How Mbadi will tame Kenya's rising debt, ensure sustainable debt management

Mbadi added that claims of agreements that stop the government from disclosing some of the debt details are excuses the country should move past.

Cabinet Secretary nominee for Treasury John Mbadi will spearhead reforms at the Kenya Revenue Authority in a bid to widen the national revenue base.

Mbadi was responding to a question by Deputy Speaker Gladys Boss on how he will help the government raise revenue amid a growing national debt, the withdrawal of Finance Bill 2024, and tax revenue shortfalls by KRA.

More To Read

- Seven IEBC nominees to face vetting panel on Saturday

- National Assembly resumes sitting with focus on vetting of Ruto’s nominees, tax amendment bills

- Why I'm fit for the role at ICT and Digital Economy docket - William Kabogo

- President Ruto's cabinet nominees face MPs for vetting today

- Concerns raised over ethical issues, gender balance as Ruto’s Cabinet nominees prepare for vetting

- MPs vet President Ruto's nominees for key diplomatic roles

"As you know, there are only two sources of revenue for the government: borrowing and taxing. Currently, Kenya's debt is approximately 72 per cent of our GDP, which has raised concerns across the country, and increased debt servicing costs have affected our fiscal space for development projects. So, in light of the rejection of the finance bill, if approved, how do you plan to address Kenya's rising debt and ensure sustainable debt management?" Gladys Boss posed.

"It is true that public debt levels in this country are worrying. It could be true up to 72 per cent but I believe it's still at 67.68 per cent of our GPD, which is very high. The number one priority for me is debt accountability. If you listen to Kenyans today on this issue, they seem to be asking what our actual debt is; they want proof and evidence, so that is my number one priority," he said.

Mbadi added that claims of agreements that stop the government from disclosing some of the debt details are excuses the country should move past.

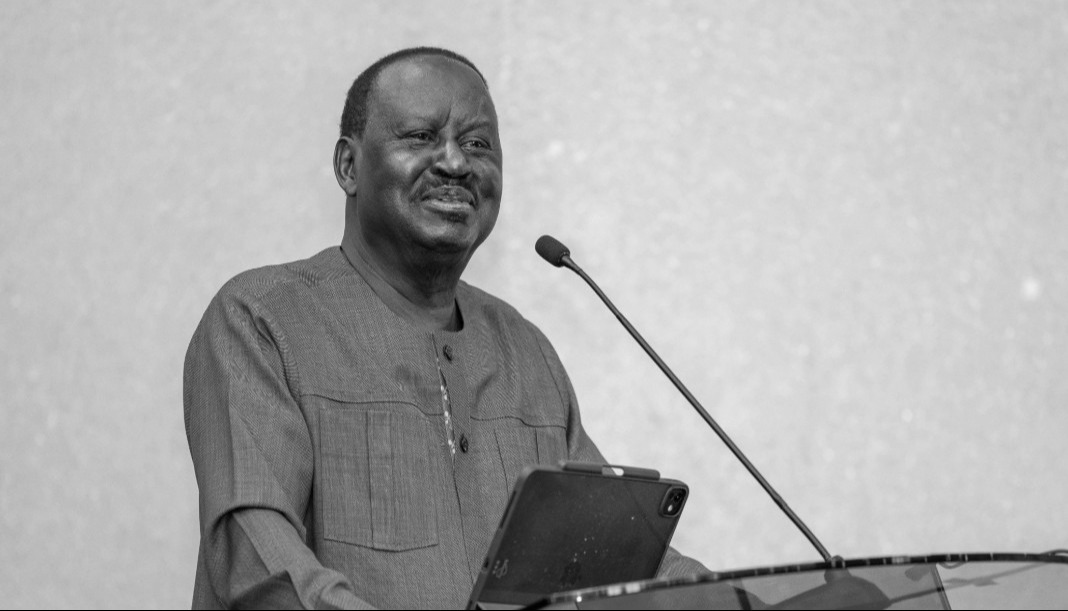

Members of the National Assembly’s Committee on Appointments following proceedings during the vetting of CS nominees on Saturday, August 3, 2024. (Photo: Parliament)

Members of the National Assembly’s Committee on Appointments following proceedings during the vetting of CS nominees on Saturday, August 3, 2024. (Photo: Parliament)Members of the National Assembly’s Committee on Appointments following proceedings during the vetting of CS nominees on Saturday, August 3, 2024.(Photo: Parliament)

"We should make the debt register a statutory document which should be published every year like we do other documents. It's not the government that owes money to China or to the World Bank or the IMF. We know the World Bank is the single most leading lender to Kenya in terms of amounts, followed by the Africa Development Bank. Number three is China, and number four is Eurobond. It is the people of Kenya that owe these people money. You cannot owe people money without knowing how much it is, so I want to put it out that debt accountability is important," he said.

The professional accountant further said the government must link projects to loans.

"We cannot borrow loans for general support. We lost it in 2014 when we shifted our borrowing strategy from specific donor-funded projects to general support. What has happened has happened but going forward, that is what we must do," he said.

On revenue mobilisation, Mbadi said the solution to tax mobilisation is not raising the tax base but targeting KRA.

