Kenyans borrowed Sh57bn from Hustler Fund, new product for SMEs to be rolled out

By Lucy Mumbi |

The Cabinet has also announced the introduction of a third product focused on the Small and Medium Enterprises (SME) sector.

Kenyans have collectively borrowed Sh57 billion from the Hustler Fund since it was launched, according to a Cabinet meeting chaired by President William Ruto on Tuesday.

The Cabinet revealed that at least 2 million citizens are regular daily users of the fund, which also boasts Sh3.2 billion in savings.

Keep reading

“Cabinet noted that, to date, the Fund has disbursed Sh57 billion to Kenyans, with at least 2 million customers now regular daily borrowers. Additionally, in keeping with the Administration's pledge to inculcate a culture of saving for posterity, the Fund has successfully mobilised Sh3.2 billion in savings,” reads the dispatch from Cabinet.

In celebration of the Fund's second anniversary, the Cabinet has also announced the introduction of a third product focused on the Small and Medium Enterprises (SME) sector.

Cabinet noted that the new offering will initially target the 2 million consistent borrowers who have established a solid credit history with the Hustler Fund.

“This groundbreaking initiative aims to create a pathway for banking the targeted beneficiaries, further deepening financial inclusion within the SME sector,” the Cabinet said.

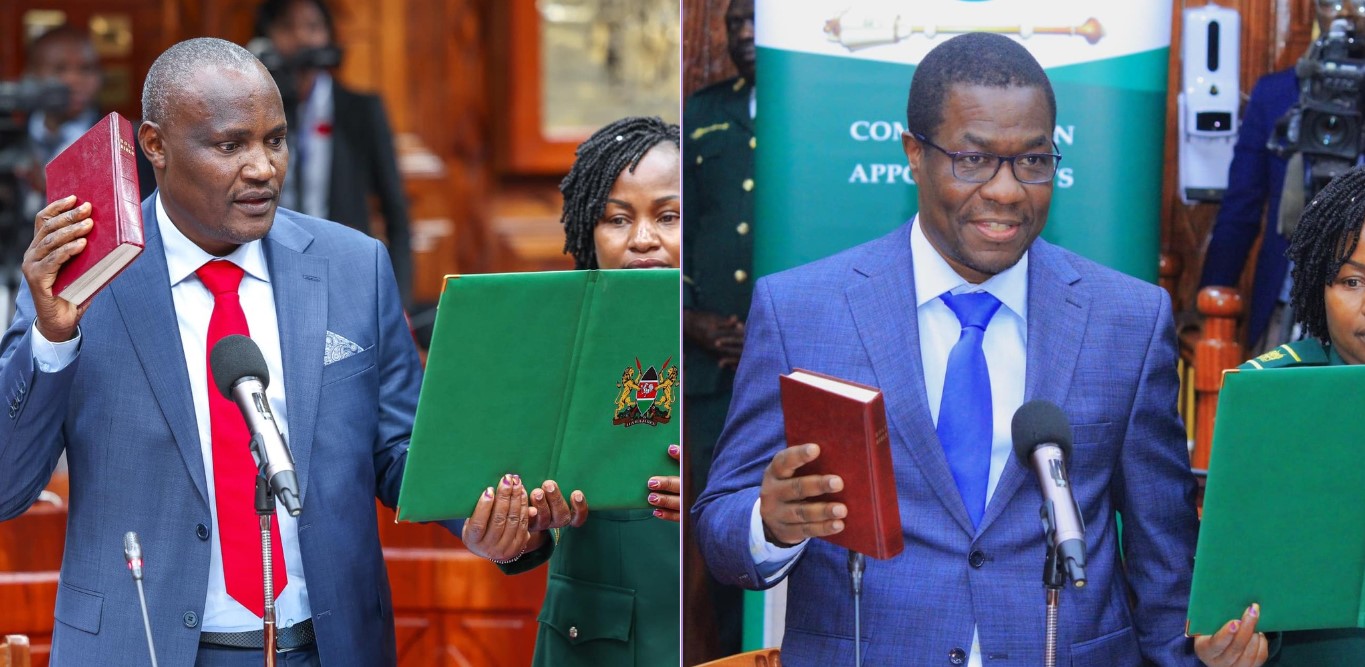

In August, Cooperative and MSMEs Cabinet Secretary Wycliffe Oparanya announced plans to target Kenyans who have defaulted on their Hustler Fund loans.

Oparanya, while speaking at a Small and Medium Enterprises conference in Nairobi, revealed that his ministry is developing a tracking system to identify loan defaulters.

“The problem we have had with the fund is that during the first round, 21 million people borrowed money but out of this number, 19 million disappeared with the money. Two million are borrowing regularly. For those 19 million, I am coming for you to make sure that you pay so that others can benefit, even yourself can benefit,” he said.

“You will see someone knocking at your door and ask, can you pay the Hustler loan back for the benefit of others.”

He emphasised that the Hustler Fund was a groundbreaking initiative designed to create wealth and generate job opportunities across the country.

Oparanya also revealed plans to reward responsible borrowers. He highlighted an example of a borrower who now manages to secure up to Sh2 million and runs a successful business.

“This public money should be borrowed and repaid so that other people benefit from it,” he said.

He noted that failure to repay loans would result in being ineligible for future borrowing.

“I want you to borrow again and again so that you can develop yourselves. As the government tries its bit, you must also do the same,” he said, adding that the government is committed to creating a conducive environment for people to do business.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!