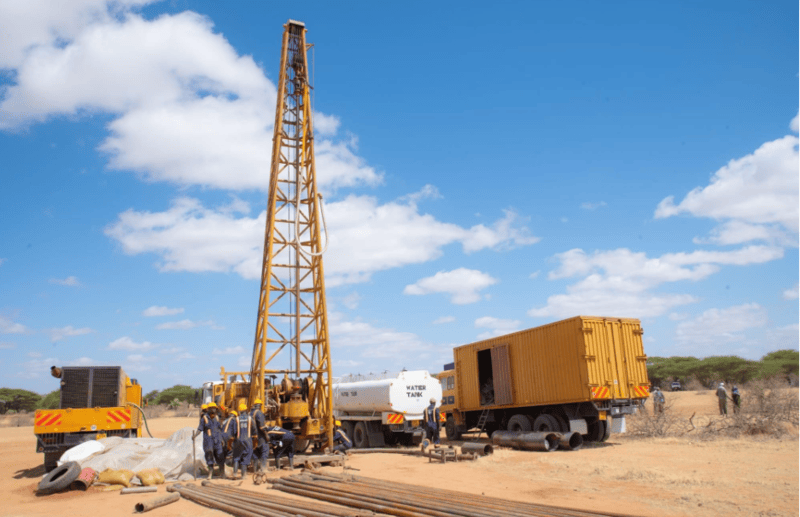

Private sector dominates Kenya’s borehole drilling as state spending dips

KNBS data shows private firms drilled over 90 per cent of Kenya’s new boreholes in 2024–25, even as public funding for rural water supply faces steep cuts.

The private sector continues to play a dominant role in borehole drilling across Kenya, according to new data released by the Kenya National Bureau of Statistics (KNBS).

The latest economic survey shows that the majority of new boreholes in the country were drilled by private entities during the 2024-25 period.

More To Read

- Daua Dam, irrigation masterplan gain momentum after high-level talks in Nairobi

- Eastleigh MCA blames county officials for destruction of newly built Captain Mungai Street

- Lake Victoria Fish farming booming but pollution and disease are wiping out millions: How to reduce losses

- How control of water shapes power, national security and economic stability across Africa

- Africa’s land holds the future of climate adaptation: Why COP30 can’t overlook it

- Water crisis deepens in Iftin Ward, Garissa, as residents demand boreholes and water tanks to ease shortages

The total number of boreholes drilled rose by 2.9 per cent from the previous year, reaching 47,199 in 2024–25. Out of these, private players were responsible for 42,791, reflecting their continued lead in the development of groundwater resources.

In comparison, public sector institutions drilled only 4,408 boreholes in the same period. This follows a similar pattern observed over the past five years.

In 2020-21, the private sector drilled 17,954 boreholes compared to the public sector’s 2,455. The following year saw a jump, with private entities drilling 35,304 boreholes while the public sector handled just 3,859.

The number of boreholes drilled by the private sector continued to rise, reaching 40,763 in 2022-23 and 41,508 in 2023-24.

Meanwhile, public sector drilling increased at a much slower pace, with 4,323 boreholes in 2022-23 and 4,348 in 2023-24.

“The number of boreholes drilled increased by 2.9 per cent to 47,199 in 2024-25, with those drilled by the private sector accounting for the largest share,” the Economic Survey 2025 notes.

Despite the increase in drilling activity, the government’s development expenditure on water supply and related services is projected to decline. The report shows that the budget for water services will drop by 4.1 per cent to Sh64.3 billion in 2024-25.

Water supply funding

Funding for rural water supply is expected to fall sharply by 24.3 per cent to Sh5 billion, raising concerns over access to clean water in underserved areas.

Water abstraction in the country also increased during the year under review. According to the report, the total volume of water abstracted grew from 32.5 billion cubic metres in 2023 to 32.7 billion cubic metres in 2024. Surface water remained the primary source, accounting for 99.3 per cent of total abstractions.

Abstraction from groundwater sources recorded a slight increase, moving from 243.9 million cubic metres in 2023 to 244.1 million cubic metres in 2024.

The survey also projects a small rise in water purification infrastructure. The number of purification points is expected to grow from 376 in 2023-24 to 380 in 2024-25.

Beyond water, the report highlighted other key sectors.

In fisheries, the quantity of fish landed increased by 4.4 per cent to reach 168.4 thousand tonnes in 2024. This boost also translated to higher earnings, with the total value of fish rising from Sh35.9 billion in 2023 to Sh39.6 billion in 2024.

In forestry, the area covered by net-stocked plantations expanded from 144.8 thousand hectares in 2023 to 147.0 thousand hectares in 2024, showing a positive trend in forest cover.

However, the mining sector saw a major decline. Earnings from mineral production dropped by 24.4 per cent, from Sh33.8 billion in 2023 to Sh25.5 billion in 2024, marking a notable dip in performance.

As Kenya continues to face growing demand for water, especially in arid and semi-arid regions, the steady increase in borehole drilling by the private sector reflects a shift in how communities and institutions are addressing water scarcity.

Top Stories Today