Finance Bill 2024: Ex-senator Billow Kerrow warns against new taxes, lists consequences

The former lawmaker mentioned taxes imposed on food items such as bread and cooking oil as some of the tax proposals that deserved to be repealed.

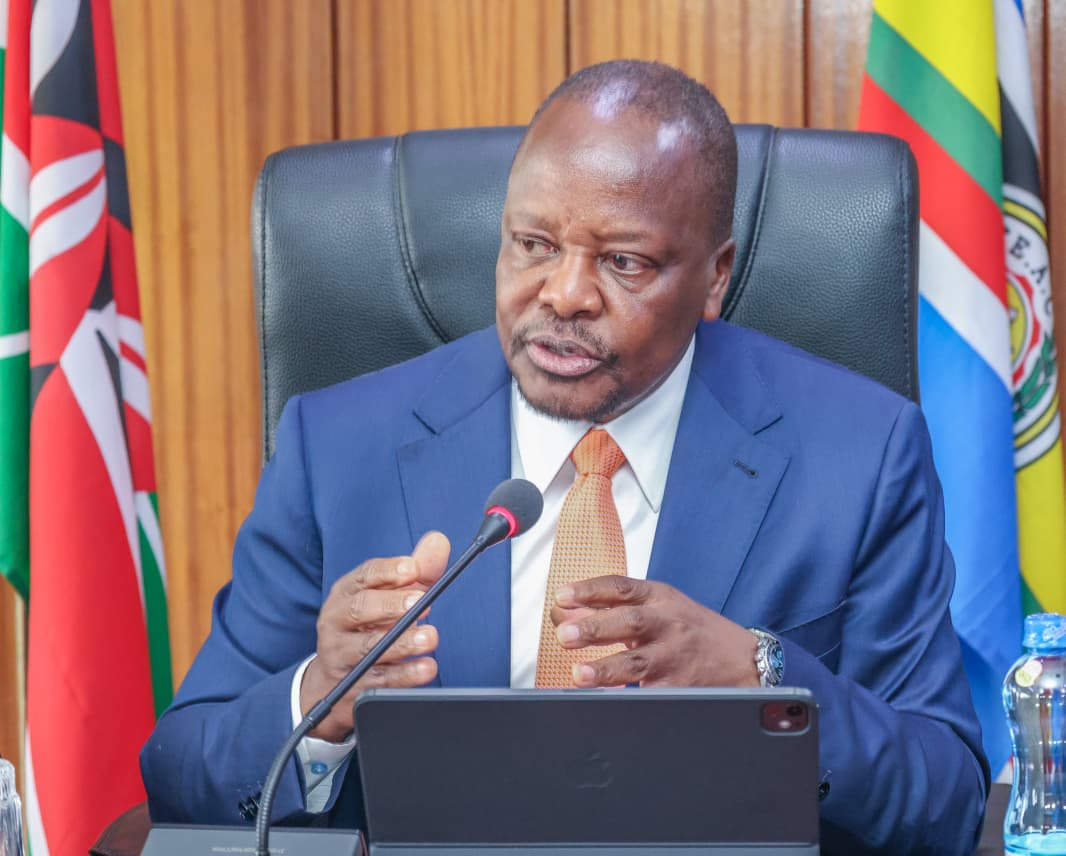

Former Mandera Senator and Economist Billow Kerrow has warned that additional taxes included in the Finance Bill 2024 will worsen the economy if not removed.

Kerrow who took to his X account to advise the Molo MP Kimani Kuri- led Finance and National Planning Committee said tax proposals in the Bill are likely to raise the cost of living, thus making it unbearable to Kenyans who are already struggling.

More To Read

- Ex-Senator Billow Kerrow slams Mandera Governor for moving Jamhuri Day celebrations to Elwak amid worsening drought

- CS Kinyanjui: Kenya cannot develop while rejecting all funding options

- Eastleigh’s 24-hour economy key to Kenya’s commerce, says CS Lee Kinyanjui

- Tech drives Africa’s private capital boom as Q3 deals surge to Sh646 billion

- Kenya’s exports to EAC partners grow as diaspora sends Sh1 trillion home

- Kenya-UK trade hits Sh340 billion for the first time

"To align proposals outlined in the Finance Bill 2024 with the requirements of the law, and also in consideration of views shared by Kenyans and different groupings, my advice to the Finance Committee as it writes its report is to remove any tax that will raise the cost of living to ordinary Kenyans," he suggested.

The former lawmaker mentioned taxes imposed on food items such as bread and cooking oil as some of the tax proposals that deserved to be repealed.

In his view, taxes on plastics and the cost of communication and sending money through mobile transactions should also be done away with as they will contribute to businesses closing down.

"Remove any tax proposal that will lead to businesses closing down, job losses or relocation because of its impact on the business environment and reject proposals that will reduce our export competitiveness such as the eco-levy," he argued.

Finance Bill: My advice to the Finance Committee as it writes its report:-

— FCPA Billow Kerrow (@BillowKerrow) June 11, 2024

1. Remove any tax that will raise cost of living to ordinary Kenyans e.g those on bread, cooking oil, plastics, Mpesa etc

2. Remove any tax proposal that will lead to businesses closing down, job loses or…

He also avers that there is no need to have taxes that will undermine trade protocols in the East African Community (EAC) and the African Continental Free Trade Area (AfCTA).

AfCFTA is a free trade area encompassing most of Africa. It was established in 2018 by the African Continental Free Trade Agreement, which has 43 parties and another 11 signatories, making it the largest free-trade area by the number of member states, after the World Trade Organisation, and the largest in population and geographic size, spanning 1.3 billion people across the world's second-largest continent.

The former Senator believes that the Treasury's decision to impose more taxes as captured in the Finance Bill 2024 will not translate to more revenue for the country.

His plea came when curtains closed on receiving views and proposals on the Bill on Monday at a public participation forum held at the Kenyatta International Conference Centre (KICC) where various groupings and individuals from different sectors of the economy pleaded with Parliament to reject various components of the Bill.

During the exercise, the citizens lamented that some of the taxes imposed on various products and services were punitive.

Mungai Kihanya, a private citizen, proposed changes to the Motor Vehicle Tax, suggesting that it should be charged during the transfer of ownership rather than 2.5 per cent of the value of the motor vehicle during the issuance of an insurance cover.

"The rate of tax should be four per cent of the value of the motor vehicle but it should not be charged at the time of first registration of the motor vehicle," argued Mungai.

Paul Kypyamat, who heads the Baringo South County Focus Group, warned against imposing taxes on any products or services that are in the health and education sectors. According to him, Kenyans will suffer should taxes be imposed on essential health products such as drugs.

"If there are two sectors that the government must not think of imposing any taxes on, they are health and education. Doing so will increase poverty levels in the country," argued Kypyamat.

The Association for the Physically Disabled of Kenya (APDK) pleaded with the government to further exempt from import duties and value-added tax (VAT) all input and raw materials, whether produced locally or imported, for the production of wheelchairs, special seating, tricycles, and assistive devices.

Top Stories Today