Explainer: What you need to know about new health fund replacing NHIF

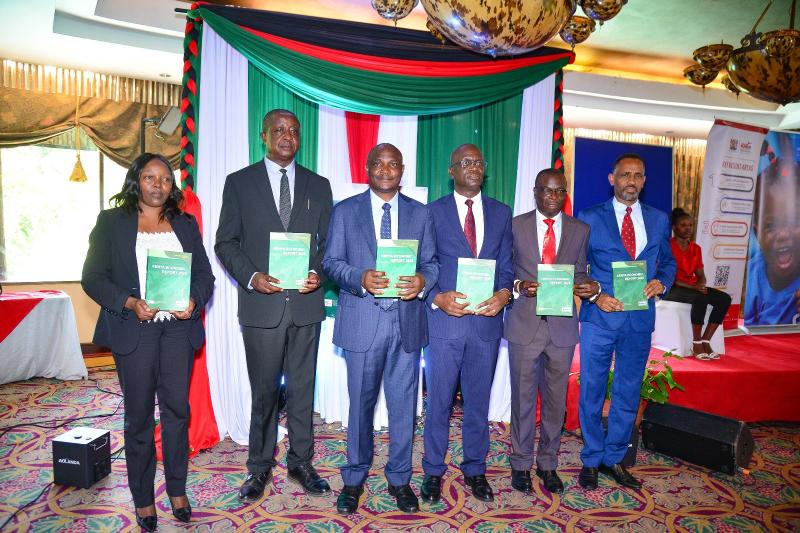

The government aims to register around 15 million Kenyans into the new system.

The transition to the new Social Health Authority (SHA) system is in full swing, with official operations set to begin on October 1, 2024.

The SHA will take over from the National Health Insurance Fund (NHIF), which has been in place for 66 years.

More To Read

- Health Ministry clarifies Kenya–US health partnership respects sovereignty, data protection

- KNCHR says Kenyans still locked out of healthcare despite Sh138 billion SHA boost

- Kenya urges stronger regional cooperation as transport corridors fuel disease risks across East Africa

- MPs ditch SHA, the public health scheme they once praised, and opt for private cover

- WHO calls for urgent action to achieve universal health coverage by 2030

- How Trump–Ruto health deal fills the void left after USAID exit

This shift marks a significant change in how healthcare services will be financed and delivered in Kenya.

What is the SHA?

The Social Health Authority is a government agency created to manage the Social Health Insurance Fund (SHIF), one of three funds designed to streamline healthcare financing.

Alongside SHIF, there are two other funds — the Primary Health Care Fund (PHCF) and the Emergency, Chronic, and Critical Illness Fund (ECCIF).

Each fund has its role, with SHIF operating as a contributory scheme, while PHCF and ECCIF are funded by the government.

Why the change?

President William Ruto indicated that the new SHA aims to address gaps in the NHIF and offer better healthcare services for all Kenyans, regardless of their economic status.

The overhaul is seen as crucial for achieving Universal Health Coverage (UHC), a goal that has remained elusive despite several initiatives.

"NHIF made it mandatory for only salaried Kenyans to pay for insurance. Only 20 per cent of Kenyans are salaried, which means 80 per cent had to rely on out-of-pocket payments to settle hospital bills," said Daniel Mwai, an advisor to the president on health financing.

How does SHA differ from NHIF?

The NHIF underwent several reforms, including new contribution rates introduced in 2021.

However, challenges persisted, particularly in providing equitable access to healthcare for the poor and those in the informal sector.

SHA aims to address these shortcomings by consolidating different funding pools, which will help reduce inefficiencies and lower healthcare costs.

The SHA's main goal is to ensure that Kenyans have equitable and affordable access to healthcare.

It also seeks to alleviate the financial burden caused by catastrophic illnesses, which often push households into poverty.

How much will Kenyans pay?

Under the new SHA system, workers will contribute 2.75 per cent of their salaries to the health fund.

This is a departure from NHIF's fixed contributions, which ranged from Sh150 to Sh1,700 for salaried employees, and Sh 500 for self-employed individuals.

For instance, under the SHA, those earning Sh20,000 will contribute Sh550, while those with salaries of Sh50,000 will pay Sh1,375.

The highest earners, such as those making Sh1 million or more, will contribute up to Sh27,500.

Meanwhile, self-employed individuals will continue to contribute, but their contributions will be determined using a means test to ensure fairness.

Notably, the minimum monthly premium has been reduced from Sh500 to Sh300, easing the burden on lower-income earners.

For the first time, the government will cover the health contributions for vulnerable Kenyans who are unable to afford them.

Both national and county governments will contribute on behalf of these individuals, with the national government paying Sh13,300 for each person identified as vulnerable by the State Department of Social Protection.

What about foreigners?

Foreigners visiting Kenya for over 12 months will be required to enrol in the SHA and contribute to the social health insurance scheme.

However, visitors staying for less than a year will need to purchase travel health insurance that complies with Kenyan regulations.

How will the transition work?

The government aims to register around 15 million Kenyans into the new system.

Registration can be done through USSD code *147#, the SHA website, NHIF offices, or with the help of community health promoters.

The transition from NHIF to SHA is governed by a detailed legal framework.

A transition committee, established in February 2024, is overseeing the process.

The committee, in coordination with the boards of NHIF and SHA and the Ministry of Health, is tasked with ensuring a smooth transition over 12 months.

The process includes managing assets and liabilities, human resources, pensions, and other staff benefits.

Funds under the SHA

Primary Health Care Fund (PHCF): Provides free outpatient services at community facilities classified under Primary Care Networks (PCNs).

Emergency, Chronic, and Critical Illness Fund (ECCIF): This fund is designed to handle diseases such as cancer, hypertension, and diabetes, which require long-term management and can be financially draining for households.

Top Stories Today