MPs seek to limit Treasury CS’s role in VAT exemptions after Sh300 billion revenue loss

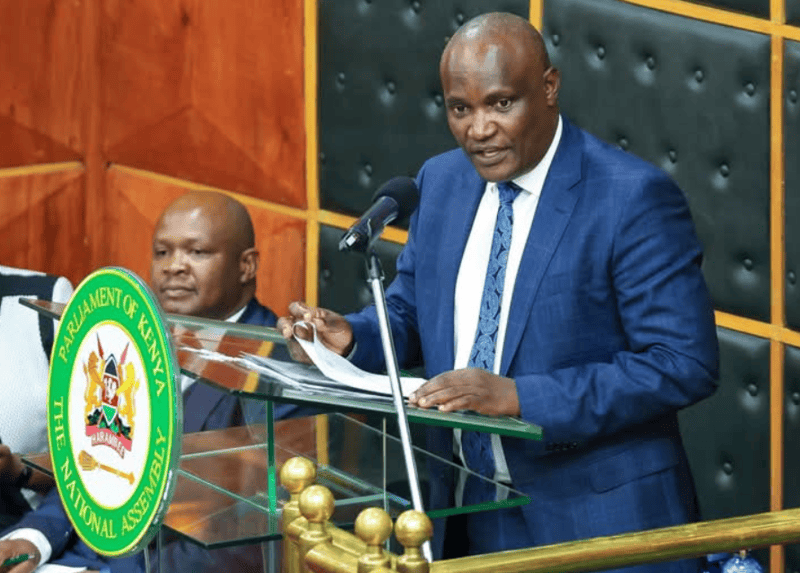

Budget and Appropriations Committee Chairperson Samuel Atandi has said there is growing consensus in the National Assembly that the authority to issue tax exemptions should rest solely with Parliament, which is constitutionally mandated to manage public finances.

The National Treasury Cabinet Secretary could soon lose the power to grant tax exemptions if a push by Members of Parliament to amend the VAT Act gains traction.

This comes amid revelations that the government has lost more than Sh300 billion in Value-Added Tax (VAT) exemptions in the current financial year, with some benefits going to local manufacturers at a time when Kenya is grappling with expensive loans to fund state operations.

More To Read

Budget and Appropriations Committee Chairperson Samuel Atandi has said there is growing consensus in the National Assembly that the authority to issue tax exemptions should rest solely with Parliament, which is constitutionally mandated to manage public finances.

“As a committee, we will study the Finance Bill, 2025 once published, with a view to amending the VAT Act — among other laws — so that only the National Assembly holds the power to grant tax exemptions,” Atandi told Nation.

He added, “We are a House charged with approving revenue collection measures to finance the budget. We cannot sit back and allow the continued abuse of tax exemptions, only to take the blame from the public for punitive taxation.”

Abusing authority

The Alego Usonga MP accused previous National Treasury Cabinet Secretaries of abusing their authority by issuing exemptions to entities that did not merit them.

“We know they have abused those powers. There is no justification for issuing exemptions while burdening ordinary Kenyans with harsh tax measures to fund government operations,” he said.

A report by the Parliamentary Budget Office, which advises Parliament and its committees on fiscal matters, shows that as of 2020, VAT-related tax expenditure due to exemptions and zero-rating stood at Sh234 billion.

Currently, the National Assembly's Departmental Committee on Finance and National Planning, chaired by Molo MP Kuria Kimani, is investigating how 14 local companies were granted VAT exemptions amounting to Sh15 billion. The companies claimed a combined capital investment of Sh93.53 billion, but the committee seeks to establish whether they genuinely qualified for the exemptions.

“It would reflect poorly on this House if we continue with such practices, knowing well that we are failing to meet our revenue targets,” Atandi said.

The government is targeting to collect Sh2.8 trillion in ordinary revenue in the next financial year to support a Sh4.2 trillion budget, with the balance expected to be financed through grants and borrowing from both local and international lenders.

“We will never achieve this target if such exemptions continue unchecked. They must be scrutinised thoroughly before the Bill is brought before this House,” Atandi said.

While narrowing zero-rating and scrapping some VAT exemptions, particularly outside the agriculture sector, could boost VAT’s contribution to GDP, such reforms could be unpopular among sections of the public.

Top Stories Today