Kenya Kwanza Government adds Sh1.4 trillion to national debt in two years

The latest figures place the debt at 63 per cent of the country’s Gross Domestic Product (GDP), well above the recommended ceiling of 55 per cent.

Kenya’s public debt rose by at least Sh1.4 trillion during President William Ruto’s first two years in office, pushing the total to Sh10.6 trillion by the end of 2024 despite his campaign promise to slow down borrowing.

The latest figures place the debt at 63 per cent of the country’s Gross Domestic Product (GDP), well above the recommended ceiling of 55 per cent.

More To Read

- Senator Omtatah sues Uhuru, Ruto over trillions in public debt

- Legislature asleep on its job as country sinks deeper into debt, warns Omtatah

- Suppliers struggle as government debt soars to Sh706 billion

- Kenya yet to utilise Sh1.3 trillion in external loans - CS Mbadi

- Ruto’s administration withdrew Sh1.3 trillion manually in seven months - CoB

- Government under pressure to settle Sh161 billion debt by October 2025

Data from the Central Bank of Kenya shows the debt comprises Sh5.2 trillion in domestic loans and Sh5.4 trillion in foreign loans.

When Ruto took office in September 2022, Kenya’s debt stood at Sh8.6 trillion, evenly split between the two sources. At the time, Ruto vowed to reduce reliance on borrowing by prioritising investment-led growth and broadening the tax base.

“We will change this tradition of applying for loans and be all about investments and labour-intensive programmes as opposed to capital-intensive projects,” he said in June 2022.

But two years later, the trend has gone in the opposite direction. The 2025/2026 budget proposes Sh4.2 trillion in spending, with a deficit of Sh876.1 billion that the government plans to finance through domestic and external loans.

Treasury documents show the administration has already exceeded its domestic borrowing target for the current financial year by Sh220 billion.

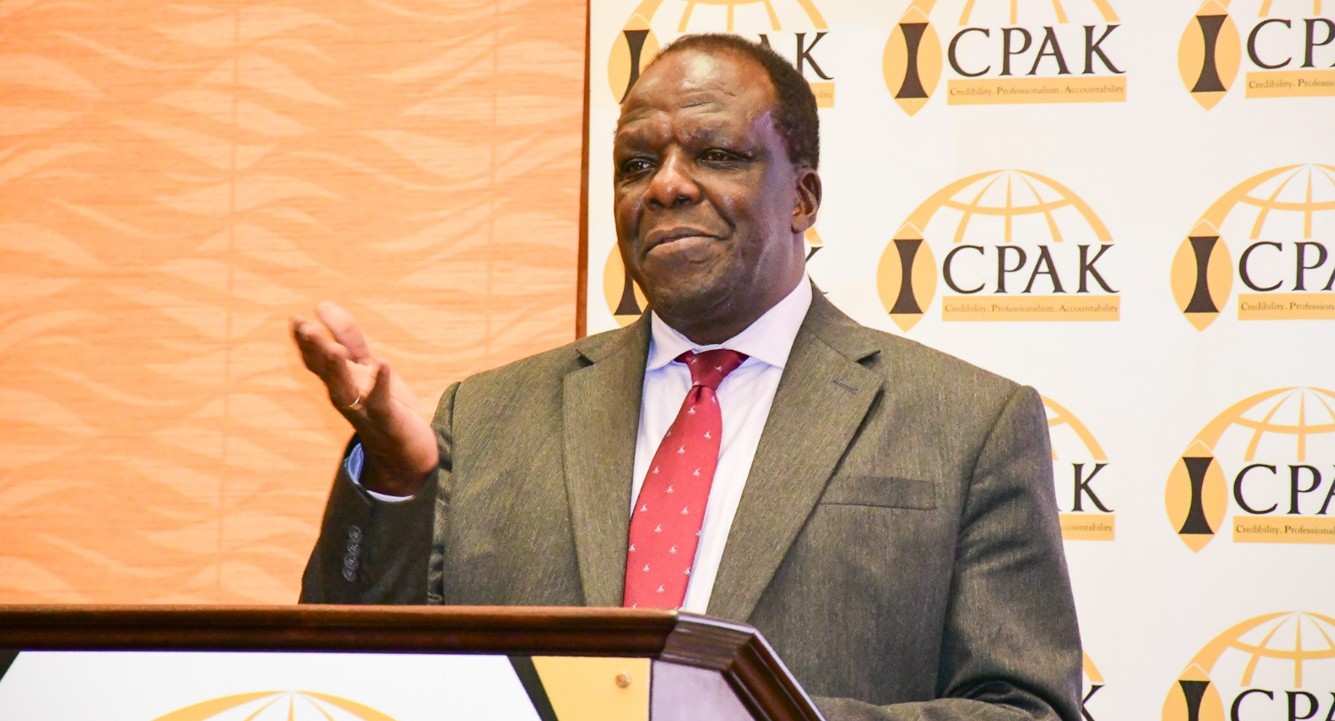

Auditor-General Nancy Gathungu has warned that the proposed budget is not backed by realistic revenue projections, raising concerns over the country’s increasing dependence on debt.

She noted that the Kenya Revenue Authority has consistently fallen short of its ordinary revenue targets, limiting the government’s ability to meet spending needs without borrowing.

Interest payments have also surged sharply, rising from Sh171 billion in 2014 to Sh1.2 trillion in the current financial year.

Despite the growing cost of debt, National Assembly Budget Committee chairperson Samuel Atandi said the country’s borrowing remains under control.

“Debt is unavoidable. We must borrow prudently going forward,” he said.

Top Stories Today