Opposition vows court challenge as National Assembly approves Kenya Pipeline privatisation

On Wednesday, a section of opposition MPs announced plans to move to court to block the planned sale, describing the process as irregular and rushed.

Opposition leaders have vowed to challenge the National Assembly’s approval of the Kenya Pipeline Company (KPC) privatisation, citing a lack of public participation and transparency.

On Wednesday, a section of opposition MPs announced plans to move to court to block the planned sale, describing the process as irregular and rushed.

More To Read

- Privatisation Commission issues notice for sale of Kenya Pipeline shares

- Kenya borrowing Sh32.4 million every hour as total public debt hits Sh12 trillion

- Parliament approves plan to use KPC sale proceeds to settle liabilities, compensation claims

- MPs approve strict oversight framework for Kenya Pipeline ahead of privatisation

- Raila backs Kenya Pipeline privatisation, says selling public assets doesn’t mean losing them

- Kenya Pipeline, geothermal firm questioned on ethnic inclusivity and regional balance

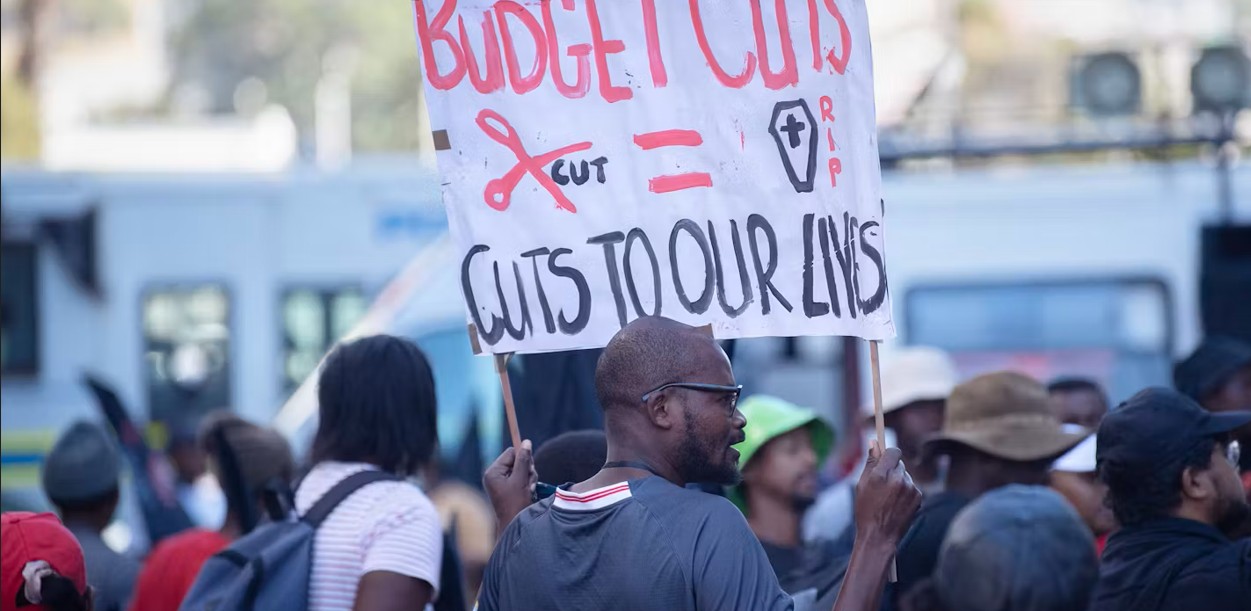

The National Assembly approved a motion to consider the Sessional Paper on KPC privatisation and the Public Privatisation Bill in a tense session, with opposition-allied MPs staging a walkout in protest. The dissenting MPs accused the House leadership of “sneaking the motion into the order paper without proper notice.”

“The government has ambushed members on the motion to approve the motion… We will be moving to court. A matter as grave as this one should not be dealt with in a casual manner like this,” said Kathiani MP Robert Mbui.

Mbui, Deputy Minority Leader, described the move as a “daylight auction” of a strategic national asset, alleging that the matter was introduced in the supplementary Order Paper after 3:00 pm, in violation of parliamentary Standing Orders.

“According to our Standing Orders, members must be made aware before the Order Paper is introduced. This specific issue of KPC was sneaked in after 3 pm in the supplementary Order Paper,” he said.

Opaque

Other opposition MPs also called for legal redress, arguing that the process was opaque and excluded their voices.

“The ground for this privatisation is a crooked process, all skewed to benefit a few people, and leave the Kenyan people poorer than they were,” said Finyula MP Dr Wilberforce Oundo.

Kiharu MP Ndindi Nyoro warned of potential market instability.

“This issue of KPC will bring a lot of excitement, but after the announcement of the share capital in February for the full year, the share company will collapse, and the share price will collapse. And this is the reason: the current investor in the NSE is not buying assets; they are buying revenue,” he said.

Kajiado North MP Onesmus Ngogoyo echoed concerns over public involvement, asking: “KPC inauzwa, nani alihusishwa? Wananchi wamehusishwa? … Ripoti inasema KPC ina deni ya zaidi ya Sh5 billion, nani atalipwa hiyo deni? Hii ni ukora ambayo Rais analeta na inastajabisha. Wamekiuka sheria.”

Kigumo MP Joseph Munyoro highlighted the lack of adequate debate.

“We need arbitration by the Judiciary. We must call out the House leadership for not giving members equal opportunity to debate the issue,” he said.

Matungulu MP Stephen Mule questioned KPC’s valuation.

“The fundamental question is: what is the value of KPC? Such a national asset is being given away at only Sh100 billion,” he said.

In defence

Government-allied MPs, however, defended the move, saying privatisation would attract investment, improve efficiency and reduce fiscal pressure on taxpayers.

“IPO offers everyone an opportunity to invest. It enhances corporate governance in the management of these companies, increases efficiency in operations and improves profitability,” said National Assembly Majority Leader Kimani Ichung’wah.

He explained that the Sessional Paper proposes to privatise 65 per cent of government shareholding while retaining 35 per cent, ensuring the State maintains majority control.

“The government will still maintain control because no single investor will acquire the entire 65 per cent. Majority shareholding will remain with the State even as we allow public participation. I invite Kenyans to start saving in preparation to buy shares in this company. This is a good buy,” Ichung’wah said.

He further defended privatisation as part of a broader strategy to fund infrastructure and service delivery without overburdening taxpayers.

“We have depended on taxes, but Kenyans have said we must innovate new ways of funding. One option is releasing part of the shareholding in profitable organisations,” he said.

The Bill, currently at its second reading, also seeks to formally incorporate public participation into the law, following a High Court decision that quashed a similar Act in 2023 for lack of consultation.

Top Stories Today