Audit exposes gaps in university funding, shows how deserving students miss out

Auditor-General Nancy Gathungu’s report attributes the flaws to poor coordination between government agencies and a failure to integrate the funding model with the Kenya Universities and Colleges Central Placement Service (KUCCPS).

Kenya’s higher education funding system has come under scrutiny after an audit exposed major failures that have seen many deserving students miss out on financial support, while others who were ineligible benefited from the scheme.

Auditor-General Nancy Gathungu’s report attributes the flaws to poor coordination between government agencies and a failure to integrate the funding model with the Kenya Universities and Colleges Central Placement Service (KUCCPS).

More To Read

- Public hospital patients may have received untested drugs, Auditor-General reveals

- Sh1.6 billion paid to three unidentified companies prompts probe at Rerec

- Audit flags deep staff shortfall at Kenya School of Government

- Audit exposes fake firms, unsafe inputs and lost billions in Ruto's fertiliser subsidy plan

- Kenya Railways losing millions as ticketing flaws let passengers ride free, Auditor General reveals

- Kenya Forest Service under fire over irregular staff sackings, court lapses

This disjointed system has made it difficult to monitor students from the point of placement to the time they receive funding.

“The model is not integrated with the KUCCPS system to ensure seamless tracking of students from placements in the universities, to funding,” the report states.

The lack of a proper tracking system has resulted in students receiving money before being formally placed in universities, while others have been excluded due to missing or duplicated details.

The report reveals that some of those who benefited had deferred their studies, were expelled, or never reported to their institutions.

“A review of documents and interviews with the Fund’s management revealed critical challenges the model is facing. For instance, there is no coordination between the other government agencies dealing with the higher education students’ support,” the audit says.

The Auditor-General further questions the fairness of the funding model, saying the effectiveness of controls around scholarship management could not be confirmed.

The report raises concerns about whether the system is capable of distributing resources equitably and efficiently.

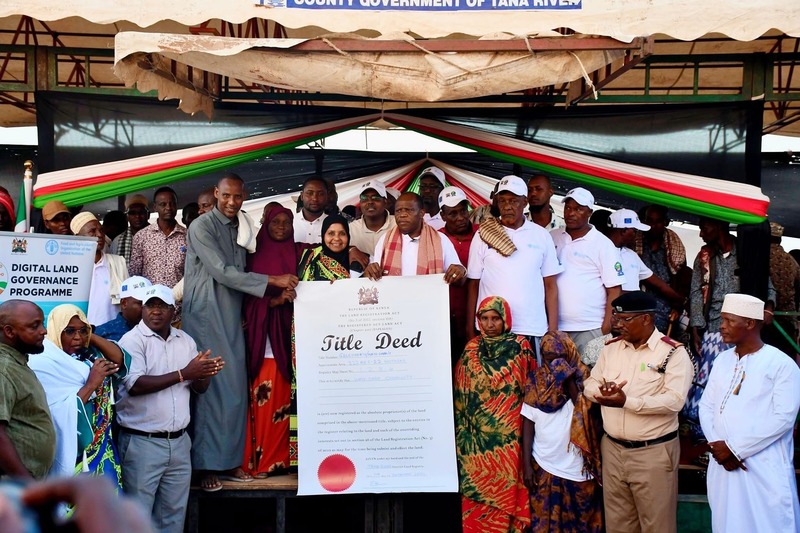

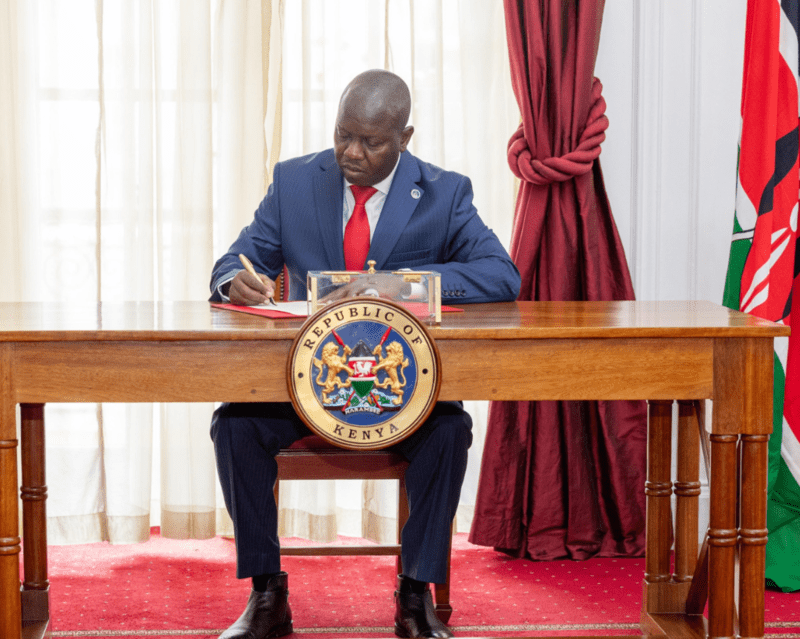

Introduced by President William Ruto’s administration in 2023, the model was promoted as a fair and inclusive approach to education financing, placing students at the centre of the process.

It uses a Means Testing Instrument (MTI) to assess applicants’ financial needs and assigns them to one of five categories that determine the level of support, through scholarships, loans or household contributions.

However, the audit found discrepancies between the officially approved MTIs and the versions used in the system. This led to inaccurate placement of students in the funding bands.

“Review of the means testing instruments (MTIs) used for placing students in bands against approved MTIs revealed variances between the approved MTIs and the system-configured MTIs. In the circumstances, students’ placements resulting from the use of the unapproved MTIs were inaccurate,” the report reads.

The Auditor-General also notes that a lack of awareness about the model has undermined its accessibility, especially in marginalised regions. Many students did not know how to apply for support, locking them out of the process.

“Vulnerable groups such as students living with disabilities and those from remote areas have faced difficulties accessing funds,” the report adds.

Inclusivity concerns were also raised over the lack of financial products tailored to specific needs.

“There were also emerging concerns on unique challenges, such as those faced by Muslim students who require Sharia-compliant financial products, further hindering inclusivity.”

The audit further warns that the long-term stability of the funding model is in doubt due to poor loan recovery.

High levels of unemployment and underemployment among graduates have made repayment difficult, pushing up default rates.

“Loan repayment burden due to high unemployment and underemployment rates is making it difficult for graduates to repay their loans, increasing default rates and threatening the sustainability of the revolving fund,” it says.

In addition to operational problems, the model has also faced legal setbacks. A court in December 2024 declared the funding plan unconstitutional, stating that it was discriminatory and had not involved the public in its development.

Top Stories Today

Reader Comments

Trending