Controller of Budget flags 287 new bank accounts opened by counties

The growing number of bank accounts operated by counties has made it more difficult for the Controller of Budget to track public expenditure.

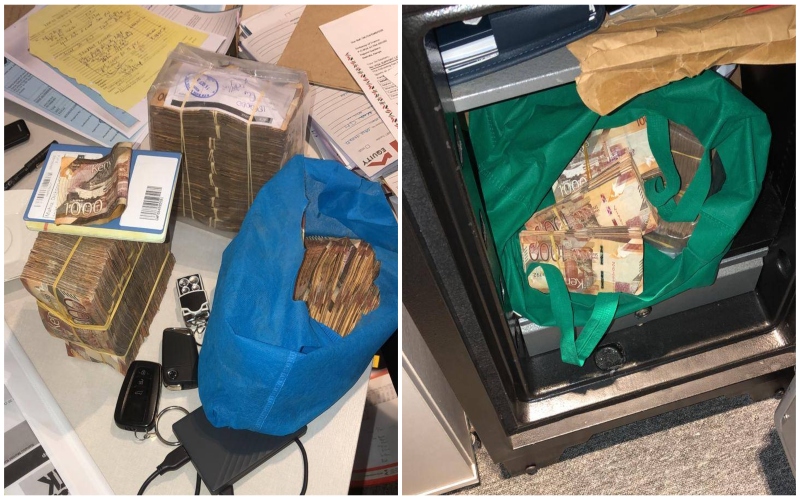

The Controller of Budget (CoB) has revealed that between December 2023 and March of this year, counties opened 287 additional accounts at banks, which were unlawful.

This according to the CoB undermines efforts to ensure transparency in how the devolved units use public funds.

More To Read

- Senate probe uncovers unpaid loans by ex-governors, county officials

- Billions locked in stalled county projects across the country - CoB Margaret Nyakang'o

- Treasury warns billions at risk as counties rely on third-party revenue systems

- Counties spend nearly half of budgets on salaries, audit shows

- Funding cuts spark urgency in state corporation shake-up, says Parliamentary Budget Office

- Controller of Budget flags 16 counties for concealing true staff expenditures

The report reveals that as of March 31, 2024, all 47 counties had 1,668 accounts at commercial banks, up from 1,381 at the end of last year.

During this period, the counties that saw the highest increase in new accounts include Bungoma, Machakos and Taita Taveta.

Bungoma added 31 accounts bringing its total to 352. Machakos increased 26 new accounts bringing its total to 31, while Taita Taveta added 27 new accounts, raising its tally to 37.

On the other hand, Kwale reduced its number of accounts at commercial banks by 102, leaving it with 63 accounts as of March.

Additionally, Makueni closed seven accounts, leaving it with a total of 17 during the period.

The law only allows counties to open and maintain bank accounts at the Central Bank of Kenya (CBK) for ease of accountability.

The only exemption is for imprest accounts for petty cash and revenue collection. The number could be higher given that some such as Nairobi and Mombasa did not disclose the number of accounts they are operating.

Tracking public expenditure

The growing number of bank accounts operated by counties has made it more difficult for the Controller of Budget to track public expenditure.

There have been concerns that certain accounts are being utilised for personal transactions with commercial banks, which could potentially lead to financial losses and legal actions against taxpayers.

The CoB's recent attempt to secure real-time access to the bank accounts held by counties at the CBK was unsuccessful.

Since 2021, the Controller of Budget has been advocating for both the CBK and the Treasury to grant real-time access to county accounts in order to prevent unexplained expenditure of funds.

This unsuccessful effort means that counties can avoid scrutiny, especially at a time when there are increasing concerns about widespread corruption in settling outstanding bills.

CoB Margaret Nyakango has repeatedly raised concerns about the use of these accounts. She argues that they are susceptible to misuse and, without proper oversight, can facilitate corrupt activities involving taxpayer money.

"Key challenges that hampered effective budget execution during the period; use of commercial bank accounts to operate the established public funds and other operational accounts contrary to the regulations," reads the report.

The Public Finance Management (County Governments) Regulations, 2015 bar regional governments from operating accounts at commercial banks, except those for petty cash and revenue collection. Counties use bank accounts for their car loan and mortgage schemes, debt collection, hospitals, bursaries and conditional grants.

Top Stories Today