"KRA is like a cow, which we milk without feeding. We have a provision that two per cent of our revenue should go towards building the capacity of our KRA, but we don't do it. The systems that KRA is using now need re-engineering; we are losing a lot of custom duties through smuggling and counterfeit products because we do not have a system that is foolproof," he said.

Mbadi added that the manner of KRA staff recruitment is also worrying and building on its general claps in capacity.

"You cannot have people who are not properly trained to collect taxes from people who hire properly trained accountants to calculate their taxes," Mbadi noted.

He stated that one of his priorities would be to meet with KRA management to discuss and spearhead reforms.

"There was a time we could collect 18 per cent in taxes of our GDP. Today we collect 14 per cent. If we could just increase 14 per cent to 8 per cent we would be adding about Sh600 billion to our revenue base," he said.

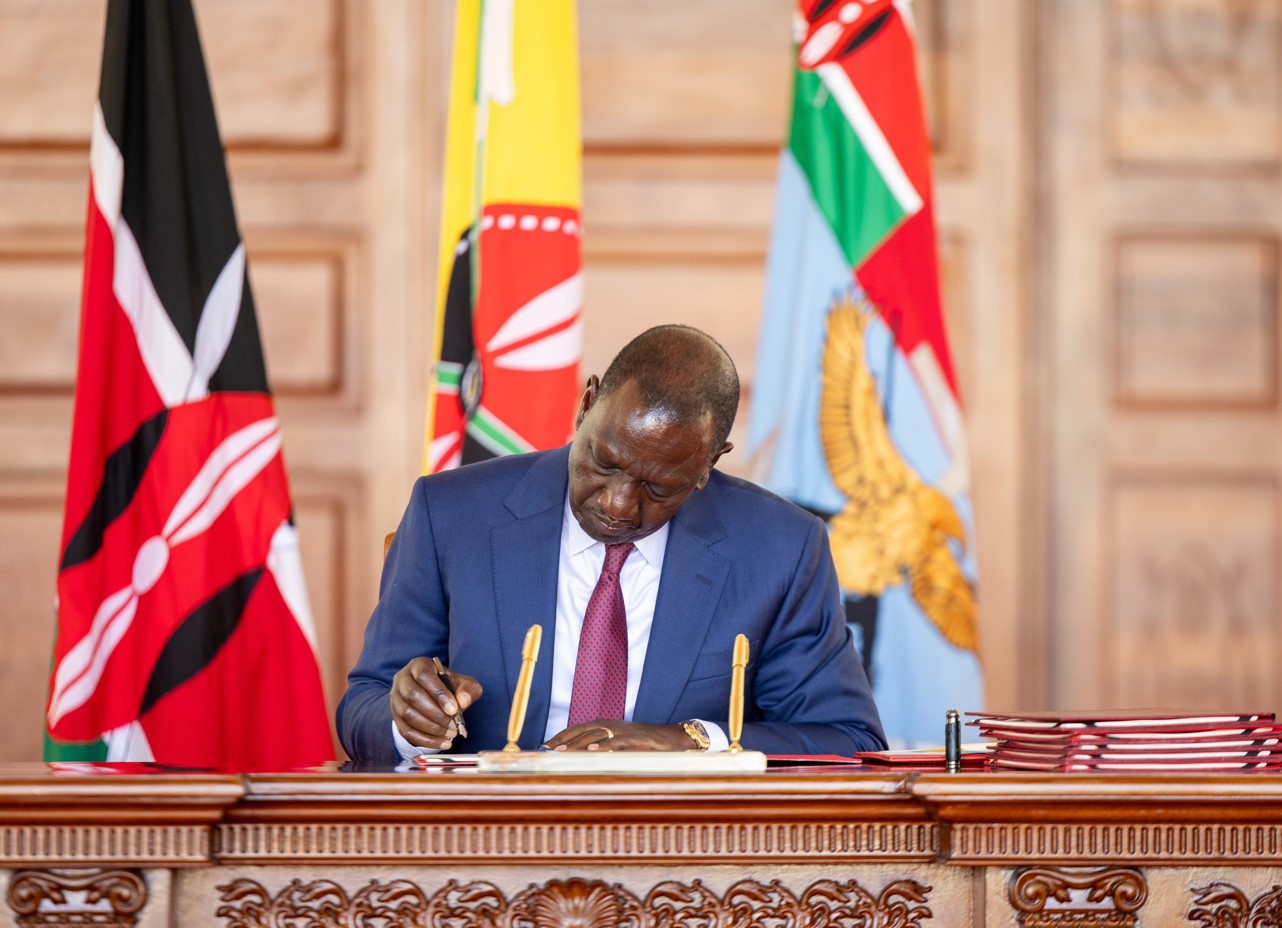

John Mbadi, Treasury CS nominee, appears before the National Assembly’s Committee on Appointments on Saturday, August 3, 2024.(Photo: Parliament)

John Mbadi, Treasury CS nominee, appears before the National Assembly’s Committee on Appointments on Saturday, August 3, 2024.(Photo: Parliament)John Mbadi, Treasury CS nominee, appears before the National Assembly’s Committee on Appointments on Saturday, August 3, 2024.(Photo: Parliament)

Top Stories Today