Banks urged to tone down use of jargon to enhance performance

By Alfred Onyango |

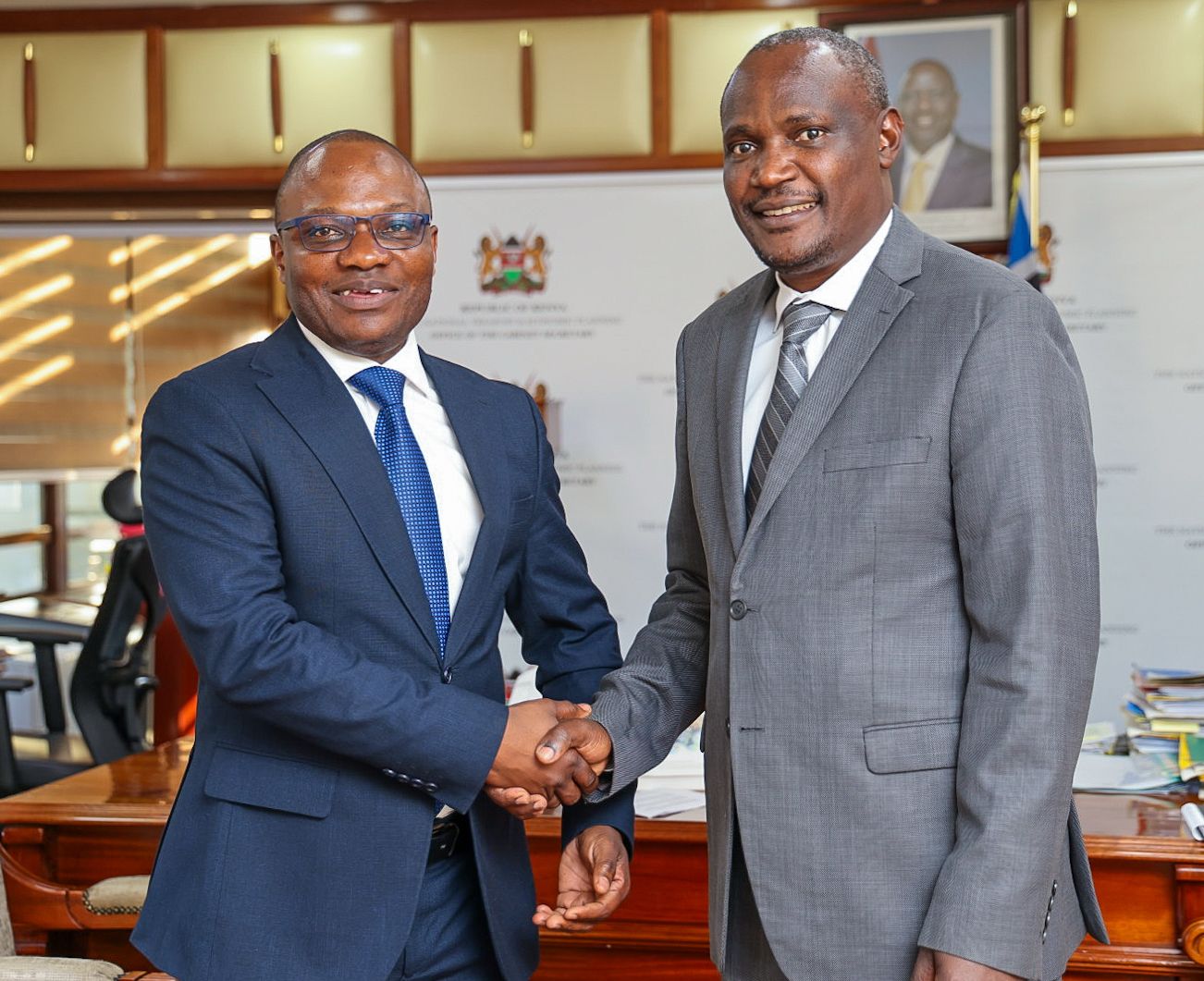

Economic analyst Mihr Thakar argues that the use of jargon may significantly hinder business performance.

Researchers in the banking sector have been encouraged to make research more accessible by using simpler language, ensuring that research outputs are more effective in solving market problems.

This is among the key deliberations by thought leaders, policymakers and industry experts who convened at the 13th Annual Kenya Bankers Association (KBA) Research Conference in Nairobi.

Keep reading

In today's fast-paced corporate environment, experts have weighed on the importance of effective communication as a crucial tool for success.

Economic analyst Mihr Thakar for instance, argues that the use of jargon may significantly hinder business performance.

"Excessive technical language can alienate clients and mislead employees, leading to decreased productivity and poor decision-making," he notes.

He thus emphasises the importance of clear language, suggesting that simplifying communication can enhance collaboration and drive better outcomes.

Speaking during the forum, Betty Korir, the vice chair of the KBA governing council and CEO of Credit Bank, emphasised the importance of the banking sector's adaptability in navigating economic downturns, geopolitical conflicts, and technological disruptions.

"The banking sector must foster an environment of proactive thinking and strategic responses to continue playing a pivotal role in the nation's socio-economic development," Korir said.

The conference also highlighted the importance of sustainability, with discussions focused on integrating environmental, social, and governance principles into banking practices.

KBA's Sustainable Finance Initiative was lauded for mobilising industry players to prioritise sustainable banking practices that support Kenya's broader climate and socio-economic development goals.

KBA acting CEO Raimond Molenje reiterated KBA's commitment to driving transformation through evidence-based advocacy.

He emphasised that the conference plays a vital role in producing knowledge that informs policy and helps the banking sector remain resilient while promoting sustainable growth.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!