MP Kuria Kimani indicates additional tax measures likely in Finance Bill 2025

The government’s proposed Sh4.2 trillion budget for the 2025/26 financial year, approved by the Cabinet in February 2025, includes Sh3.09 trillion for recurrent spending, Sh74.8 billion for development, Sh436.7 billion for county transfers and Sh5 billion for the Contingency Fund.

National Assembly Finance Committee Chairman Kuria Kimani has indicated that additional tax measures may be introduced in the upcoming Finance Bill, 2025, as the government faces challenges in financing its proposed Sh4.26 trillion budget for the 2025/26 financial year.

This, he said, is expected to help bridge a potential shortfall in funding for the government’s budget.

More To Read

- We just want to survive: Small traders plead for lower taxes, fuel prices and honest governance

- Finance Bill 2025 proposes 16% VAT on internet radio and TV

- Kenya's uncollected taxes balloon to Sh2.3 trillion as KRA struggles

- Most Kenyan employers to freeze hiring in 2025 despite economic optimism – CBK survey

- Kiharu MP Ndindi Nyoro raises alarm over rising debt, warns of possible default

- MPs push to scrap one-third salary rule amid rising tax burden

Speaking during a simulcast with NTV and Nation FM, Kimani explained that while existing revenue sources may not fully cover the rising expenditure, tax increases could be necessary to close the gap.

The government’s proposed Sh4.2 trillion budget for the 2025/26 financial year, approved by the Cabinet in February 2025, includes Sh3.09 trillion for recurrent spending, Sh74.8 billion for development, Sh436.7 billion for county transfers and Sh5 billion for the Contingency Fund.

Despite the significant budget allocation, Kimani emphasised that the growing demands may require additional taxes to meet the fiscal goals.

“The question we’ll be asking is, are the current tax measures sufficient to finance the increment on the expenditure side?” Kuria said.

Kimani outlined that three primary sources of income are being considered to fund the budget: the already-established tax measures, revenue generated through government services like passport applications or park fees (appropriation and aid), and funding from donors for specific projects.

"The question is, is the current revenue sufficient to finance the budget? In the event that it is not, that's when there will be additional tax measures to raise the additional revenue needed to finance the budget," Kuria stated.

"But in the event that there is empirical evidence to show that the existing tax measures, appropriations, aid raised, and donor commitments are sufficient to finance the budget, then there will be no need for a finance bill," he said.

Although tax collections have increased recently, the government has still not met its revenue targets in the past two quarters, causing concerns about balancing the budget.

According to Kuria, this shortfall suggests that higher taxes may be needed.

He acknowledged the challenges ahead as the government attempts to balance the need for increased funding with the public’s desire to avoid new taxes.

Kuria pointed out that one of the key challenges is the contrast in public sentiment during budget discussions.

The Budget Committee often hears demands for more funding for infrastructure, healthcare, and other essential services.

On the other hand, the Finance Committee faces public calls to avoid raising taxes and reduce what is considered "excess fat" in government spending.

Top Stories Today

- Lamu records highest increase in ID card applications as border regions see surge

- First white South Africans to arrive under US refugee plan as soon as next week

- EAC central banks adopt master plan to modernise cross-border payments

- Seven dead, houses submerged as heavy rains cause severe flooding in Mogadishu

- Chef Mohamud shares his recipe for crispy chicken wings you can make at home

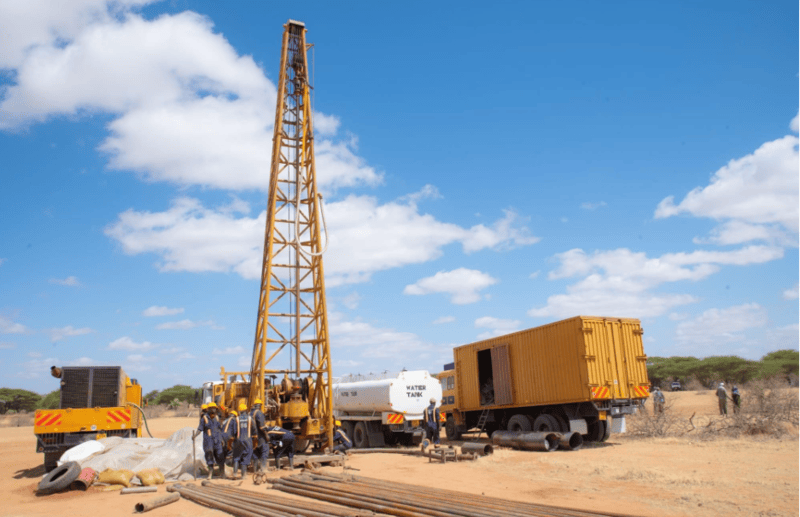

- Private sector dominates Kenya’s borehole drilling as state spending dips

- Consumers to benefit from decline in global commodity prices, says World Bank

- Health Ministry begins issuance of title deeds to safeguard public facilities from land grabs

- Google messages to roll out 'Delete for Everyone' feature on Android

- Senate starts probe on expired medicine crisis in counties

- Cheluget family backs Ruto’s Narok land deal for resettlement

- Gaza’s health system under fire: 1,400 medics killed in targeted attacks

- Nurses reject payroll transfer to counties, vow to continue strike

- China, Russia unite against global bullying and power play

- Pakistan denies nuclear meeting amid escalating clashes with India

- Dock workers to receive 10 per cent pay rise in new deal

- Court jails repeat offender for road vandalism in Mombasa

- Sensitive goods control Bill seeks to block influx of weapons

- Govt orders action against 23 TV stations over illegal betting ads

- Is Kenya ready for next health crisis? Covid toll reveals system cracks