Farmers to access loans faster with AI-powered credit scoring

The AI-powered system consolidates farmer information into a digital database, using multiple data sets to determine creditworthiness.

Farmers seeking loans will soon have an easier time accessing credit following the launch of an AI-driven solution by Fortune Sacco aimed at streamlining the lending process.

The new credit scoring system seeks to eliminate lengthy paperwork and background checks, making loan approvals faster and more efficient.

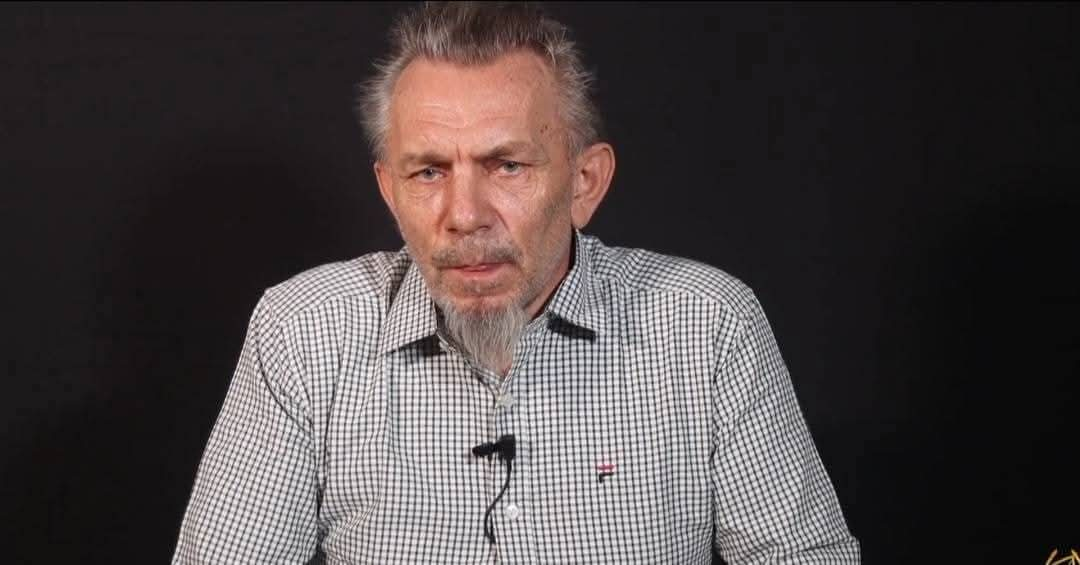

Speaking during the launch in Nairobi, Fortune Sacco Deputy CEO Timothy Muthike said the programme would enhance financial services for farmers by leveraging artificial intelligence to analyse various data points.

More To Read

- Ruto hails agricultural reforms, cites registration of seven million farmers in digital drive

- High interest rates, collateral gaps still hindering farmers' access to credit – CBK survey

- Wheat traders to enjoy continued tax relief after EAC deal

- Kenya's small-scale farmers to benefit from Sh10.9 billion funding boost

- Tough times ahead: Proposed tough agriculture laws worry Kenyan farmers

“We are focusing on organised sectors like coffee and tea, with a key interest in unstructured farmers engaged in subsistence activities such as banana, tomato, muguka, avocado, and French beans,” he said.

Muthike noted that despite these sectorsu significantly contributing to Kenya’s GDP, lending institutions remain hesitant to offer credit to farmers due to the lack of comprehensive databases. The challenge has left many small-scale farmers struggling to secure financial assistance.

The AI-powered system consolidates farmer information into a digital database, using multiple data sets to determine creditworthiness. It assesses factors such as marital status, spouse details, number of children, children’s school reports, land size, and the number of crop stems.

“This database is ordinarily unavailable. With AI, we collect vital information that accelerates lending decisions using multiple data sets as opposed to traditional approaches such as guarantors, shares, and production methods,” Muthike said.

He added that the new system takes a holistic approach to evaluating farmers, considering not only their financial needs but also their aspirations.

“We want to consider farmers as a whole so that we can tailor a product beneficial to both the Sacco and the farmers. The use of technology and data to make accurate or near-accurate credit decisions is important,” he said.

The initiative, funded by the German Agency for International Cooperation (GIZ), targets 60,000 registered farmers. So far, about 15,000 farmers have already begun accessing credit through the AI-driven system. Other partners include data, AI, and innovation firms such as Pathways Technologies.

Pathways Technologies CEO Joel Onditi emphasised the importance of digital transformation in agriculture, noting that data-driven solutions would help address farmers’ challenges and support financial institutions in making informed lending decisions.

“To digitise agriculture, we need to forgo traditional methods. Fintech has revolutionised finance. Agriculture needs to follow suit,” he said.

Meanwhile, the government is implementing the National Livestock Master Plan, an intervention aimed at streamlining the country’s animal sector.

The AI-powered credit scoring solution by Fortune Sacco has been allocated Sh100 million for implementation this year.

To comply with the Data Protection Act, registered farmers will have to provide consent before their data is used.

Muthike assured that the Sacco has adhered to all required standards to safeguard farmers’ information.

Other Topics To Read

Top Stories Today