How Africa’s ‘ticket’ to prosperity fueled a debt bomb

Credit ratings were meant to help sub-Saharan countries tap global investors to fund much-needed development.

In 2002, Africa seemed poised to rise. Wealthy creditor nations were wiping billions of dollars of unsustainable debt off the books of sub-Saharan countries, and global demand was surging for the commodities the region exports, supercharging hopes of a sustained economic boom.

The United Nations, backed by the United States, had a plan to fuel the expansion: sovereign credit ratings. These metrics — essentially an informed guess of a nation’s ability to repay lenders — would for the first time allow a wide swath of the poorest region on Earth to tap yield-hungry investors in the global bond market.

More To Read

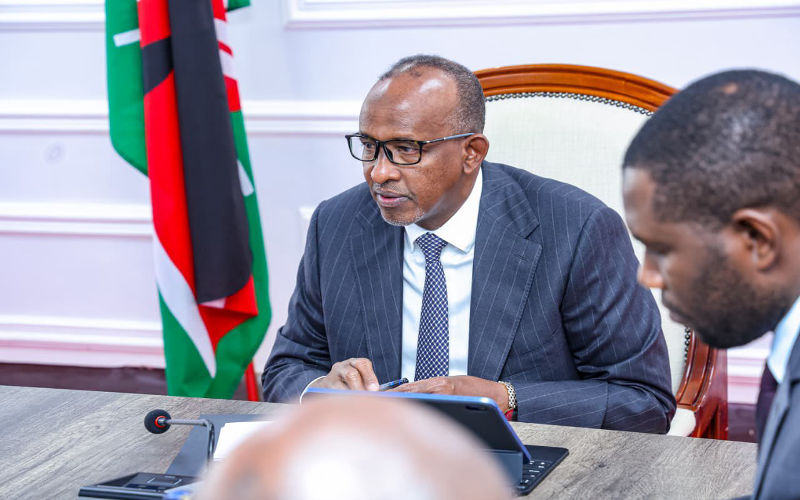

- Kenya and IMF agree to start formal talks on new lending programme

- Kenya to defer Sh88.1 billion IMF funding to next year

- CBK's foreign reserves hit four-year high after IMF boost

- IMF concerned over Kenya's budget shortfall despite proposed new taxes

- IMF warns Kenya over further interest rate cuts, citing risks to economic stability

- Kenya seeks Sh37.6 billion IMF funds cut citing lower financing pressures

And the cash borrowed wouldn’t come with strict controls on how it would be spent, as is the case with financing from multilateral institutions like the International Monetary Fund. The U.N. heralded the initiative as “an assault on poverty in Sub-Saharan African countries.”

Today, the optimism has faded, washed away by a deluge of debt.

Essential to the plan were the “Big Three” U.S.-based credit rating agencies — S&P Global Ratings, Moody’s Ratings and Fitch Ratings, which together account for more than 90 per cent of global ratings.

The rating agencies collected fees for their services and began applying their complex analyses to the region.

Given the troubled economic history and conditions of sub-Saharan Africa, it came as little surprise that the Big Three gave most countries below-investment-grade, or “junk,” ratings.

Those low scores meant the countries had to pay higher interest rates on their bonds to attract investors who might otherwise balk at the risk.

The thinking at the time was that African countries’ ratings would improve, and their cost of borrowing decline, as their growing economies allowed them both to repay their debts and invest in development.

Instead, the push for credit ratings set these nations on a path to debt many could not afford.

Over the past two decades, more than a dozen sub-Saharan countries borrowed nearly $200 billion from overseas bond investors, according to World Bank figures. As their nations’ finances faltered, African leaders lashed out at the rating agencies with allegations that the firms were biased in their assessments.

Reuters did not find evidence of systemic bias in the Big Three’s ratings for the region. Rather, Africa’s debt crisis highlights the potential pitfalls when sophisticated financial markets meet impoverished countries eager for development.

Other Topics To Read

Top Stories Today