, port delays, and increased competition from foreign retailers on August 7, 2025. (Photo: Ahmed Shafat)

The business community also raised the issue of inefficiencies in clearing goods at the port.

Traders said delays in offloading and clearance of consignments have worsened, resulting in higher storage fees and increased costs for final consumers.

Another concern raised was the rising cost of construction materials. Abdi Dahir Mohamed, the Secretary General of the Property Developers Welfare Society of Nairobi, said the cost of building materials has increased significantly. “A tile imported from abroad costs Sh300, while the same tile in Kenya goes for Sh780,” he said.

Traders from Eastleigh, under the Eastleigh Business District Association (EBDA), met with Kenya Revenue Authority (KRA) officials to raise concerns over rising import taxes, port delays, and increased competition from foreign-owned retailers.

— The Eastleigh Voice (@Eastleighvoice) August 7, 2025

They said sharp tax hikes on goods… pic.twitter.com/u6XEN1SCUt

Traders also noted the growing presence of foreign nationals, particularly Chinese citizens, who engage in small-scale retail trade within Eastleigh. They said this trend adds unfair competition to local businesses, especially since the foreign traders import goods from their own countries at lower costs.

To address these issues, the traders proposed several solutions. They called for early notice before implementing any tax policy changes. They also urged the government to ensure public participation in the decision-making process.

EBDA members requested KRA to improve its accessibility and offer tax education to the business community. They also called for collaboration between government agencies to address concerns about foreign nationals engaging in retail trade.

In response, KRA Chairman Nderitu Muriithi first thanked EBDA for supporting KRA by providing a free office space in Eastleigh over the past year.

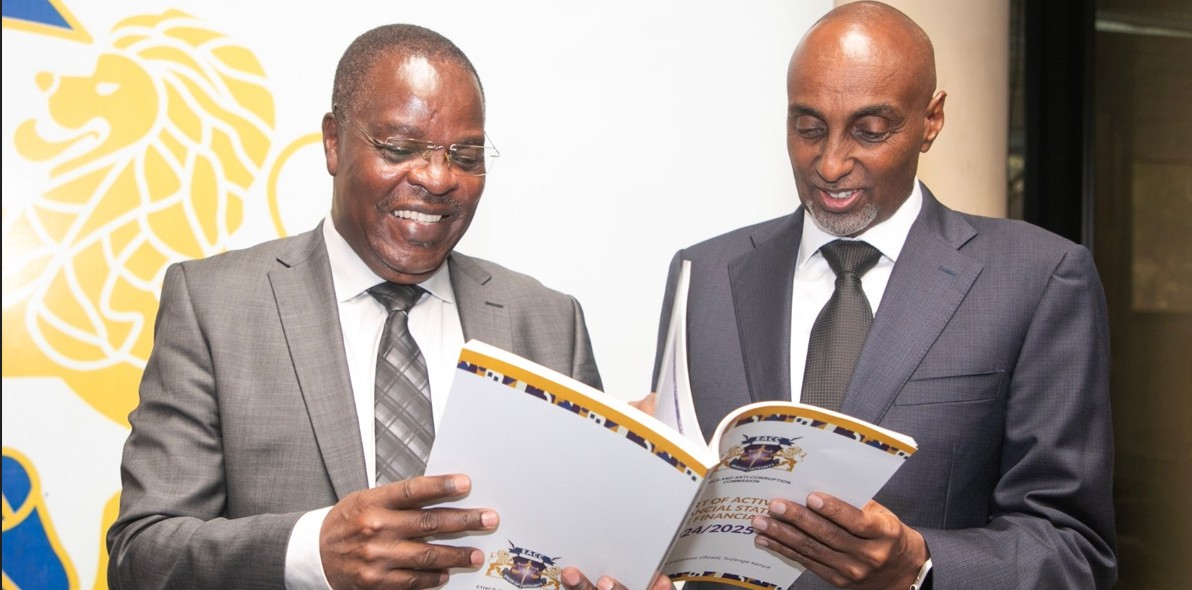

KRA Board Chairman Nderitu Muriithi addresses traders from Eastleigh, represented by the Eastleigh Business District Association (EBDA), on August 7, 2025. (Photo: Ahmed Shafat)

KRA Board Chairman Nderitu Muriithi addresses traders from Eastleigh, represented by the Eastleigh Business District Association (EBDA), on August 7, 2025. (Photo: Ahmed Shafat)

He acknowledged the concerns raised by the business community and gave assurances that the issues would be forwarded to the relevant authorities.

On the issue of import duties, he noted that local manufacturers such as Bata have raised concerns about competition from imported goods that are taxed less. He said this makes locally manufactured goods more expensive compared to imports. He called for a balanced approach that supports both local industries and importers.

Speaking to The Eastleigh Voice, the Chairman said he looks forward to deeper cooperation between KRA and the Eastleigh business community.

“Eastleigh, as a part of the city, has been growing rapidly. It has a lot of business activity, and so it is a very important business hub,” said Muriithi.

He promised to escalate the issues raised during the meeting and work with relevant authorities to find lasting solutions.

Mandera County Deputy Governor Ali Mohamud, who also attended the meeting, urged KRA to build positive relationships with business communities, especially in areas that generate high revenue.

“We should create a good relationship. We can create a good relationship or one based on fear and intimidation. KRA should be friendly to areas where they get revenue from,” he said.

KRA officials confirmed that a new office will be opened in the area by next month, and this time, the agency will cover the rent.

During the meeting, KRA officials also explained various tax categories, including income tax, residential rental income tax, and value-added tax (VAT).

They committed to continuing engagements with the traders and exploring ways to streamline the taxation process to ensure fairness and efficiency.

The meeting ended with an agreement that more consultations would be held between the business community and government agencies to foster better understanding and support for traders operating in Eastleigh.

Top Stories Today