Alarm over shift of Kenyan businesses to Uganda, Tanzania due to high costs

Most of those affected are in the Cement, Steel and Paper industries which are directly hit by the export promotion levy.

There is alarm as a growing number of companies that have been manufacturing in Kenya for years start relocating their operations to neighbouring countries, to escape high taxes that have raised the cost of doing business.

The exodus of companies has attracted the attention of lobbies in Kenya’s private sector manufacturing and employment industries, who are now calling on the government to address the challenge that has mainly been caused by additional taxes and levies.

More To Read

- SMEs sound alarm over rising failure rates amid investment gaps

- Report warns withholding tax risks pushing digital traders to informal platforms

- COTU demands immediate deportation of Chinese manager filmed assaulting Kenyan worker

- Grade 10 textbook supply at risk as Sh11 billion debt stalls printing

- COTU urges Kenyan workers abroad to register with embassies for protection, support

- MPs to private sector: No tax incentives without proof of public good

The government through the Finance Act, 2023, introduced the Housing Levy, raised Value Added Tax (VAT) on petroleum products and introduced an export promotion levy that applies to players in the cement, steel and paper sectors.

The taxes have introduced more burden on employers and workers.

This is causing many companies to scale down operations as costs of energy, transport and payroll eat into their revenues, and leaders in business management organisations have now raised the alarm that many have strategised to exit Kenya.

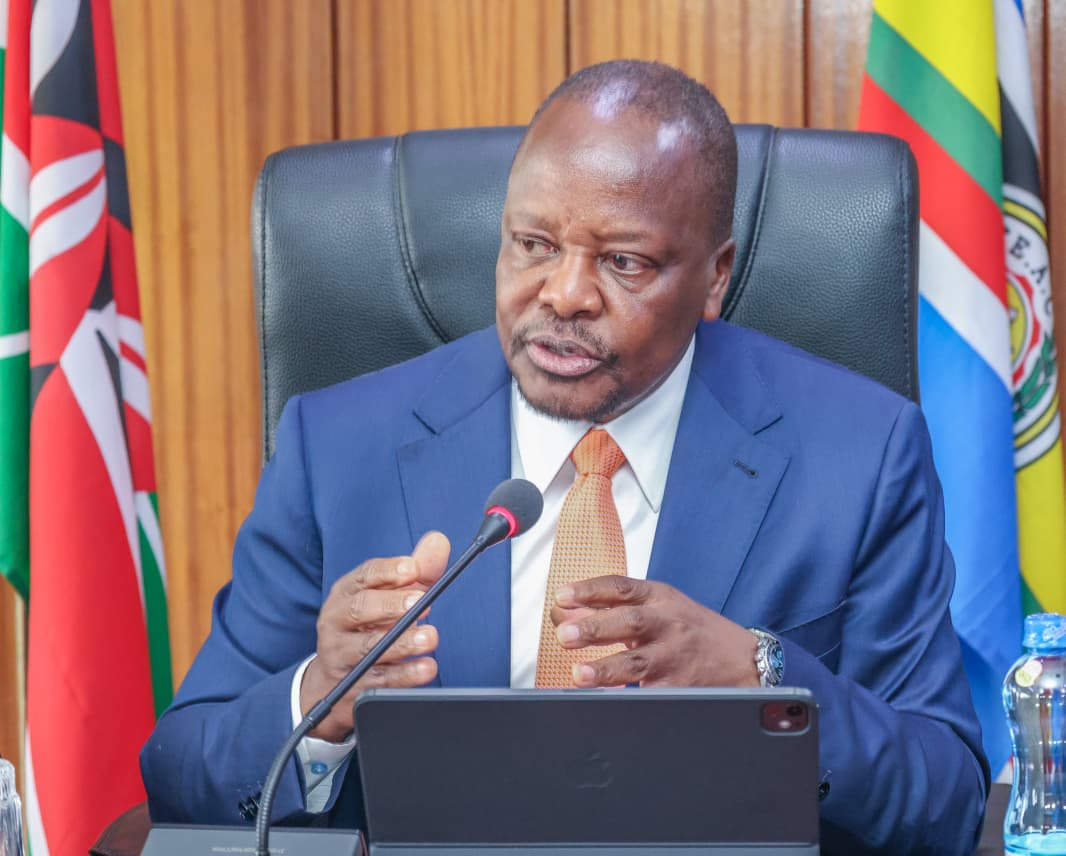

“Some investors are already relocating to Tanzania, Uganda and other neighbouring countries where they can be listened to. We must address that,” Cotu Secretary General Francis Atwoli said in a media briefing this week.

Loss of jobs

Atwoli complained that many Kenyans would lose jobs if more companies continued making the decision to operate from neighbouring countries and only accessing Kenya’s market.

The concern by Cotu only served to lift the veil on a trend that could see even more companies shift operations and deal a huge blow to Kenya’s employment sector, since it would result in layoffs.

Most of those affected are in the Cement, Steel and Paper industries which are directly hit by the export promotion levy at the rate of 17.5 per cent, which charges companies importing clinker, steel and paper materials such as those used to make packaging materials.

The Kenya Association of Manufacturers (KAM) has previously reported that some of their members have it in their strategy to move core production operations to neighboring jurisdictions that have had lower tax burdens, which will see them fire employees.

“Some manufacturers are also contemplating relocation as a strategic move for 2024. The possibility of moving operations to other countries, within the region, is being considered as a proactive measure to navigate potential hurdles and sustain business operations,” KAM said.

This would have a huge impact since factories across the country, mainly located within Nairobi and surrounding counties, employ more than 300,000 Kenyans.

“Manufacturers are evaluating their workforce strategies for this. The consideration of laying off permanent staff and employing temporary workers is being explored to manage costs and facilitate the recoupment of investments,” KAM said.

The companies are taking the heavy decisions noting that increased taxes and levies since last year have dwindled employment within the manufacturing sector.

Kenya Private Sector Alliance (KEPSA) also notes that the lowering of the category of businesses eligible to pay corporation tax from those with annual revenues of Sh50 million to those earning Sh25 million has contributed to more burden for businesses.

“Kenya’s high cost of doing business and reduced competitiveness in the East Africa region creates the risk of capital flights to neighbouring countries, which is likely to adversely affect even the current jobs in the formal sector,” KEPSA CEO, Caroline Kariuki, said.

The departure of businesses employing most Kenyans working in the private sector would worsen the state of employment in Kenya, this coming after the Federation of Kenya Employers (FKE) in November revealed that 70,000 jobs were lost since October the previous year.

Top Stories Today