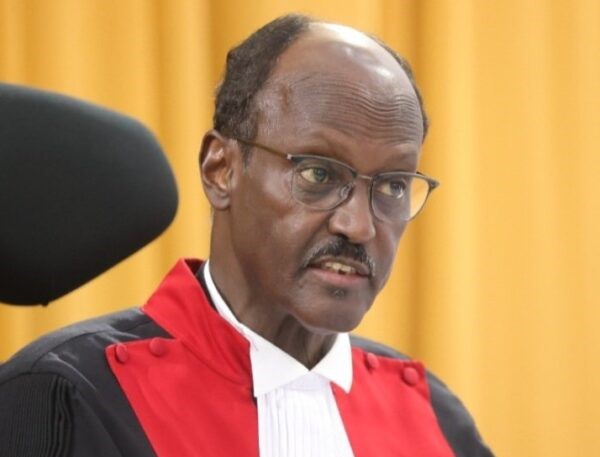

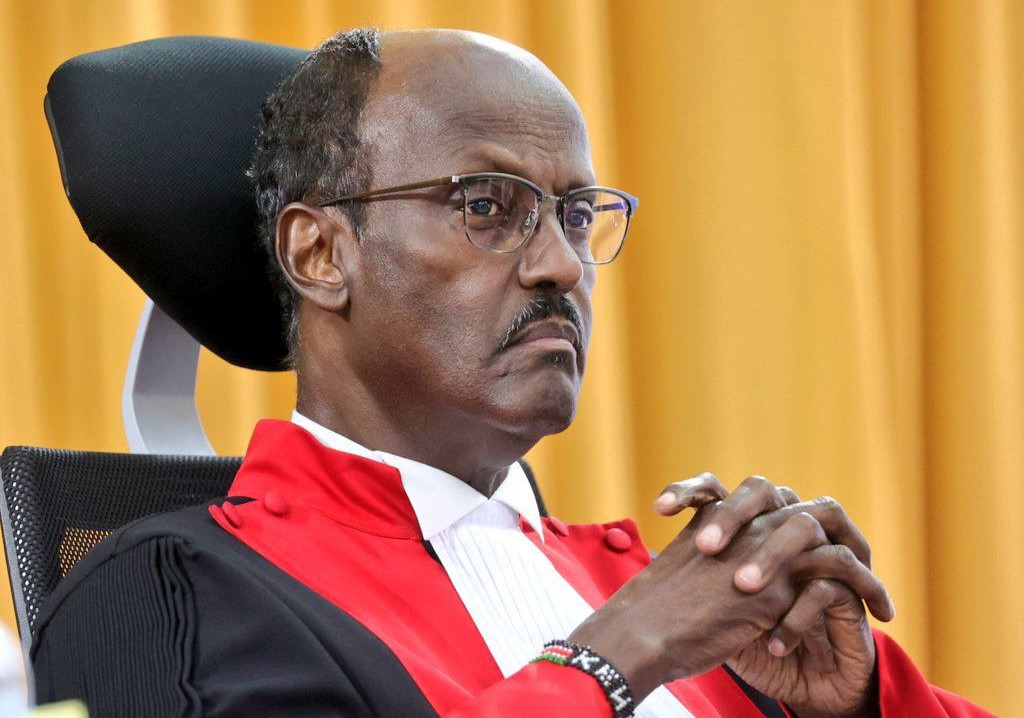

High Court Judge Mwita says 2.75 per cent SHIF deductions from salaried employees illegal

Justice Chacha Mwita on Monday ruled that the law states that only income tax is withheld from gross income; therefore, no other deductions can be made from an employee's total earnings.

High Court Judge Chacha Mwita has said that the 2.75 per cent deduction from gross income for the Social Health Insurance Fund (SHIF) is double taxation and, therefore, illegal.

Justice Chacha Mwita on Monday said that the law states that only income tax is withheld from gross income; therefore, no other deductions can be made from an employee's total earnings.

More To Read

- Nakuru's Sisto Mazzoldi Hospital downgraded to level 3 over fraud allegations

- DCI forwards 18 SHA fraud cases to ODPP with 24 suspects charged

- KNCHR says Kenyans still locked out of healthcare despite Sh138 billion SHA boost

- MPs ditch SHA, the public health scheme they once praised, and opt for private cover

- TSC confirms shift to SHA cover for teachers from December 1

- TSC sued over teachers’ migration from MINET insurance to SHA

According to the judge, any further deductions after the payment of income tax introduce an unlawful and harmful component that constitutes double taxation.

"There can be no other gross income from which the person can again contribute 2.75 per cent to the Fund under SHA and the regulations made thereunder. Any subsequent or other statutory eduction(s) based on the person's gross income after income tax, is undoubtedly double taxation, charge or levy because the same gross income will have been taxed more than once under the Income Tax Act and the regulations made under SHA as contribution to the Fund," said Justice Mwita.

He added that by providing that a person contributes 2.75 per cent of his/her gross income to the Fund after paying income tax from the same gross income, the regulation introduces a negative element of taxation, which is double taxation and would, as a result, make such a regulation unlawful.

The court, however, declined to issue any orders after finding there was a separate case on the same before the Court of Appeal.

It ruled that issues raised in the petition closely mirrored those in Petition E513 of 2024, which questions the legality of SHIF regulations, as well as the constitutionality of several health laws, including the Social Health Insurance Act, 2023, the Digital Health Care Act, 2023, and the Primary Health Care Act, 2023.

In the case filed by four medical doctors, the petitioners argued that the 2.75 per cent contribution from one's gross income would see higher income earners contributing more than lower earners, yet they would enjoy the same benefits would be the same, terming it discriminatory.

Top Stories Today