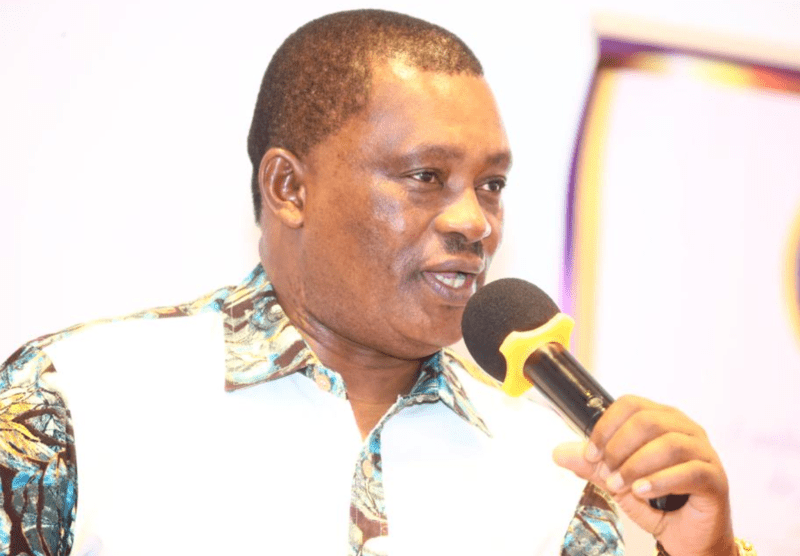

Attorney General advises KRA against Housing Levy collection

The AG said the Housing Levy is unconstitutional.

Attorney General Justin Muturi has advised the Kenya Revenue Authority (KRA) to stop collecting the Housing Levy from Kenyans, terming the move unconstitutional.

In a letter to the KRA Commissioner General, Muturi referred to rulings by the High Court and the Court of Appeal which confirmed that there is no legal provision for its collection or administration.

More To Read

- KPA declares 80 per cent waiver to clear long-stay cargo at Mombasa Port

- Justin Muturi denies secret talks with President Ruto, labels reports ‘fake news’

- KRA announces scheduled eight-hour downtime for customs system

- Explainer: All you need to know about the prestigious 'Senior Counsel' title

- KRA sets 30-day deadline for clearing goods at Nairobi depot

- NG-CDF faces fresh headwinds as KRA moves to recover Sh2 billion tax arrears

The Housing levy was introduced by an amendment to the Finance Act and required both employers and employees to contribute a non-refundable levy of 1.5 per cent to the National Housing Development Fund.

Last year, the High Court banned the levy following a petition by Busia Senator Okiya Omtatah and one Eliud Matindi, a Kenyan living in the USA.

Omtatah, who rejected the levy even before it was passed by Parliament, argued that some sections of the Bill violated the constitution. He said the executive has no right to impose the three per cent levy on Kenyans.

"Articles 209 and 210 of the constitution state clearly that taxation can only be done as provided by the legislation. That power cannot be donated to any other organ," he said at the time.

Aggrieved by the ruling, the government appealed and lost its case after the Court of Appeal last month refused to extend a stay that had allowed the government to continue collecting a 1.5 per cent levy to fund affordable housing.

Following the ruling, KRA wrote to the AG seeking advice on the contentious matter on February 12.

The AG in his response dated February 21, cited the two courts' decisions and advised against the collection of the levies.

"The upshot of this is that there is no legal basis on which the Housing Levy as provided in Section 84 of the Finance Act, can be implemented. Therefore, our considered opinion is that as of the date of the delivery of the ruling of the Court of Appeal, i.e. January 26, 2024, there is no legal provision that enables the collection and administration of the Housing Levy," the AG directed.

Top Stories Today