High fuel prices to persist as Kenya renews Gulf oil deal

By Maureen Kinyanjui |

The extension, meant to avoid penalties on pre-agreed volumes, has prevented motorists, households, and industries from benefiting from recent global drops in fuel prices.

Kenyan consumers are set to face extended high fuel costs after the government prolonged its fuel import deal with major Gulf suppliers.

This extension, meant to avoid penalties on pre-agreed volumes, has prevented motorists, households, and industries from benefiting from recent global drops in fuel prices.

Keep reading

Initially set to expire at the end of this year, the government-backed fuel import deal will now continue until Kenya has imported the full volume stipulated in the original contract with three Gulf oil giants.

This extension comes as a change to the original contract terms, which specified the end of the deal by this year.

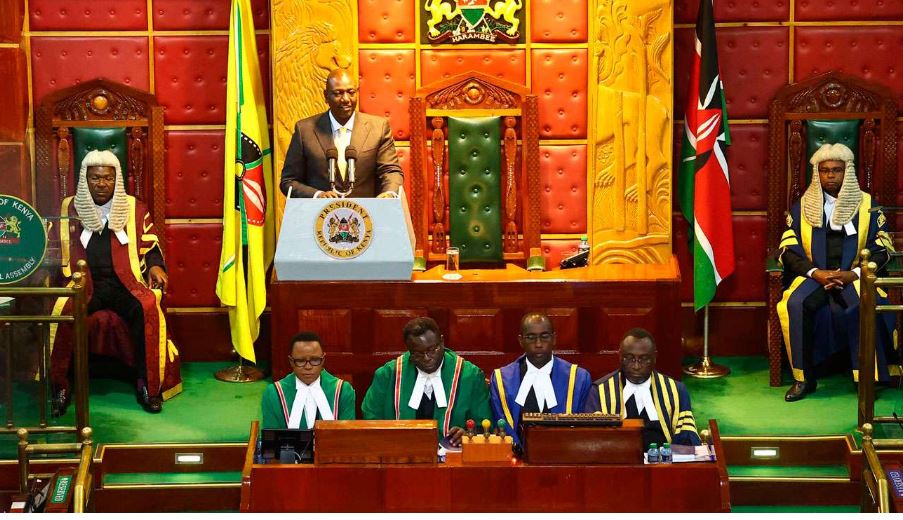

Energy and Petroleum Cabinet Secretary Opiyo Wandayi confirmed that the contract is based on a required volume of fuel, rather than on a fixed time period.

"The current contract on importation of refined petroleum products under the Government-to-Government arrangement is based on quantity rather than time or term. As such, the contract will terminate once the agreed volumes are lifted," he explained.

Kenya has been purchasing fuel on a 180-day credit term from Saudi Aramco, Abu Dhabi National Oil Corporation (Adnoc), and Emirates National Oil Company (Enoc) since April 2023.

The arrangement was initially intended to stabilise the shilling by reducing the monthly demand for over $500 million (Sh64.56 billion) in foreign currency needed to pay for fuel in the open market.

While the shilling has seen some improvement, the deal's fixed prices have resulted in Kenyan consumers missing out on global price drops.

Energy and Petroleum Cabinet Secretary Opiyo Wandayi (3rd left) during a familiarisation tour of the port of Mombasa on September 26, 2024. (Photo: Kenya Ports Authority)

Energy and Petroleum Cabinet Secretary Opiyo Wandayi (3rd left) during a familiarisation tour of the port of Mombasa on September 26, 2024. (Photo: Kenya Ports Authority)

Consumers paying more

Recent audits by consulting firms Channoil Consulting and Kurrent Technologies found that consumers are paying Sh2.70 more per litre under the current deal compared to what they would under the Open Tender System (OTS).

The firms highlighted that while the average suppliers' premium for January-February 2023 under OTS was Sh4.51 per litre, the government-backed mechanism had a premium of Sh7.21 per litre in mid-2024.

The international price of a barrel of crude oil fell to $83.80 in September, a significant decrease from $87.28 at the same time last year.

Despite this, Kenya is locked into fixed premiums of $90 and $88 per barrel for petrol and diesel, respectively, under the Gulf deal.

Globally, the price of petrol dropped to $695.05 per tonne from $804.16 in October last year, while diesel prices fell to $600 per tonne from $839.26.

In Nairobi, pump prices dropped in October by the largest margin in 19 months, with petrol falling by Sh8.18 to Sh180.66 per litre, and diesel by Sh3.54 to Sh168.06.

