HELB offers 80 per cent penalty waiver to loan defaulters in new recovery push

The waiver applies only to those who pay their full arrears at once through the HELB portal, mobile app, or USSD code *642#.

The Higher Education Loans Board (HELB) has rolled out an 80 per cent penalty waiver for loan beneficiaries who settle their outstanding arrears in full, in a renewed effort to recover billions owed by former students.

In a public notice on Tuesday, August 5, HELB urged loanees to take advantage of the offer, stating that repaying their loans in a lump sum would grant them significant relief from accumulated penalties.

More To Read

- HELB extends student loan application deadline

- Government disburses Sh23.16 billion to university, TVET students

- Universities directed to update student portals amid frustration over HELB delays

- HELB disburses Sh9.46 billion to over 309,000 university students, easing fee confusion

- First-year university students face chaos over upfront payments after fee reductions

- HELB loans awarded to 136,000 first-time university students as government caps fees

The waiver applies only to those who pay their full arrears at once through the HELB portal, mobile app, or USSD code *642#.

“We are slashing down those penalties so you can smack down those arrears. Pay in a lump sum today and claim your waiver," HELB said."

The announcement comes days after the government increased funding for higher education, raising HELB’s annual allocation from Sh36 billion to Sh41 billion in the 2025/2026 financial year.

Education Cabinet Secretary Julius Ogamba said the move was aimed at ensuring all eligible students receive financial support and that no one misses out on education due to a lack of fees.

“To ensure no student is left behind, the Government has increased HELB’s annual funding from Sh36 billion to Sh41 billion, a significant boost of Sh5 billion. Of this, Sh13 billion has already been released to support tuition and upkeep for students, while Sh16.9 billion has been allocated to the Universities Fund for Scholarships,” said Ogamba.

He confirmed that disbursement of HELB loans for first-year university students would begin on August 15, 2025.

“These funds will be released in phases to ensure a smooth transition into University/TVET College and to help students settle into their academic journey without interruption,” he said.

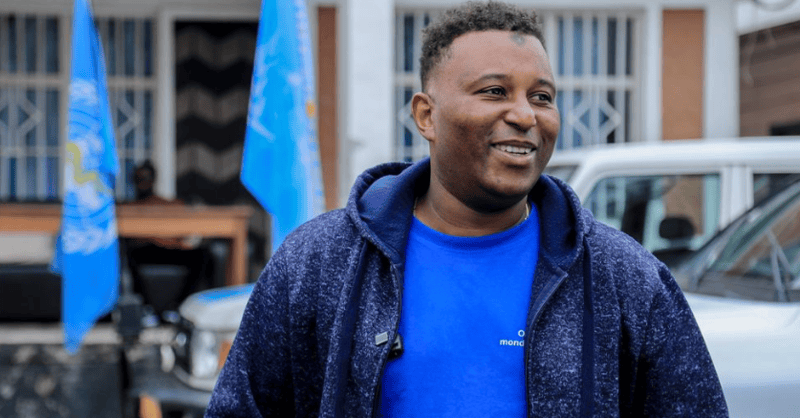

In a June 17 interview with Citizen TV, Higher Education Loans Board (HELB) CEO Geoffrey Monari revealed that professionals in private practice, including accountants, doctors, lawyers, and engineers, were among the highest defaulters of HELB loans.

Monari stated that only 11 per cent of trained accountants were actively repaying their loans. Out of 20,420 accounts associated with accountants, just 2,420 were active in repayment, while the rest remained in default. Doctors followed closely, with only 18 per cent of 11,501 practising doctors servicing their loans.

He further disclosed that 51,594 individuals who graduated over 20 years ago still owed HELB a combined total of Sh8 billion. The trend extended to lawyers and engineers, with only a small fraction of beneficiaries having repaid their loans.

“The problem is when people go to the private sector, they start to become a problem to us,” Monari said, noting the challenge of tracing graduates outside government employment.

To improve recovery, Monari said HELB had started working with professional bodies and employers to deny licence renewals to persistent defaulters. This effort formed part of a wider strategy that also includes partnerships with credit reference bureaus and possible legal action.

Despite the default rates in the private sector, Monari commended teachers as the most consistent in repayment. He noted that over 44,000 teachers were actively servicing their loans, with only about 3,500 yet to begin repayment despite being in formal employment.

Top Stories Today