Government clears Sh93 billion in road bills after borrowing Sh104 billion from banks

Proceeds from the bond will be serviced using part of the Roads Maintenance Levy Fund, which collects Sh7 per litre of petrol or diesel sold. The levy was increased from Sh18 to Sh25 per litre in July 2024, with the extra revenue earmarked for payments to bond investors.

The government has cleared Sh93 billion in outstanding road sector bills by borrowing Sh104 billion from commercial banks, allowing contractors to restart stalled projects ahead of a planned Sh175 billion roads bond later this month.

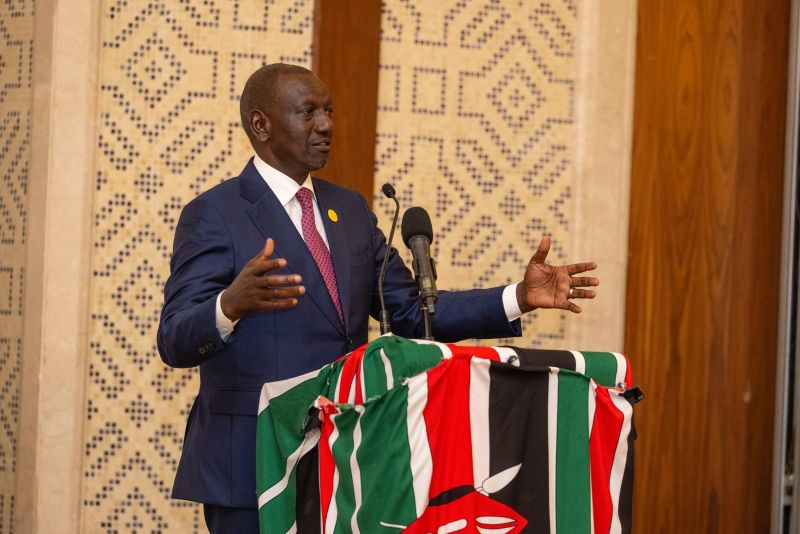

Treasury Cabinet Secretary John Mbadi said the payments have revived the construction sector, which had experienced a technical recession after two consecutive quarters of contraction up to September 2024.

More To Read

- Mbadi confirms Treasury deliberately influencing shilling’s value against dollar

- Finance Committee slams CS Mbadi for dodging key oversight sessions

- Treasury approves phased settlement of lecturers’ Sh7.76 billion arrears

- Treasury rolls out new plan to expand financial inclusion in Northern Kenya

- Kenya borrowing Sh32.4 million every hour as total public debt hits Sh12 trillion

- Kenya confident of new IMF funding deal amid improved economic outlook

“We have already paid Sh93 billion to road contractors who have since resumed work, and I am sure you can attest that road construction has resumed across the country,” Mbadi said on Tuesday.

He explained that the Sh104 billion loan was intended as a bridge facility and will be repaid once the roads bond is issued.

“We started by going for a bridge facility where we have raised Sh104 billion. This shall be extinguished once the road bond is finalised. We are currently finalising the market sounding process ahead of the bond issuance, which will take place this month, where we aim to raise Sh175 billion in the first tranche,” he said.

Proceeds from the bond will be serviced using part of the Roads Maintenance Levy Fund, which collects Sh7 per litre of petrol or diesel sold. The levy was increased from Sh18 to Sh25 per litre in July 2024, with the extra revenue earmarked for payments to bond investors.

The bridge facility was financed primarily by the Trade and Development Bank, KCB Bank Kenya, Absa Bank Kenya and UBA Kenya. UBA said its contribution to the fund was Sh12.9 billion ($100 million), backed by its Nigerian parent.

The Kenya Roads Board has been channelling funds from the facility to road agencies, including the Kenya National Highways Authority, the Kenya Rural Roads Authority and the Kenya Urban Roads Authority, to pay contractors.

The injection of funds has helped the construction sector grow by 5.7 per cent in the second quarter of 2025, reversing a 3.7 per cent contraction in the same period last year, according to data from the Kenya National Bureau of Statistics (KNBS). The growth in construction also lifted overall gross domestic product to five per cent from 4.6 per cent previously.

Cement consumption rose by 23.9 per cent to 2,424,400 tonnes from 1,957,100 tonnes, while imported bitumen increased to 22,659,300 tonnes from 15,566,200 tonnes. Iron and steel imports grew to 526,606,400 tonnes from 222,112,300 tonnes. Lending to construction enterprises also rose 21.7 per cent to Sh159.6 billion in the 12 months to June 2025, up from Sh131.1 billion a year earlier.

“Payments to the road sector have helped in boosting economic growth,” Mbadi said.

A presidential task force is expected to complete verification of all pending bills next month and submit a report to the Exchequer with recommendations for clearing arrears.

“We have put up diverse financing strategies and payment plans to deal with pending bills once the final report is received,” the CS added.

Despite the payments, national government pending bills increased to Sh526 billion in June, up from Sh421.6 billion in March, indicating that arrears in other sectors remain a challenge.

Top Stories Today