Audit report lifts lid on State's Sh1.4 trillion loan contracted without AG consent

Auditor General Nancy Gathungu revealed that 39 loans were obtained between July 1, 2010, and December 31, 2021, exposing the government to unfavourable terms.

The government contracted Sh1.4 trillion in commercial loans without consulting the Attorney-General and applied them to unintended projects, Auditor General Nancy Gathungu has revealed.

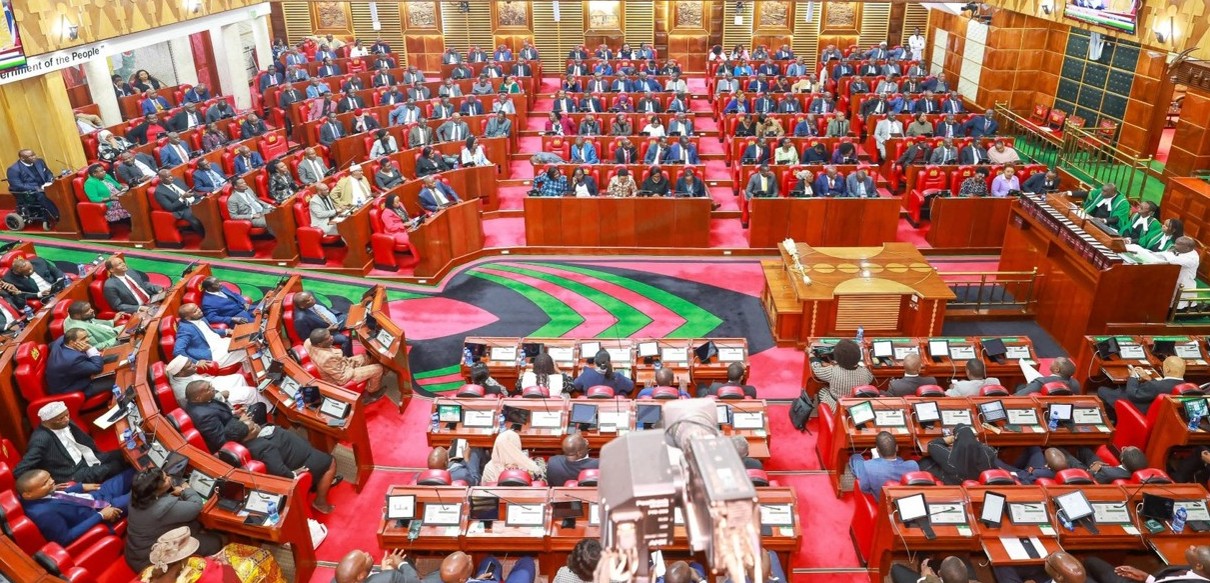

In a special audit presented to Parliament, Gathungu revealed that 39 loans were obtained between July 1, 2010, and December 31, 2021, exposing the government to unfavourable terms.

More To Read

- Millions wasted, no homes built: Auditor General slams counties over speaker housing plan

- Mombasa MCAs question water firm over missing funds, sewage discharge into the ocean

- Auditor General Nancy Gathungu exposes IFMIS failures, Sh10.2 billion unapproved government spending

- Senate orders crackdown on governors, MCAs over use of public funds for self-promotion

- PS Susan Mang’eni denies Hustler Fund misuse, reports Sh4.8 billion savings

- "Where did the money go?" Hustler Fund faces scrutiny over Sh8 billion gap

She indicated that these loans, procured externally, often lacked the necessary legal scrutiny and raised questions about their usefulness.

"In the absence of the legal opinion ahead of contracting of the loans, the country is at risk of entering into agreements whose terms may be unfavourable. This is critical "to save the government from undue costs on commitment fees," reads the audit.

The audit also found that out of the 39 loans, 26 were contracted without the Attorney-General's opinion, despite requirements outlined in the 2020 Public Debt Borrowing Policy.

Section 5.4.2.1 of the 2020 Public Debt Borrowing Policy (PDBP) states that the "debt management office shall seek the legal opinions from the Attorney General on loan negotiations and liaise with implementation agencies to ensure that conditions precedents are fulfilled in time."

The loans, denominated in USD, Euro, and South Korean Won (KRW), saw only Sh1.1 trillion out of Sh14 trillion hitting the Consolidated Fund (CF).

Of the 39 loans, 16 were US dollar-denominated with a value of Sh1.074 trillion, 22 in Euros worth Sh288.18 billion and one in KRW currency worth Sh102.55 billion.

Additionally, 13 of these loans were syndicated loans and sovereign bonds, while 26 were project funding loans for the implementation of specific government projects.

The audit notes that the debts, which have pushed the country's total debt past the Sh11 trillion mark, were plagued with irregularities, such as being diverted to unintended uses and involving dubious payment of commitment fees.

Chair of the Public Accounts Committee (PAC) and nominated MP, John Mbadi, described the loans as "odious debts" that provide no benefit to the people.

"Odious debts are debts that have no benefit to the people and can be viewed as a liability to the creditor. So far not much has been said of the benefit of these loans to the country. As a committee, we will dig deeper," he said.

A past Public Accounts Committee chaired by John Mbadi. (Photo: National Assembly)

A past Public Accounts Committee chaired by John Mbadi. (Photo: National Assembly)

The September 2022 audit, has specifically put the National Treasury's Public Debt Management Office (PDMO) under scrutiny for failing to ensure legal compliance and proper utilization of the funds.

DCI probe

The Directorate of Criminal Investigations (DCI) is already probing the questionable debt procurements, with individuals from the National Treasury having recorded statements.

Article 206 establishes a Consolidated Fund into which shall be paid all money raised or received by or on behalf of the national government, except money that is "reasonably excluded from the fund by law.

The public fund is established for a specific purpose or may under the law be retained by the state organ "that received it to defray the expenses of the state organ."

The purpose of ensuring loans procured by the government are paid into CF was to subject the monies to checks and balances in terms of the requisite approval by parliament and authorization by the Controller of Budget (CoB) before the funds are withdrawn. This is critical in ensuring that they are applied only for intended projects.

However, in 2014, MPs amended the PFM Act to give the National Treasury Cabinet Secretary the sweeping powers to operate the CF over and above what is stipulated in the constitution.

"The CS shall ensure that the proceeds of any loan raised under this Act are paid into the CF or into any other public fund established by the national government or any of its entities as the CS may determine in accordance with regulations approved by Parliament," reads section 50 (7) of the PFM Act.

Governance expert Barasa Nyukuri criticised the amendments to the Public Finance Management Act, which he argued unconstitutionally allowed the National Treasury Cabinet Secretary to direct loan proceeds.

"You cannot amend the constitution through an Act of Parliament. This amendment allowed individuals the avenue to negotiate for higher commissions effectively increasing the cost of loans in high interest rates that are eventually passed on to Kenyans," he said.

Despite Sh1.13 trillion from syndicated loans and sovereign bonds being deposited in the Consolidated Fund, the audit revealed that there was no evidence it was exclusively used for development projects.

The Public Finance Management Act mandates that national borrowings should finance development and not recurrent expenditure.

"The funds are utilised for general government expenditure, with no schedule maintained on the specific use of loan proceeds," reads the audit.

Top Stories Today