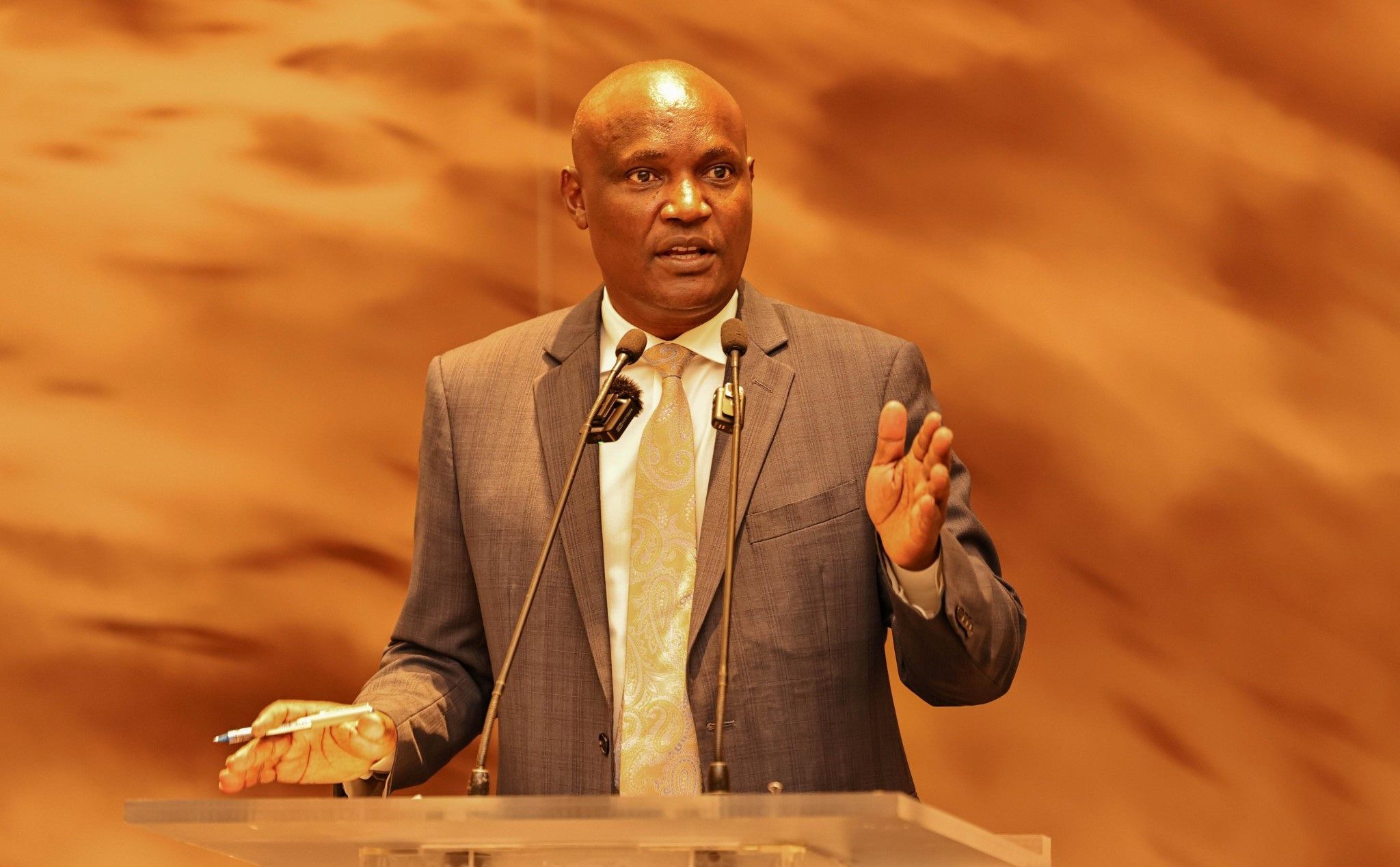

County governments turn to banks as short-term debt hits Sh3.2 billion

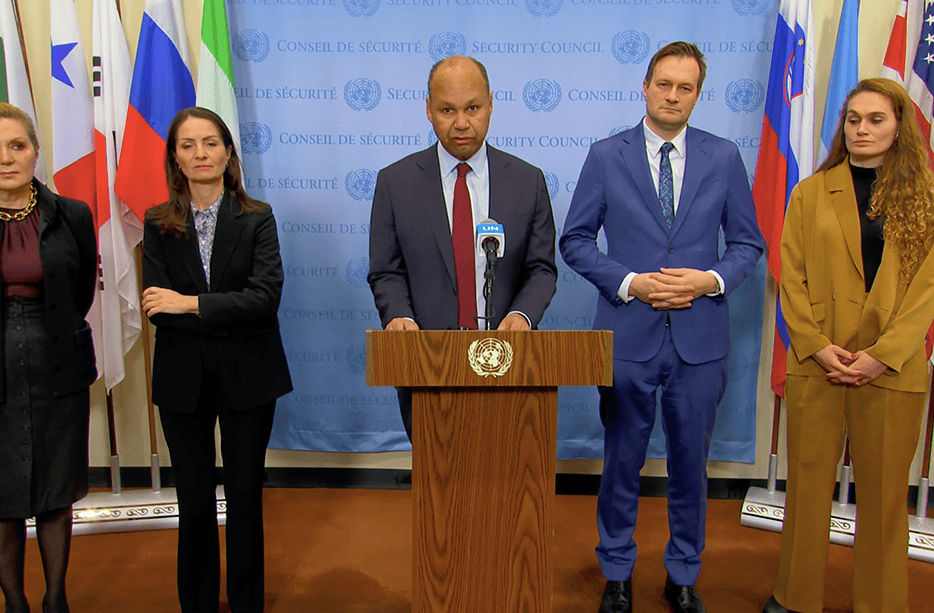

A report by the Controller of Budget Margaret Nyakang’o indicated that the number of counties turning to bank loans to meet recurrent expenses, including staff salaries, has quadrupled to eight.

County governments across Kenya are increasingly turning to commercial banks to bridge funding gaps, with total borrowing hitting Sh3.2 billion in the first quarter ending September 2025.

This represents a sharp rise from Sh1.8 billion recorded during the same period last year, highlighting the growing pressure on counties to fund operations amid delayed transfers from the National Treasury.

More To Read

- Key offices spent nearly all budgets but delivered little, parliamentary review finds

- Controller of Budget flags rising debt as first quarter repayments hit Sh507 billion

- Treasury eyes restructuring as Sh137 billion water sector debt stalls

- County services at risk as 79 public funds lapse or near expiry, CoB warns

- No layoffs for civil servants as Treasury unveils new payroll control system

- President Ruto pitches National Infrastructure Fund as engine for long‑term growth

Nairobi County recorded the highest debt, owing lenders Sh1.9 billion.

The County Executive accounted for Sh1.5 billion, while the County Assembly had outstanding obligations of Sh316.7 million, according to Controller of Budget Margaret Nyakang’o.

“The County Executive has a bank overdraft facility with the Co-operative Bank of Kenya Limited to cover its personnel emoluments, which average Sh1.6 billion per month,” Nyakang’o stated.

“As of September 30, 2025, it had an overdraft balance of Sh1.54 billion and had paid Sh68.38 million in the form of bank charges, commissions, and penalties during the period under review for use of the facility.”

