Henry Tanui appointed new CEO of Hustler Fund

The Board said Tanui brings over 24 years of experience in financial services, with expertise spanning Risk Management, MSME Lending, Business Lending, Personal Lending, Mortgages, and International Trade Finance.

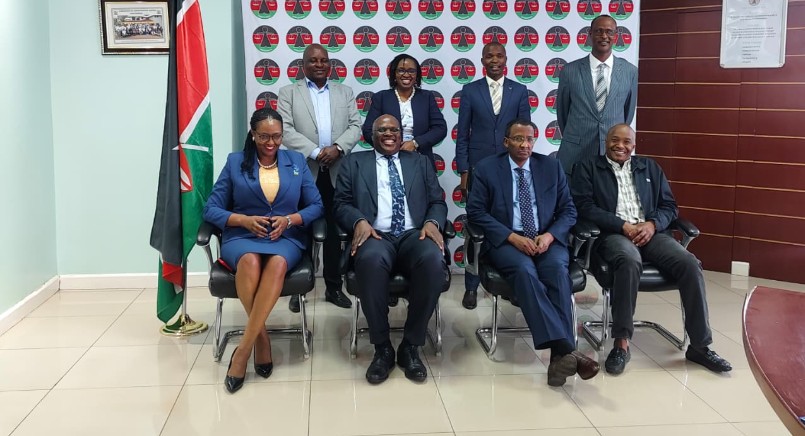

The Financial Inclusion Fund, popularly known as the Hustler Fund, has appointed Henry K. Tanui as its new Chief Executive Officer for a renewable four-year term, succeeding Elizabeth Nkukuu, who has led the Fund since its inception.

In a statement on Wednesday, the Board said Tanui brings over 24 years of experience in financial services, with expertise spanning Risk Management, MSME Lending, Business Lending, Personal Lending, Mortgages, and International Trade Finance.

More To Read

- SMEs see brighter outlook but struggle with market access, corruption - report

- President William Ruto defends Hustler Fund, says KHRC report politically motivated

- KHRC calls for immediate abolition of Hustler Fund citing high default rate and poor design

- Kenyans concerned over SHA premiums, confusion on dependents, and unclear Lipa Pole Pole model

- From NHIF to SHA: Kenya’s struggle to overcome health insurance fraud, boost affordability

- Farmers abandon Hustler Fund as CBK report shows shift to banks and digital loans

He has held senior positions at Ecobank, Consolidated Bank of Kenya, and the Industrial and Commercial Development Bank of Kenya, equipping him with a deep understanding of Kenya’s economic landscape and the role of inclusive financial services.

Cooperatives and MSME Cabinet Secretary Wycliffe Oparanya lauded the Fund’s role in Kenya’s socio-economic agenda.

“The Financial Inclusion Fund has already provided affordable credit to more than 26 million Kenyans. As we look ahead, I encourage the Hustler Fund team to enhance their efforts in promoting timely repayments to improve credit scores and to expand financial literacy programmes that support Kenyans in succeeding,” he said.

MSME Principal Secretary Susan Mangeni also highlighted the Fund’s impact on financial inclusion. She noted that through the Hustler Fund, over 9 million Kenyans now have improved credit histories and are more capable of accessing financing from mainstream financial institutions.

“We extend our gratitude to Elizabeth Nkukuu for her steady leadership in establishing the Fund and guiding it through its early stages,” she said.

On his appointment, Tanui expressed optimism about the Fund’s future. He said the Fund has already proven to be catalytic in supporting livelihoods and economic growth.

“My focus will be on reengineering our collection processes, strengthening financial literacy, and building ecosystem lending channels that expand our reach and deepen our impact,” he said.

Outgoing CEO Nkukuu thanked stakeholders for their support during her tenure.

“It has been a privilege to serve Kenyans by establishing and launching the Hustler Fund. I am proud of the progress we have made in reaching millions of households and MSMEs. I warmly congratulate Mr. Tanui and wish him every success in expanding the Fund’s impact in the years ahead,” she said.

The Board also praised Nkukuu for her pioneering leadership that laid a solid foundation for the Fund.

Top Stories Today