CS Mbadi defends Treasury over unequal VAT policy on tea, sugarcane

Senator Cheruiyot had said the continued VAT charge on transporting sugarcane to factories was unfair and called for equal treatment.

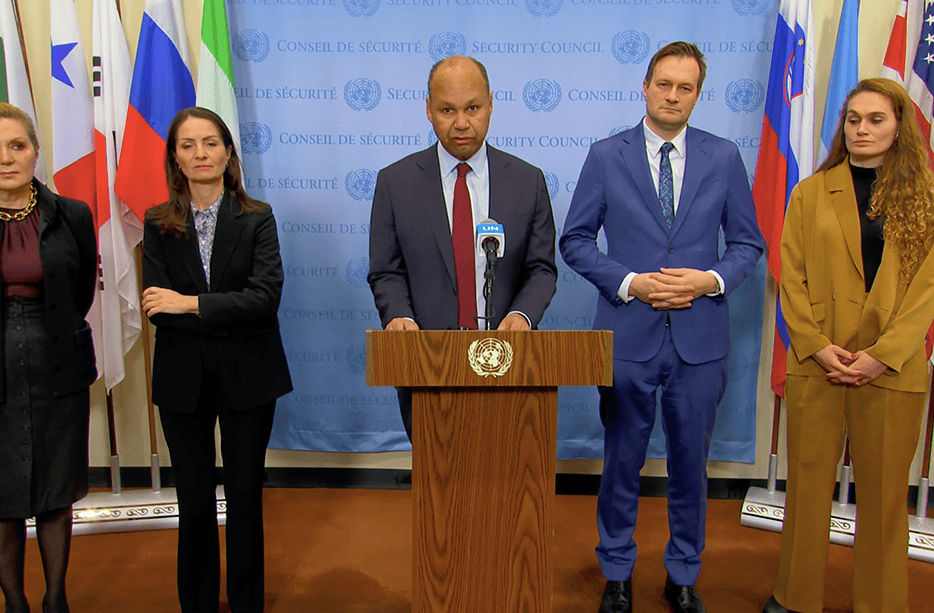

Treasury Cabinet Secretary John Mbadi has explained that the government is avoiding tax changes that reduce disposable income, in response to concerns about unequal treatment of tea and sugarcane farmers.

He was answering Kericho Senator Aaron Cheruyiot, who questioned why sugarcane transport is taxed while tea enjoys VAT exemption.

More To Read

- Senators push KTDA to adopt scientific tea grading to end bonus payment disparities

- CS Kagwe announces policy overhaul for sugar, tea and miraa to protect farmers’ earnings

- Rift Valley tea producers clash over pricing and representation

- KeNHA launches crackdown on unsafe sugarcane transport amid spike in road crashes

- Tea board to probe workers paid without farms in crackdown on fraudulent earnings

- Farmers accuse KTDA of favouring Eastern regions in bonuses

“I don’t understand why the Treasury wants to treat tea farmers and sugarcane farmers separately. They are all citizens of this republic,” said Cheruyiot during the Senate session on Wednesday.

“I appreciate what is done for tea farmers and wish the Treasury does the same for sugarcane farmers,” he added.

The senator said the continued VAT charge on transporting sugarcane to factories was unfair and called for equal treatment.

“In every Finance Bill, it is like sugarcane is always left out. Yet, transportation of tea is exempt. Why the difference?” he asked.

In his response, CS Mbadi said the government had deliberately avoided introducing new tax measures in the Finance Bill that would further reduce people’s income.

He explained this was not only a political decision, but also a shared economic position within the Treasury and Cabinet.

“It is true that we have not made major changes in taxes that will disadvantage taxpayers,” Mbadi said.

He added that although some believe the shift in tax policy is due to pressure from Gen Z, the stand against higher taxes existed even before he joined the Cabinet.

“Senator Sifuna very well knows my stand on taxes even before I joined the executive. I am one person who does not believe that higher taxes mean more revenue,” he said.

The Treasury boss acknowledged that concerns around deductions like the housing levy were valid and noted that discussions are ongoing on how to restructure such deductions.

“There is a discussion around restructuring the housing levy because it has benefits. But at the same time, the individual employees, those with payslips, have complaints which you cannot ignore,” he said.

The CS revealed that the Treasury had actually considered reducing Pay As You Earn (PAYE) during this year’s Finance Bill preparations, but pulled back due to revenue shortfalls.

“We even did some simulations on how to reduce PAYE. What stopped us was the failure by KRA to meet its revenue targets,” Mbadi explained.

He said tax cuts would be considered in the next Finance Bill, but only after assessing the performance of ongoing reforms at the Kenya Revenue Authority.

“As we carry along with reforms at KRA, in terms of automation and efficiency, we should not do too many things at the same time. First, let us see what these reforms are yielding,” he said.

Mbadi also said the Treasury had considered reducing corporate tax from 30 to 28 per cent, but postponed the move for the same reasons. “It is an item we are looking at. But we must first be sure that the system can support it,” he said.

While responding to the push for equal treatment of farmers, Mbadi did not directly commit to exempting sugarcane transport from VAT.

However, he said the Treasury is taking note of concerns raised by lawmakers and would continue reviewing tax policies with fairness and sustainability in mind.

Top Stories Today