What next now that Ruto has withdrawn contentious Finance Bill?

By Alfred Onyango |

The president’s decision has sparked debate among legal experts and the public on what grounds he withdrew a bill that had already been passed by the National Assembly.

On June 26, President William Ruto announced his decision not to assent to the disputed Finance Bill, 2024, after a series of countrywide anti-tax demonstrations that turned disastrous on Tuesday, the day before his announcement.

The president’s decision has sparked debate among legal experts and the public on what grounds he withdrew a bill that had already been passed by the National Assembly.

Keep reading

- President Ruto’s daughter appointed Director of Foreign Service

- Dangerous job without weapons: Security guards' struggles as anti-state demos turn violent

- Don't disregard constitution over isolated cases of demo infiltration by goons, state told

- Sharp fall in private business activity as anti-tax demos choke sector

Many have also questioned the fate of the country’s fiscal environment as the new financial year kicks in on July 1.

The government had intended to raise Sh346 billion in additional revenue in the 2024/2025 Financial Year.

However, on the day the bill was being passed, it had amendments that were made after public outcry, and had, as a result, scaled down the country’s projected additional revenue projections by Sh200 billion.

Charles Kanjama, an advocate, explained to The Eastleigh Voice the implications of the recent happenings.

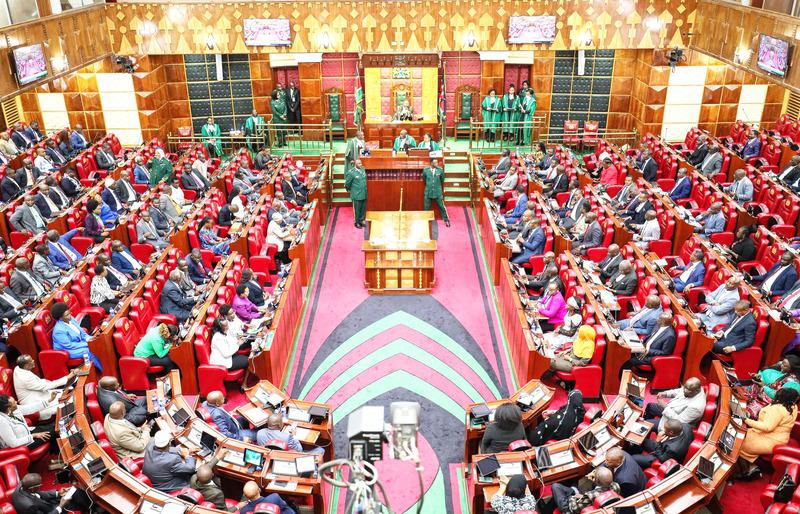

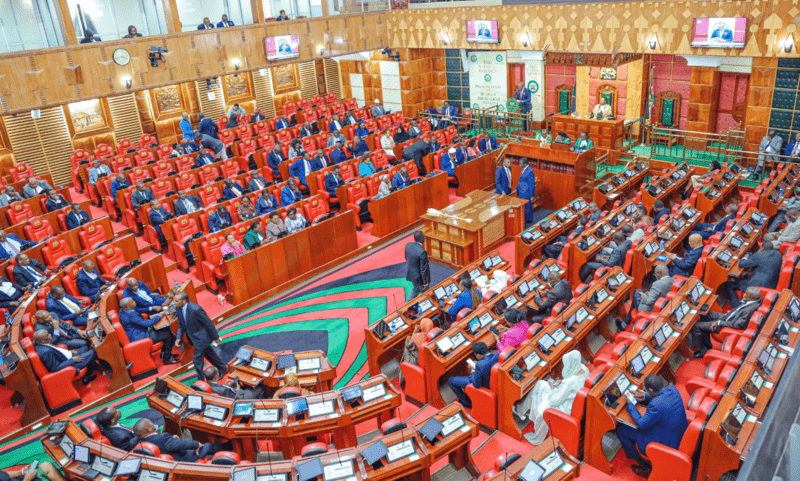

Members of the National Assembly during debate on the Finance Bill, 2024. (Photo: National Assembly)

Members of the National Assembly during debate on the Finance Bill, 2024. (Photo: National Assembly)

Grounds for bill’s withdrawal

It is a standard practice in Kenya as per the constitution, akin to most other countries with presidential systems of governance.

