Lobby asks international lenders to stop loans as Kenya fights debt crisis

The ICPC has asked the IMF, the World Bank, and other international lenders to immediately stop assisting Kenya pending an audit of the current state of debt.

Pressure is continuing to pile up for President William Ruto to be accountable for governance, with a human rights organisation urging international lenders to suspend any further support to Kenya.

The International Center for Policy and Conflict (ICPC) has asked the International Monetary Fund (IMF), the World Bank, and other international lenders to immediately stop assisting Kenya pending an audit of the current state of debt.

More To Read

- University lecturers petition IMF over unpaid wages, SRC interference in Kenya

- World Bank urges Kenya to raise excise taxes to clear Sh526 billion pending bills

- Sh438 million water agency loan default piles pressure on taxpayers eight years on, Auditor General warns

- World Bank withholds Sh96.93 billion loan to Kenya over delayed reforms

- World Bank unveils Sh16.5 billion initiative to empower Kenya’s vulnerable groups

- World Bank downgrades Kenya's GDP growth to 4.5 per cent in June projection

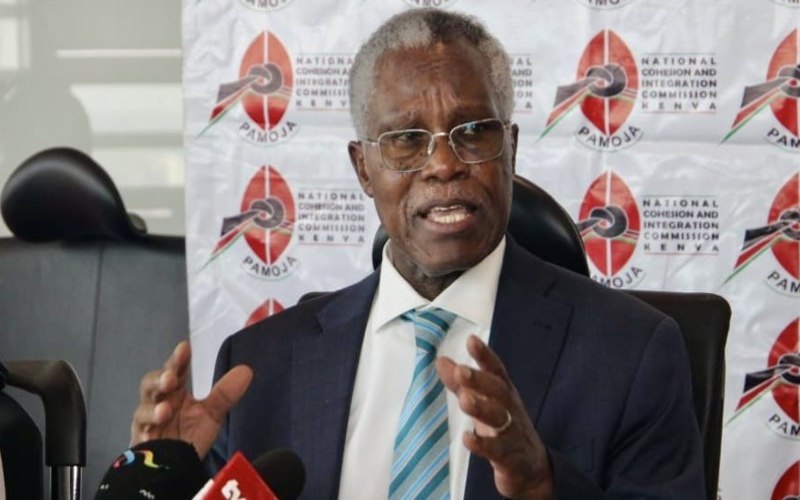

in a statement on Friday, ICPC Executive Director Ndung'u Wainaina noted the urgent need to exhaustively and independently audit Kenya's local, foreign, concessional and commercial debt.

“All lenders, both domestic and foreign, must stop forthwith lending any loans to the Kenya government until the independent forensic audit is completed,” said Wainaina. “While an independent debt audit is proceeding, development partners supporting specific essential service sectors can continue with support to those sectors."

Wainaina added that the exercise should include the total amount of state guarantees to all government-owned enterprises and agencies to reveal how the loans have been used.

“For independent forensic audit transparency, it will be important for the process of identifying the audit agency to be made public,” he also said.

The ICPC further demanded a complete overhaul of the country’s 2024-2025 budget and a fresh one crafted, with adherence to the law.

"Significant debt distress"

Wainaina regretted that Kenya is reeling under heavy debt, with the public not benefitting, saying this means it is unsustainable to take more loans.

Kenya’s debt stock currently stands at Sh11.2 trillion or 67 per cent of the country’s gross domestic product, from 46 per cent in 2010.

“It is no longer tenable to rely only on fiscal adjustments with supplemental funding from IMF and World Bank,” the ICPC boss said. “The debt service payments are equivalent to 63 per cent of ordinary revenue and interest repayment has risen to 30.1 per cent of ordinary revenue."

The lobby wants the government to enter into part of the bonds and loans debt restructuring negotiations for a minimum period of five years.

“Kenya is facing significant debt distress which is sinking the economy. Debt is causing unacceptable economic and financial throbbing to Kenyans. The country is possibly heading to default if already it is not there," Wainaina explained.

"Crucial debt sustainability indicators including debt service to revenue ratio and debt to GDP ratio are deeply troubling," he added, citing reports by the Parliamentary Budget Office, suggesting that the economy is in danger of a liquidity crisis.

He further noted that revenue collections are falling despite high taxes and that repayments are surging perilously.

“The unpredictable fluctuating exchange rates, adverse fiscal conditions and natural disasters are only making matters riskier by the day," he warned.

IMF's position

Following the deadly demonstrations against the Finance Bill, 2024,. which the president has now withdrawn, the IMF has pledged to continue supporting Kenya as it tries to overcome its economic challenges.

In a statement on Wednesday, Director of Communications Julie Kozack said they were committed to working with Kenya to chart a course towards robust, sustainable, and inclusive growth.

The IMF granted Kenya a new loan of $941 million (Sh121.9 billion) in January this year.

Kenya has made some progress in debt repayment. Last week, the country cleared the remaining $556.97 million (Sh71.5 billion) of the $2 billion (Sh257 billion) Eurobond that was due by June 24, 2024.

Figures by the National Treasury's Public Debt Management Office said that the outstanding note was settled on Friday, June 21, three days ahead of the maturity date.

The repayment saw Kenya's National Reserves move above the four-month statutory requirement for the first time in five months.

Top Stories Today