No taxes on dates imported for Ramadhan, state announces

By Bashir Mohammed |

Muslims will be exempted from paying taxes on dates imported for the holy month of Ramadhan, the State announced on Tuesday.

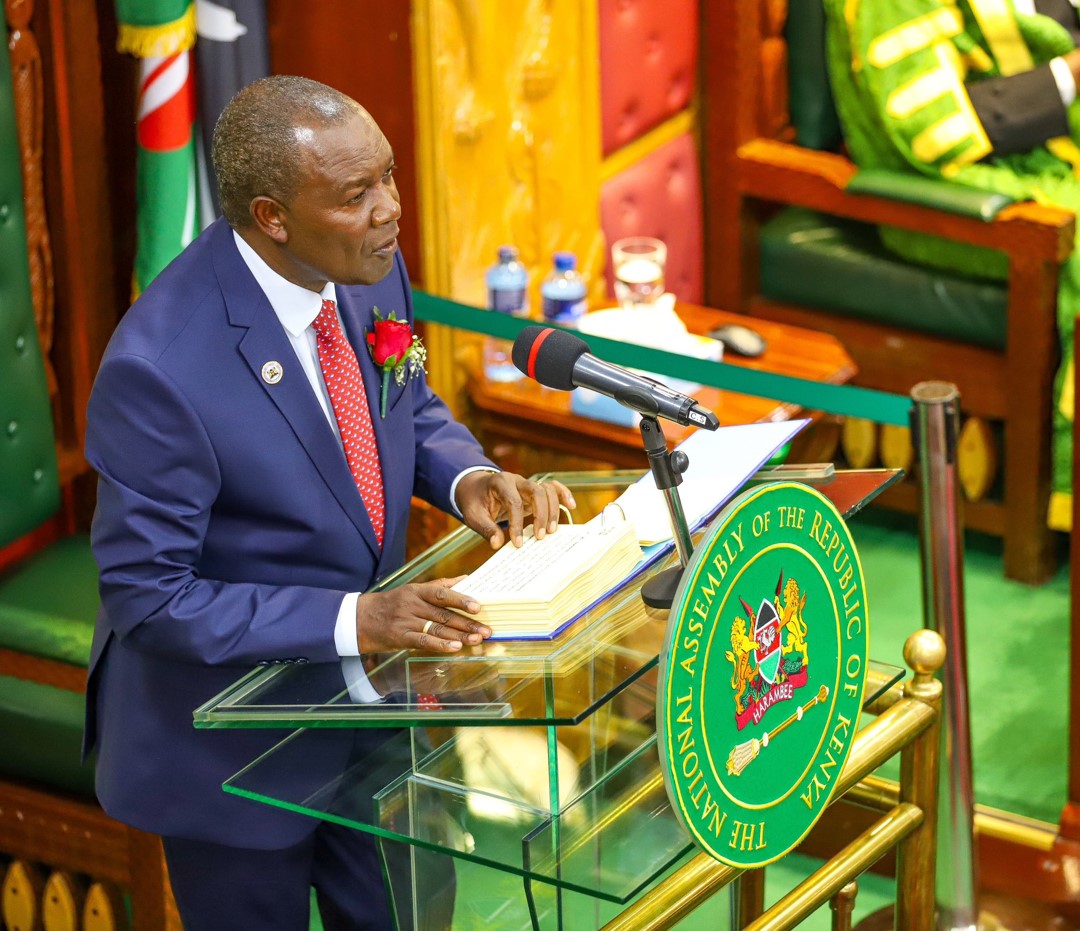

Treasury Cabinet Secretary Njuguna Ndung'u said the government had approved the duty-free importation of dates, the goal being "to provide support to the Muslim community".

Keep reading

"The government has authorised that the dates imported and cleared during this year's Ramadhan period be without payment of taxes, import declaration fees, or railway development levies,” the CS said in an internal memo seen by The Eastleigh Voice.

The taxman, the Kenya Revenue Authority, acknowledged the decision.

With March 10 - April 4 being the tentative Ramadhan period, dates imported and cleared between March 1 and April 20, 2024, will be considered for the tax exemption.

As Ramadhan approaches, Muslims around the world are preparing to fast from dawn to sunset, abstaining from food and drink and therefore in need of the dates which are used to break the fast.

The tradition of eating dates during Ramadhan dates back to Prophet Muhammad who would break his fast by eating three of them and drinking water.

Besides their spiritual significance, dates are a nutritious fruit that provides a quick energy boost and replenishes nutrients lost during the day. Rich in natural sugars, fibre, and essential vitamins, they are an excellent source of sustenance after a long day of fasting.

In addition, dates have been known to have health benefits such as improving digestion, reducing blood pressure, and supporting heart health, which makes them an ideal choice for breaking the fast, as they are easy to digest.

In Islam, dates are considered a blessed fruit, and eating them during Ramadan is believed to bring blessings and rewards as it connects the people with their faith and the prophetic tradition, while nourishing their bodies during the holy month.

Reader comments

Follow Us and Stay Connected!

We'd love for you to join our community and stay updated with our latest stories and updates. Follow us on our social media channels and be part of the conversation!

Let's stay connected and keep the dialogue going!