Treasury mulls using existing tax rates for 2025-2026 budget after deadly protests in 2024

With revenue collection falling short of expectations, Treasury's decision to review its budget projections for the 2025-2026 fiscal year reflects the reality of a slowing economy.

The National Treasury is weighing the option of financing the 2025-2026 budget using current tax rates instead of introducing new tax measures, a move that comes after last year's Finance Bill was withdrawn following nationwide protests.

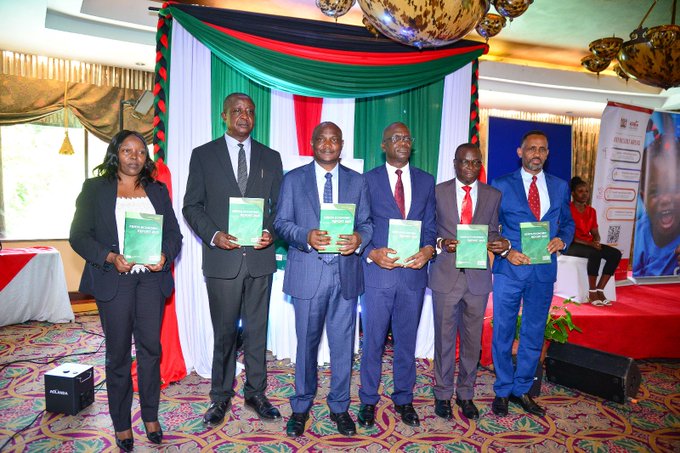

Speaking outside the Treasury offices on Thursday, Treasury Cabinet Secretary (CS) John Mbadi said the government could still finance the budget without increasing tax rates.

More To Read

- Treasury eyes restructuring as Sh137 billion water sector debt stalls

- Treasury sanctions Sh43.5 billion in unplanned spending in first quarter, budget watchdog says

- Kenya’s economic recovery not translating to quality jobs, report finds

- No layoffs for civil servants as Treasury unveils new payroll control system

- Government eyes handing NTSA’s smart driving licence programme to private investor

- Government sets 14-day deadline to end student bursary delays nationwide

"There is also a misconception in this country that you need a new Finance Bill all the time to finance the budget. That is not true. Even without a Finance Bill, we have tax rates that are obtaining. The Finance Bill only varies the rates, but we already have a legal framework for all taxes. We can use the same tax rates to raise revenue to finance this budget," Mbadi said.

He added that while it is a constitutional requirement to present a Finance Bill every year, it does not have to include tax increases.

"It's a constitutional requirement that every year we must prepare a Finance Bill. What is not a must is to have a Finance Bill with increased rates of taxation. No one says that the Finance Bill must always have an increase in our taxes. It can have a decrease; it can remain the same, but we will have to produce a Finance Bill, however thin," Mbadi said.

Treasury has revised its projected budget for the upcoming fiscal year downwards from Sh3.018 trillion to Sh2.835 trillion. Of this, the government expects to raise Sh2.8 trillion through taxes.

KRA's struggling revenue targets

The Kenya Revenue Authority (KRA) has faced difficulties in meeting revenue targets during the current fiscal year, raising concerns about how the government will fund its operations.

Treasury data shows that as of December 2024, KRA had collected Sh1.07 trillion, falling short of targets in five out of the six months since July.

"It is true that in the first six months, KRA did not meet the targets, more particularly in July, August, and September. We had a problem in November, but in October, KRA met targets. In December, we didn't meet targets, but the targets were very high. January has shown very positive signs," Mbadi said

According to Treasury Principal Secretary Chris Kiptoo, tax collection figures presented by KRA differ from the gazetted numbers.

While Kiptoo reported that KRA collected Sh199 billion in July, Treasury records show Sh159.5 billion. Similarly, in August, the PS indicated a collection of Sh173 billion, but gazetted figures show Sh153.3 billion.

In September, Kiptoo reported Sh236 billion, while the gazetted amount stood at Sh212.7 billion.

No specific figures

The PS did not provide specific figures for November and December, only stating that the shortfalls for the two months were Sh10 billion and Sh16.5 billion, respectively.

Treasury data, however, shows that KRA collected Sh160.3 billion in November and Sh217 billion in December.

"The total revenue target missed was by Sh90 billion for the first six months. We hope that in the next six months, we will not miss any target," Mbadi said.

The Treasury's decision to consider maintaining current tax rates is influenced by economic challenges, including low credit provision by banks to the private sector and last year's Gen Z-led protests, which disrupted economic activities.

With revenue collection falling short of expectations, Treasury's decision to review its budget projections for the 2025-2026 fiscal year reflects the reality of a slowing economy.

The government now faces a delicate balancing act, ensuring it funds key operations while avoiding further tax hikes that could spark public backlash.

Top Stories Today