Court of Appeal stops housing levy deductions

The court also declined an invitation to allow the government to collect the levy pending a hearing of the appeal.

The Court of Appeal has ordered the government to halt the Housing Levy deductions until cases filed against the programme are heard and determined.

In its ruling on Friday, the three-judge bench consisting of, Justices Lydia Achode, John Mativo and Mwaniki Gachoka ruled that the housing levy remains suspended as declared by the High Court.

More To Read

- Confusion over President Ruto’s 250,000 housing jobs as sector shrinks

- Kenyans warned over unregistered real estate agents

- Over 130,000 housing units underway as state allocates Sh11 billion to Jua Kali artisans

- Kenya’s budget cuts hamper key development projects in health, housing and transport

- Ruto defends Shauri Moyo affordable housing amid opposition criticism, vows more development

- Billions in housing levy funds remain idle amid slow project rollout

The Appeals Court declined the plea by the state to reverse the High Court's orders.

The court ruled that there is no legal framework for the government to continue making deductions as per the Finance Act 2023's amendment to the Employment Act 2007.

The judges declined an invitation to allow the government to collect the levy pending a hearing of the appeal.

“The trial Court held that the Housing Levy was introduced without a legal framework. It also held that the levy was targeting a section of Kenyans. In our view, public interest lies in awaiting the determination of the appeal. This is because if the stay sought is granted at this stage, should the appellate Court affirm the impugned decision, then some far-reaching decisions that will have been undertaken pursuant to the impugned laws may not be reversible. Public interest in our view tilts favour of in not granting the stay or the suspension sought," the Court of Appeal ruled.

Last November, a three-judge bench of the High Court ruled that the Finance Act 2023 amendment to Sec84 of the Finance Act amending the Employment Act introducing the Housing Levy was unconstitutional.

Petitioners' case

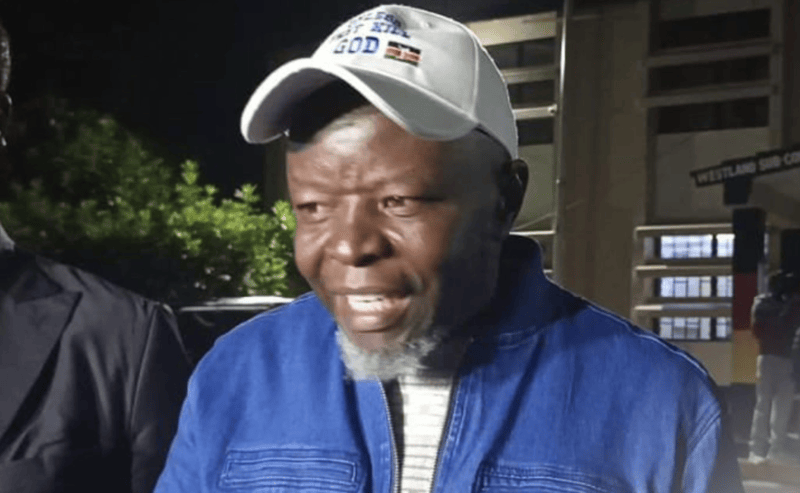

The petitioners who included Busia Senator Okiya Omtatah, Azimio la Umoja Coalition and the Law Society of Kenya among others moved to court wanting the levy declared unconstitutional.

They argued that the Finance Act 2023 was illegal as the new provisions were introduced on the floor of the House without being subjected to public participation as required by law.

The petitioners also argued that the introduction of the levy did not exist in law – as it purports to give powers to the Kenya Revenue Authority to collect deductions – which is unconstitutional.

President William Ruto in June signed the Finance Bill into law, which introduced the new housing levy.

The law contained the contentious provision which saw the introduction of a 1.5 per cent levy on the salaries of all tax-paying Kenyans that will be matched by employers to fund an affordable housing programme.

The President has been a staunch defender of the three per cent deduction on employees' pay for housing schemes, saying it contributed to individual savings towards owning decent houses.

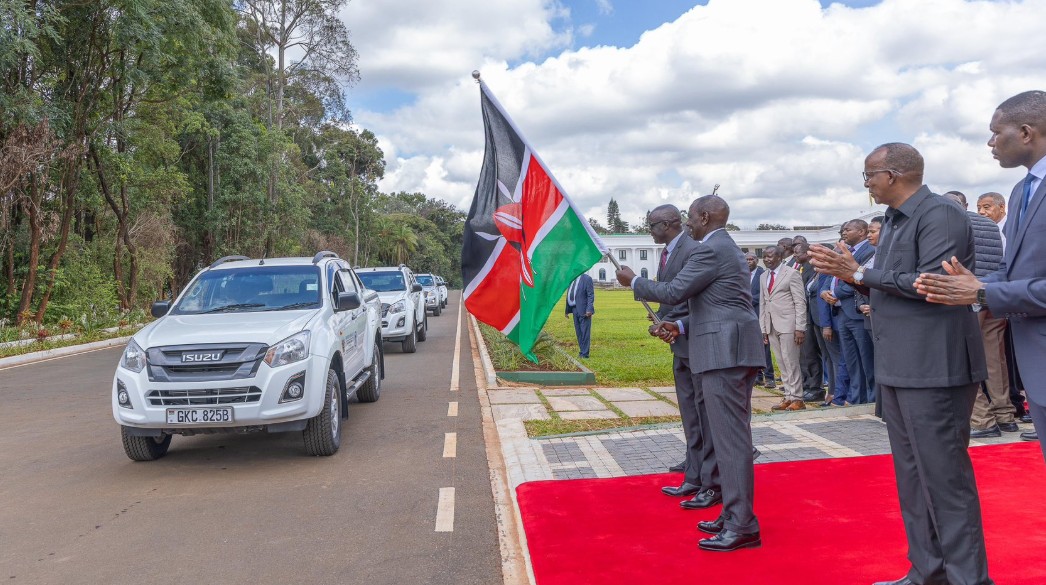

Ruto insisted that the affordable housing programme spearheaded by the Kenya Kwanza government will ensure millions of Kenyans living in informal settlements own houses despite their meagre pay while at the same time providing job opportunities for thousands of youth in the process.

Top Stories Today