Uncertainities over SHIF transition as locals, health providers raise more grievances

The lack of adequate public participation and clarity has discouraged many Kenyans from registering for SHIF.

"What Happens Next After Registering for the Social Health Insurance Fund?" This question is on the minds of many Kenyans, particularly given the ongoing challenges and cash payment issues affecting the rollout.

Many, especially those in the informal sector, find themselves confused about the process. After registering, most are uncertain where to turn for assistance or guidance.

More To Read

- MPs demand SHA clears Sh10 billion in pending NHIF bills within three months

- TSC confirms shift to SHA cover for teachers from December 1

- Court of Appeal postpones hearing on constitutionality of Health Acts

- Over 29,000 Kenyans die of cancer yearly as high costs force them to abandon treatment

- SHA faces Sh30 billion backlog despite Sh81 billion collected since inception

- Health Ministry tops list of NHIF debtors with Sh7.8 billion owed- RUPHA

Challenges faced by new enrollees

Simon Kiprotich is one of the affected. Weeks after Kiprotich, a resident of Pumwani, took the initiative to enrol in the Social Health Insurance Fund (SHIF), he's facing challenges with registering his dependents. With a sick daughter in need of treatment, he worries about what comes next, particularly after hearing numerous complaints.

"I followed the registration process, and the system confirmed my enrollment, but I still can't add my daughter and other details. She's coming home from school because she needs medical care, and now I'm uncertain about what happens next," Simon told The Eastleigh Voice.

He feels lost about whom to turn to for help and how the system operates, especially since many healthcare providers only accept cash payments. At times, they are sent home and asked to come back with the cash.

"Many children aren't receiving treatment at school because of problems with the Edu Afya programme, leading some schools to send children home for care. My plea is for this issue to be resolved quickly, as Kenyans are suffering," he lamented.

Simon Kiprotich, a resident of Pumwani, has faced challenges registering his dependents on SHA. (Photo: Charity Kilei)

Simon Kiprotich, a resident of Pumwani, has faced challenges registering his dependents on SHA. (Photo: Charity Kilei)Simon Kiprotich, a resident of Pumwani, has faced challenges registering his dependents on SHA. (Photo: Charity Kilei)

In mid-September this year, the Cabinet stated that health programmes such as Edu Afya would be broadened to encompass all school-going children, extending beyond its current focus on secondary school students, once the country transitions from National Health Insurance Fund (NHIF) to SHIF.

With the social health scheme not functioning smoothly, Kiprotich is left feeling uncertain and deeply concerned. Despite completing the registration process, he is unable to add any details about his dependents or access necessary services. This lack of clarity leaves him anxious about his daughter's health and the potential financial burden of seeking treatment outside the scheme.

"With this new scheme, I don't even know how much I'm supposed to contribute. I've heard that my spouse and I might be contributing separately, which is a lot to take in. We're asking the government to support Kenyans by ensuring a smoother rollout, as they had promised."

Clinton Omonge, a Majengo resident, has not updated his account since the transition from NHIF to SHIF, despite the government's call for members to refresh their profiles and provide additional details.

Clinton Omonge a resident of Majengo, has faced constant challenges in onboarding the Social Health Insurance fund. (Photo: Charity Kilei)

Clinton Omonge a resident of Majengo, has faced constant challenges in onboarding the Social Health Insurance fund. (Photo: Charity Kilei)Clinton Omonge a resident of Majengo, has faced constant challenges in onboarding the Social Health Insurance fund. (Photo: Charity Kilei)

"It's very hard to fully commit to something when you don't understand its implications," he says. "I'm waiting to see how things will turn out. If the process improves, then I'll consider updating my profile; if not, I'll just leave it as it is."

He noted that many facilities have already been requiring cash payments, as some hospitals have stopped accepting NHIF.

Other Topics To Read

For him, paying out of pocket has proven to be more cost-effective in the long run compared to what the new scheme is promising. The uncertainty surrounding the new system and the lack of trust in its implementation have left him hesitant to engage further.

Joshua Omondi, another resident of Gikomba, chose not to enrol in the scheme due to unclear payment issues. As a trader, he believes a simpler system would be more effective.

"We thought the government would come up with better ways to collect money from the informal sector, but they've insisted on the 2.75% contribution. Now that I've been moved to the scheme, I won't make any payments until it's simplified and understandable."

He emphasised the importance of considering public concerns, especially those from the informal sector.

"We started raising issues early on and are still waiting for clarification. If I'm told that this is the exact amount I need to pay, that's much easier than trying to calculate payments for people who manage their income independently."

A view of the NHIF headquarters in Upper Hill, Nairobi. (Photo: File)

A view of the NHIF headquarters in Upper Hill, Nairobi. (Photo: File)

Digitalisation and accessibility issues

While many Kenyans were already sceptical about the new scheme due to a lack of adequate public participation and clarity, this has discouraged many from registering.

The Ministry of Health aimed to enrol 12 million Kenyans in the new health scheme by October 1st, 2024. However, only about 1.9 million have voluntarily registered, falling significantly short of this target.