The constitutional frameworks provide clear guidelines regarding the president's powers concerning bills passed by the legislature.

Typically, these frameworks delineate three primary courses of action a president can take when faced with a bill: assent, veto and no action or decline to assent.

What has happened in the country is what is termed as a veto, meaning the president has exercised his constitutional mandate to disagree with the bill with the belief that it is not in the best interest of the country.

This action sends the bill back to the legislature, usually with an explanation of the reasons for the veto.

What next for the bill?

Noting that the president’s veto on a bill can be either partial or complete, Kanjama said when it is partial, the president disagrees with certain provisions and recommends amendments.

Comparatively, when he disagrees with all the provisions, the bill is sent back to parliament which can override the president's veto. However, for the National Assembly to actualise this, it requires a supermajority, which is two-thirds of the members.

Currently, as per the country’s atmosphere on the matter, there is no chance parliament will get two-thirds to override the president's veto.

This is because the president has yielded to public pressure. No MP is going to disagree with the president, but parliament can, with a simple majority, also accept the president's amendments if they are partial amendments.

In this case, it is a complete rejection of the bill, so the only way it can have life is if parliament overrides the presidential veto with a two-thirds majority.

If it doesn't, there are two options: the bill would fail or it can be repatriated before it comes for a new vote. This means the mover of the bill in the National Assembly has to officially withdraw it.

Anti-Finance Bill protestors on Kenyatta Avenue. (Hafsa Hassan)

Anti-Finance Bill protestors on Kenyatta Avenue. (Hafsa Hassan)

What’s in for taxpayers?

Firstly, it's regrettable that most Kenyans do not seem to understand what the Finance Bill does.

The focus has been on the Finance Bill and most people don't understand what it does. The Finance Bill is an amendment Act, meaning it is a law that amends other laws; it doesn't have any independent provisions.

Ideally, it amends laws like the Income Tax Act and the VAT Act, such that if the government wants to introduce new taxes, it goes to the existing law and amends it to introduce the new taxes.

On the contrary, if the government does not amend the existing taxes, as is the case with the withdrawn bill, it means the existing law – in this case, the Finance Act 2023 – prevails in the new fiscal year.

This also means there are no new taxes but the country continues paying the existing taxes.

Constitutional exception on bill becoming law without assent

The constitution stipulates that in case of no action or decline to assent by the president as is the case with the Finance Bill 2024, it may within a specified timeframe automatically become law without the president's signature.

It stipulates that within 14 days after receipt of a bill, the president shall assent to it or refer it back to parliament for reconsideration, noting any reservations.

“If the president refers a bill back for reconsideration, parliament may amend the bill in light of the president’s reservations, or pass the bill a second time without amendment,” the constitution says.

“If parliament amends the bill fully accommodating the president’s reservations, the appropriate speaker shall re-submit it to the president for assent.”

However, it says that if the president does not assent to a bill again or refers it back within 14 days, it shall be deemed to have been assented to on the expiry of that period.

Checks and balances

Kanjama said that the power of presidential assent or veto serves as a critical check and balance within the governmental system.

It ensures that legislation reflects the consensus of both the executive and legislature, promoting dialogue and compromise in the legislative process.

“While the act of presidential non-assent to a bill introduces complexities into the legislative process, it also reinforces the democratic principles of checks and balances,” he said.

“Understanding these provisions is crucial for ensuring effective governance and the enactment of laws that best serve the interests of the nation and its citizens.”

Kanjama said as legislative and executive powers interact, the process surrounding presidential assent to bills remains a cornerstone of democratic governance worldwide, continually evolving to meet the challenges of modern governance.