Despite this reduction, analysts argue that prices would be even lower if Kenya were purchasing fuel on the open market instead of through the extended government-backed contract.

Additionally, the deal included Uganda as part of the market; however, Uganda exited the agreement a year after imports began.

The International Monetary Fund (IMF) has since raised concerns that Uganda's departure could expose Kenya to financial liabilities for failing to meet contracted volumes.

According to the IMF, Kenya may face contingent liabilities because of the decline in fuel consumption, both domestically and in re-export markets.

The IMF's warning comes amid diplomatic discussions between Kenya and Uganda.

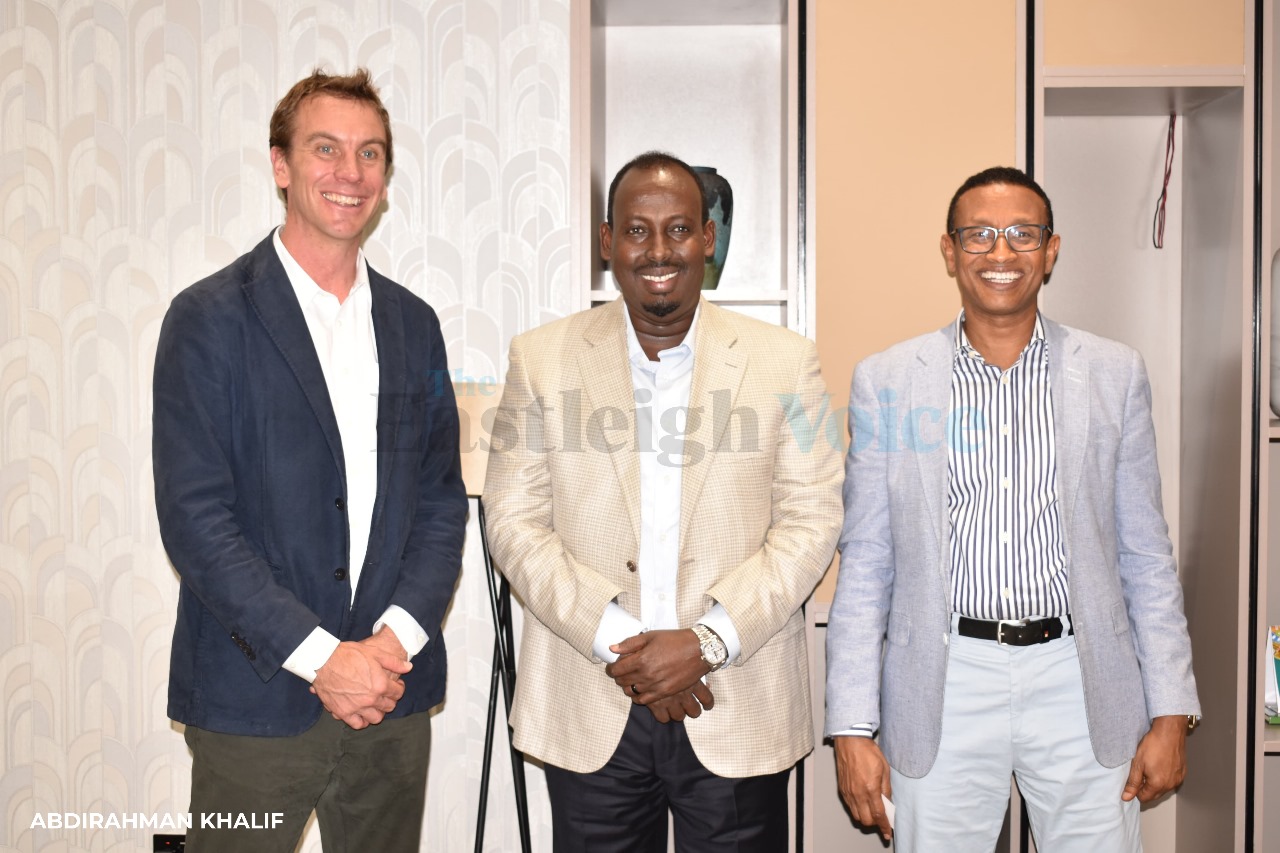

Last week, Cabinet Secretary Opiyo Wandayi led a high-level Kenyan delegation to meet with President Yoweri Museveni, reportedly to discuss regional cooperation in petroleum imports.

While Museveni acknowledged the meeting, details of the discussions have not been made public.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!