Motor vehicle sales soar as lending rates fall amid economic recovery

The rebound follows a period of slow sales in 2024, when reduced government spending and tighter financial conditions dampened demand.

Kenya’s motor vehicle market is experiencing renewed momentum this year, with dealers reporting a sharp rise in sales driven by cheaper loans and stronger economic activity.

According to the Kenya Motor Industry Association (KMIA), a total of 10,101 new vehicles were sold between January and September, compared to 8,165 units in the same period last year, a 24 per cent increase.

More To Read

- Kenya sees major boost from visa-free policy as tourist numbers hit 1.8 million

- KNBS data shows uneven food price shifts as inflation dips slightly

- Kenya Kwanza adds Sh3 trillion to national debt in three years, CBK reveals

- CBK warns of rising debt distress, urges fiscal coordination

- MPs question rising debt despite Treasury’s reduced CBK borrowing

- CBK data shows Sh344 billion decline in mobile money transactions, steepest drop in 18 years

The rebound follows a period of slow sales in 2024, when reduced government spending and tighter financial conditions dampened demand.

The industry says this year’s performance has been buoyed by a drop in lending rates and rising investments in sectors such as transport, construction, and manufacturing.

September recorded 1,184 new vehicle registrations, up from 1,010 in the same month last year, with the monthly average remaining above 1,000 units for most of 2025.

Trucks continued to dominate the market with 4,113 units sold, reflecting strong demand in logistics and infrastructure projects.

The Central Bank of Kenya (CBK) has played a key role in stimulating the market by easing its base lending rate eight times since June 2024, bringing it down from 13 per cent to 9.25 per cent.

This monetary policy shift has made borrowing cheaper for both individuals and enterprises, encouraging new investments and purchases.

Recent data from the Kenya National Bureau of Statistics (KNBS) also indicates that the broader economy is gaining strength, with GDP expanding by five per cent in the second quarter of 2025, up from 4.6 per cent in the same period a year earlier.

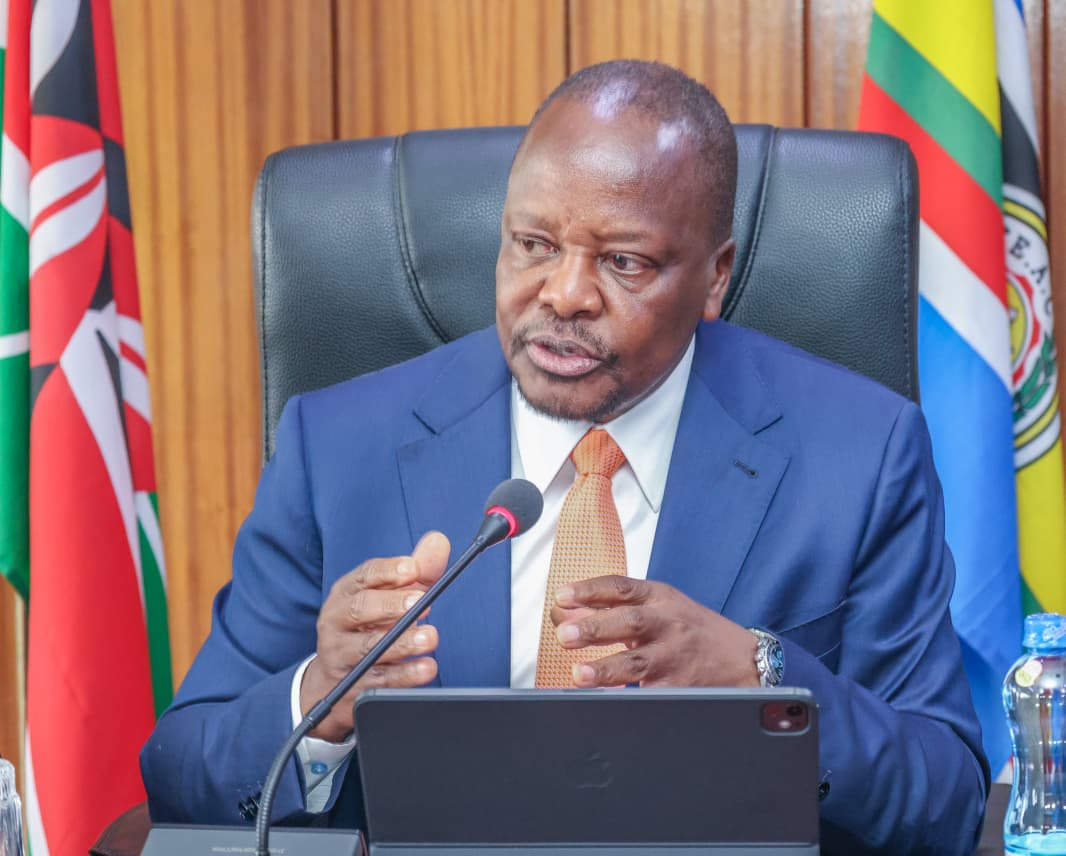

“This reflected a rebound in activity in the industrial sector, stable growth of the agriculture sector, and resilience of key service sectors, particularly transport and storage, finance and insurance, information and communication, and wholesale and retail trade,” CBK Governor Kamau Thugge said in the Monetary Policy Committee statement.

Indicators for the third quarter, he added, point to continued economic recovery supported by strong domestic demand.

Dealers also reported solid performance in pick-ups and commuter vehicles, with 2,358 pick-ups and 857 medium buses (21–40 seats) sold during the period, as public transport operators renewed their fleets. Sales of large buses reached 213 units.

Isuzu East Africa maintained a firm grip on the market with 4,830 vehicles sold, accounting for 48 per cent of total industry sales.

CFAO Motors followed with 3,268 units (32 per cent), while Simba Corporation came third after selling 881 vehicles.

Top Stories Today