Money laundering: Treasury vows action as Kenya is placed on grey list

Ndung'u confirmed the recent developments, stating that the new rating necessitates Kenya to enhance monitoring to ensure compliance.

The Financial Action Task Force (FATF) has officially placed Kenya on the grey list for international Anti-Money Laundering, Countering the Financing of Terrorism, and Proliferation of Weapons of Mass Destruction.

Countries on the grey list are those actively working with the FATF to address strategic deficiencies in their regimes to counter money laundering, terrorist financing, and proliferation financing.

More To Read

- Four African countries delisted from money laundering watchlist, Kenya still flagged

- Treasury reveals Sh30 billion paid to fund road projects across Kenya

- Kenya’s 2026/27 budget set at Sh4.65 trillion – Here’s what it means for you

- Treasury warns billions at risk as counties rely on third-party revenue systems

- Audit exposes civil servants’ mismanagement of millions in imprests across ministries

- Government’s increased revenue strategy faulted amid missed targets, public backlash

According to FATF, when it places the country on a grey list, it means the country has committed to resolving swiftly the identified strategic deficiencies within agreed timeframes and is subject to increased monitoring.

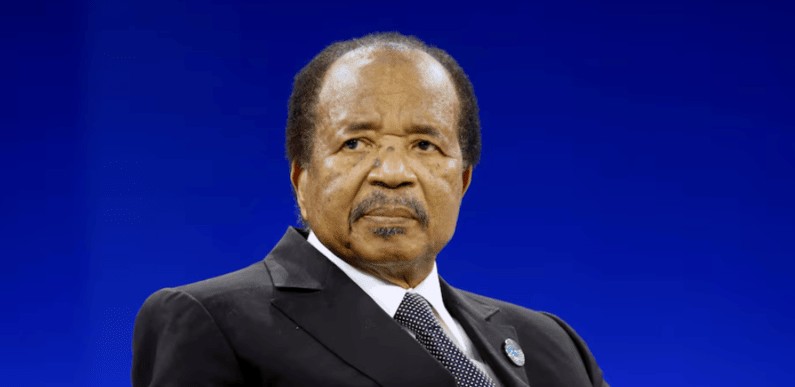

Treasury Cabinet Secretary Njuguna Ndung'u, on Friday, confirmed the recent developments, stating that the new rating necessitates Kenya to enhance monitoring to ensure compliance.

"This underscores the imperative for swift and comprehensive action to bolster our compliance efforts. It is important to note that Kenya underwent an assessment conducted by the Eastern and Southern Africa Anti-Money Laundering Group (ESAAMLG) in 2022. The evaluation revealed a mixed picture," Ndung'u stated.

He, however, added that the Kenya Kwanza government, after the inauguration, assessed the report and embarked on several interventions and initiatives to implement the recommended actions.

"This required both legal and regulatory reforms as well as a number of institutional actions," the CS disclosed.

He explained that the country has demonstrated compliance in certain areas while facing challenges in others.

One significant achievement worth noting is the enactment of the AML/CFT (Amendment) Act, 2023, which involved a comprehensive overhaul of existing legislation.

"This legislative reform consisted of 17 amendments aimed at addressing various legal and technical compliance deficiencies identified in the Mutual Evaluation Report (MER). These amendments represent a crucial step towards aligning Kenya's legal framework with international standards."

Ndung'u also explained that the government reviewed the Prevention of Terrorism (Implementation of the United Nations Security Council Resolutions on the suppression of Terrorism) Regulations, 2022 to align these Regulations with the amended Act and published the Prevention of Terrorism (Implementation of the United Nations Security Council Resolutions on the suppression of Terrorism) Regulations, 2023 which were also gazetted on 6th October 2023.

His assurance to Kenyans is that the National Treasury is actively engaged in this process and anticipates minimal effects on the country's financial stability and the costs of conducting business in Kenya. Nevertheless, we remain vigilant and committed to managing domestic ML/TF/PF risks effectively.

Top Stories Today