Concerns mount over ambiguity of new SHIF payment model for informal workers

Many Nairobi residents interviewed by Eastleigh Voice questioned why the payments couldn’t be rounded to a more manageable figure.

As the government moves forward with the rollout of the Social Health Insurance Fund (SHIF) and instructs Kenyans to register, many continue to express concerns over the 2.75 per cent contribution rate, particularly for those in the informal sector.

This new system is different from the contributions guidelines of the National Health Insurance Fund (NHIF), which had a minimum monthly rate of Sh500.

More To Read

- Fraud drains Kenya’s pension and health insurance funds, citizens left struggling

- SHA set to roll out AI-powered system to cross-check prescriptions, says Mwangangi

- 1,118 clinics suspected of fraud as SHA collections hit Sh70 billion - Mwangangi

- CS Duale vows to pay only verified NHIF claims as hospitals threaten strike

- Hospitals warn of collapse as Sh76 billion in health claims remain unpaid

- Genetic tests for cancer can give uncertain results: new science is making the picture clearer to guide treatment

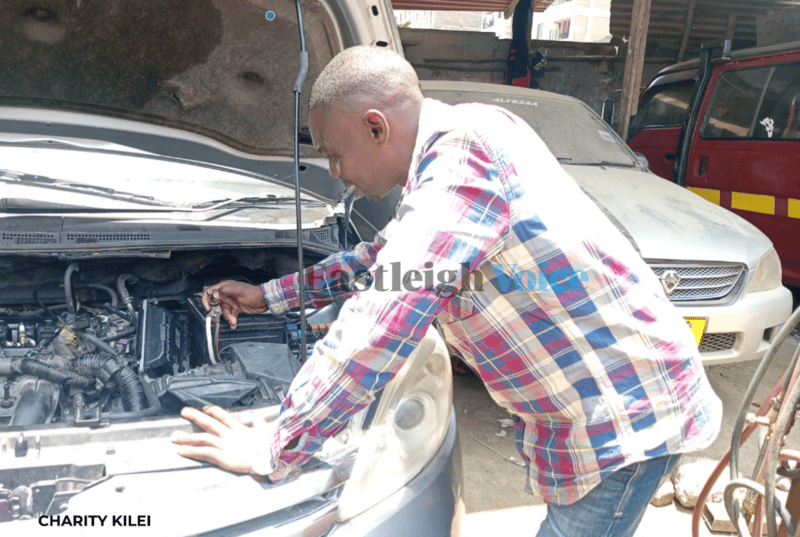

Michael Mwangi, a mechanic in Eastleigh, told Eastleigh Voice that he had not registered with the scheme because he didn't know how it works.

"At first, I thought the amount had been reduced from Sh500 to Sh300, and I was excited. But then I realised it’s not that straightforward. Now I’m wondering how the government will calculate this 2.75 per cent they keep talking about. And if they do figure it out, where will I find the money to pay all at once?” he posed.

Mwangi explained that, for people in the informal sector, it’s easier to make smaller payments over time rather than in a lump sum.

“As a mechanic, my income is unpredictable. Some days I don’t make much, and the competition is tough. When we go for days without work, how am I supposed to pay 2.75 per cent? With the NHIF model, you just pay a flat rate of Sh500 per month, no matter your job. Why can’t it be that simple now?” he posed.

Stephen Owang, another resident of Eastleigh, said he finds the process of enrolling on SHIF was tedious as compared to NHIF.

“If the process were simpler, it would make a big difference. Honestly, I often can’t even tell how much I make each month,” he said, calling for clearer communication on how the new system would work.

“When I hear discussions about SHIF, I’m confused about how the government will determine who qualifies for assistance. Are they going door-to-door to check? If the process is explained more clearly, it will help.”

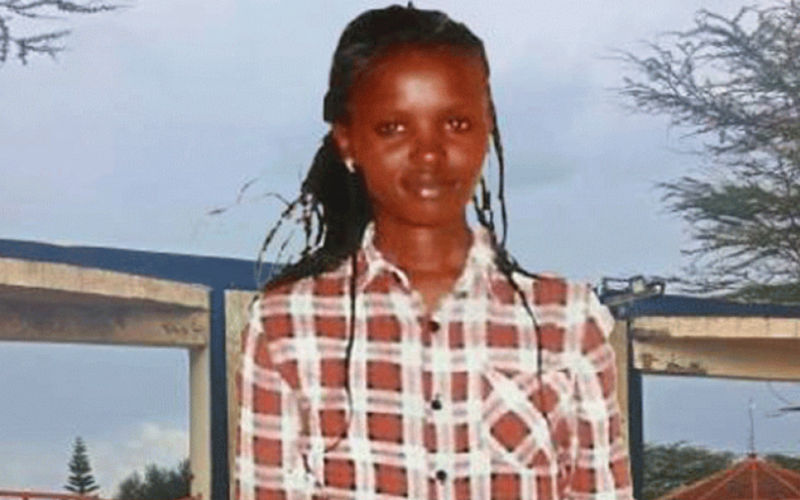

Michael Mwangi, a parent in Eastleigh, laments about the tough economic conditions amidst SHIF roll out. 9Charity Kilei)

Michael Mwangi, a parent in Eastleigh, laments about the tough economic conditions amidst SHIF roll out. 9Charity Kilei)

Abdulla Mohammed, a 46-year-old Nairobi resident, shared his distress after being turned away from multiple hospitals last year because NHIF hadn’t settled its payments. Now unable to work due to health issues, he’s uncertain about how to manage his medical expenses under SHIF.

“I went to several hospitals, but they wouldn’t accept my NHIF card. I urgently needed medication, and now that I can’t work, my family is struggling. The cost of my medication is around Sh8,000 for two weeks, which my family can’t afford.”

He expressed skepticism about registering for SHIF. “How can they expect us to consistently pay into a new fund when they haven’t provided the services we’ve already paid for? I’m not even sure I want to register for this new system, and even if I do, how will I manage to pay 2.75 per cent?”

Lulu Asman, a Nairobi resident, believes the implementation of SHIF has been rushed and lacks sufficient community awareness.

“The government needs to engage with people on the ground to understand their concerns before moving forward. Many of us are confused about how this system will work, and there hasn’t been enough information shared about it. What happens if someone can’t afford to pay the full amount at once?” she posed.

Many Nairobi residents interviewed by Eastleigh Voice questioned why the payments couldn’t be rounded to a more manageable figure.

On September 3, government spokesperson Isaac Mwaura outlined three types of SHIF contributions. Salaried employees will have 2.75 per cent of their gross salary deducted by their employers, while non-salaried individuals will also contribute 2.75 per cent of their income, determined through what they term as means testing.

The government will cover premiums for the poor, prisoners, and vulnerable populations through social protection programs.

Health PS Mary Muthoni clarified that all payments will be 2.75 per cent of gross income. For salaried individuals, contributions will be deducted monthly, while others must pay the premium annually in advance.

The government has set September 30, 2024, as the final date for NHIF coverage, with SHIF benefits beginning on October 1, 2024, managed by the Social Health Authority (SHA). Payments made by October 9 will be credited to NHIF, while payments after this will be credited to SHA.

Employers are encouraged to register employees before October 1 via the SHA employer portal. All contributions, set at 2.75 per cent of an employee’s monthly salary, will be directed to SHIF.

Health Cabinet Secretary Deborah Barasa announced new tariffs under the Social Health Insurance Act (SHIA). Programs like Linda Mama for expectant mothers will be expanded, while cancer patients will receive coverage of up to Sh400,000. Other services, including dialysis and outpatient treatment for chronic conditions, will also be covered under SHIF.

Top Stories Today