AfDB’s Sh1.3 billion capital injection to support Kenya’s sectoral development

The funding strategy is also committed to catalysing green and sustainable financing in East Africa, providing credit guarantees to stimulate private institutional investment in infrastructure.

The African Development Bank (AfDB) has pumped $10 million (Sh1.29 billion at the current exchange rate) into a Kenyan firm that specialises in offering guarantees to support sustainable growth enterprises.

Dhamana Guarantee Company, the firm receiving the capital injection, will support access to financing for key sectors including transport, water, renewable energy, and waste management.

More To Read

- Kenya must raise Sh1.6 trillion by 2030 to achieve SDGs, African Development Bank report reveals

- Kenya losing Sh194 billion annually to corruption - AfDB

- Kenya leaps to top of Africa’s electricity regulation index, matching Senegal

- Mauritania’s Sidi Ould Tah elected AfDB president, succeeding Akinwumi Adesina after close vote

- Kenya to benefit from Sh6.5 billion funding to tackle hunger in schools

- Exclusive: Kenya in talks for fresh Sh112.8bn loan from World Bank, AfDB, says official

The funding strategy is also committed to catalysing green and sustainable financing in East Africa, providing credit guarantees to stimulate private institutional investment in infrastructure.

AfDB's move to fund the projects follows an anchor investment from the UK - government-backed private infrastructure development group through its subsidiary, InfraCo Africa.

Solomon Quaynor, AfDB's vice president for private sector, infrastructure and industrialisation, said the lender's equity investment in Dhamana reinforces the catalytic role and potential of credit enhancement companies in leveraging opportunities for infrastructure financing in local currency.

"We intend to replicate this business model in appropriate markets across Africa with partners such as the Private Infrastructure Development Group (PIDG) and others," Quaynor said.

"By targeting businesses that improve citizen's daily lives, the investment will enhance access to affordable finance, reduce the capital needed for projects and advance progress towards achieving the Sustainable Development Goals (SDGs)."

He added that the first example of this type of credit enhancement company was in Nigeria which has demonstrated success.

"The investment in Dhamana aligns with the Bank's priority to mobilise financing through innovative vehicles from African institutional funds including pension funds, sovereign wealth funds and insurance companies for infrastructure development in Africa," Quaynor added.

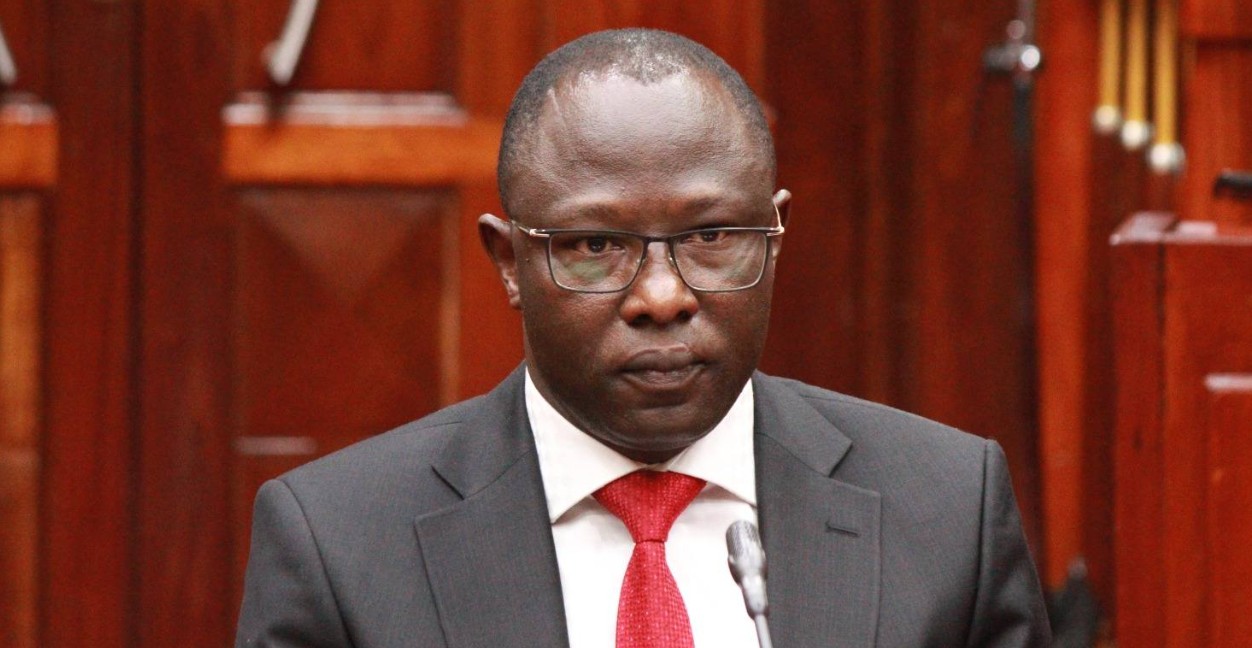

On his part, Dhamana CEO Christopher Olobo said with the support of the funding, the firm is positioned as an important catalyst for long-term sustainable finance in the region.

"Dhamana's local currency guarantees will connect pools of untapped capital with East Africa's real economy, making a tangible difference to people's lives and offering local investors the opportunity to invest in Paris-aligned initiatives," Olobo said.

Top Stories Today