Machakos County came in second with Sh544.3 million owed by its executive, followed by Homa Bay at Sh471.5 million. Kisumu County Executive reported Sh289.1 million in outstanding loans, while Laikipia County Assembly had the smallest debt at Sh24 million.

Most of the borrowing took the form of overdraft facilities, primarily used to settle salaries and cover urgent operational costs.

The trend reflects liquidity pressures at the start of the financial year, forcing counties to rely on short-term bank financing.

The CoB report showed no significant long-term borrowing, indicating that commercial overdrafts are the main contributor to the rise in debt.

County governments had taken on an additional Sh8.6 billion in commercial bank loans over the nine months to March 2025, as they grappled with a severe cash shortage caused by delayed Treasury disbursements.

According to the Central Bank of Kenya (CBK), this borrowing pushed total county debt from commercial banks to Sh15 billion in March, up from Sh6.4 billion in June 2024.

A separate report by Nyakang’o indicated that the number of counties turning to bank loans to meet recurrent expenses, including staff salaries, has quadrupled to eight.

The delays were compounded as counties awaited clarity on allocations under the Division of Revenue Bill, 2024.

The temporary suspension of the County Allocation of Revenue Bill and the Division of Revenue Bill, following the withdrawal of the 2024 Finance Bill, froze county funding and triggered cash shortages that disrupted critical services, notably salary payments.

The national government had anticipated generating Sh347 billion in the 2024/2025 fiscal year through the Finance Bill, highlighting how the delay in its passage strained county finances.

Top Stories Today