Approximately 10 million members of the National Health Insurance Fund were automatically transferred to the new scheme, but data accuracy issues meant that only 70% of the information was transferred correctly. This has caused an uproar, as the ministry initially emphasised that registration would be voluntary.

Additionally, the new contribution structure requires salaried workers to contribute 2.75% of their income, raising concerns about the financial burden. With those in the informal sector left confused, many Kenyans, even those who were transferred, remain wary of the process, especially given the numerous complaints and system failures.

Moreover, the new system offers limited coverage, fewer services, and lower reimbursement rates for specialised treatments compared to the National Hospital Insurance Fund. This could lead to increased out-of-pocket costs for patients and a decline in care quality.

Digitalisation poses another challenge. Since July 2024, citizens have been able to register for Social Health Authority services through various methods, including USSD codes and online platforms. However, participation has been slower than expected, largely due to limited awareness and infrastructure challenges. Concerns about data ownership and security further complicate the situation.

Healthcare provider raise concerns

Various hospitals have expressed concerns about the rollout of the Social Health Authority (SHA). The Kenya Renal Association, which represents kidney doctors, nurses, and other healthcare practitioners, has warned about nearly Sh10 billion in unremitted claims, highlighting the lack of a clear reimbursement pathway in the now dysfunctional NHIF.

"With the rollout of SHA, we had hoped for improvements in dialysis service delivery and reimbursement," the association stated. They emphasised that they have made several recommendations to SHA aimed at enhancing healthcare, including initiatives for kidney disease prevention, non-dialysis management of chronic diseases, and expanding transplant services.

Other organisations, including faith-based groups, have also raised alarms about the rollout, citing unclear debt settlement processes. Faith-based medical facilities, along with the Rural and Urban Private Hospitals Association of Kenya (RUPHA), have rejected the new SHA contracts, pointing to unresolved issues regarding unpaid dues and unfavourable contractual terms.

Through their Secretary-General, faith-based organisations argue that the government has failed to address the over Sh21 billion owed to them by the now-defunct NHIF. KMPDU Secretary-General Davji Atellah claimed that the government's actions seem aimed at benefiting private insurers.

"SHIF is a sinking ship! There is too much uncertainty," he stated.

The Social Health Authority (SHA) headquarters in Nairobi. (Photo: SHA)

The Social Health Authority (SHA) headquarters in Nairobi. (Photo: SHA)

SHA responds

The Social Health Authority (SHA), however, announced plans to reimburse patients who covered their medical expenses out of pocket during the National Health Insurance Fund (NHIF) outage.

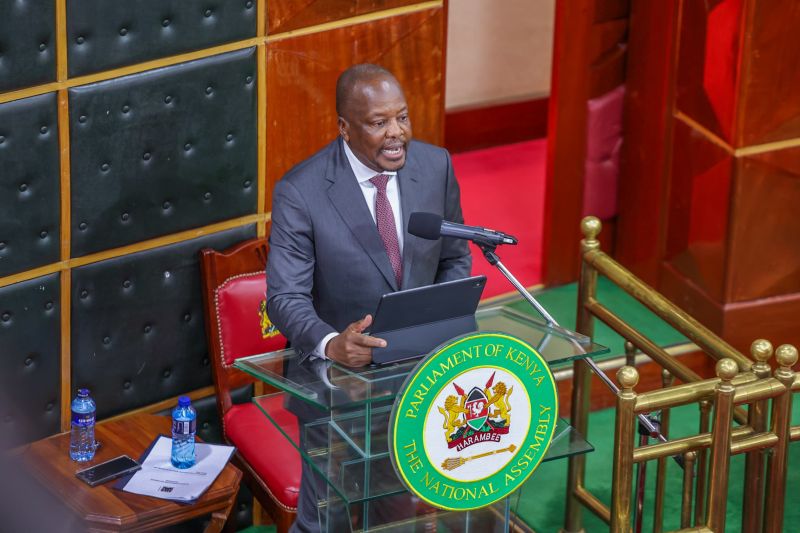

SHA Chairman Abdi Mohamed clarified that only those who incurred expenses after midnight on September 30, 2024, will qualify for refunds, urging affected individuals to reach out to the authority for assistance.

SHA Chief Executive Officer Elijah Wachira further confirmed that all outstanding cases with NHIF commitments made prior to October 1, 2024, will also be addressed.

“Patients admitted or treated after September 30, 2024, will have their bills covered by SHA; there are no coverage gaps,” he stated.

For patients whose expenses exceeded the SHA benefits, Wachira reassured them that they need not worry. “It’s not uncommon for certain procedures to go beyond SHA’s coverage limits, as hospitals may charge extra for additional services,” he noted.

Wachira highlighted SHA’s commitment to covering basic treatments for all patients and mentioned that a standard tariff is being established for various conditions. He added that payment amounts may vary based on the chosen facility, which might require additional payments in some instances.

During a stakeholder meeting today, Principal Secretary for Medical Services Harry Kimtai added that the Ministry of Health has secured 1.5 billion to settle NHIF debts and is currently developing a formula for distributing these funds.

Top Stories Today