Treasury CS Mbadi vows to overhaul govt. payroll, reintroduce Finance Bill, 2024 proposals

The new CS said a team is working on some of the proposals from the withdrawn Finance Bill 2024, which he said contain valuable revenue-raising measures.

Newly appointed Treasury Cabinet Secretary John Mbadi has vowed to overhaul the payroll system for all government workers, pledging to integrate it with the Integrated Financial Management Information System (IFMIS).

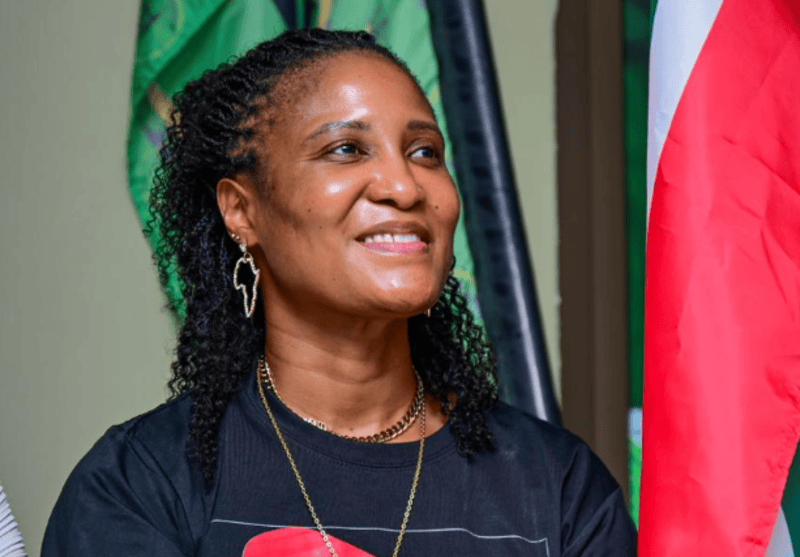

Mbadi spoke on Monday during the official handover ceremony in Nairobi, where he officially took over the office.

More To Read

- Treasury under fire for using Sh2.67 trillion in domestic loans on recurrent spending

- National Treasury secures Sh437.8 billion loan to plug budget deficit

- MPs raise alarm over alleged misappropriation of College of Insurance land

- MPs question rising debt despite Treasury’s reduced CBK borrowing

- National Treasury says weak revenue, high debt repayments straining Kenya’s budget

- CS Mbadi tables new banking rules targeting non-compliance, unethical practices

He emphasised that the reforms were crucial for improving the efficiency of government financial management.

“Clearly, if we cannot integrate our payroll systems from the state departments to IFMIS, which is our parent accounting system, and all the way to the Kenya Revenue Authority (KRA), then we don't know what we are doing,” he said.

He urged anyone opposed to the reforms to step aside, asserting that he wouldn’t allow anyone to interrupt the process.

“So anyone who is standing in the way of that reform, please give way. Please allow Kenya to move forward. Don't be an obstacle. Payroll reforms must be done,” he said.

Mbadi highlighted the urgency of the reforms given the recent challenges, including the collapse of both the Finance Bill, 2023 and Finance Bill, 2024.

He, however, asserted that a team is working on some of the proposals from the withdrawn Finance Bill 2024, which he said contain valuable revenue-raising measures.

“Our team at the Treasury is already working on some of the proposals that were in the Finance Bill 2024 which we can now put together and see how to take them to Parliament, not as Finance Bill but as other proposals. We will do an extensive public participation,” he said.

Resource management

He also called for the efficient use of resource management due to the scarcity of resources.

“We don't have an option now that resources have become scarce. We must prudently and efficiently use public resources by making public procurement systems efficient and not open to abuse. We must make sure end-to-end procurement works. If there are people who have benefited from the chaotic system, you have benefited enough. Now allow Kenyans to get value for money,” he said.

In addition, Mbadi said he is targeting an increase in state revenues by approximately Sh400 billion.

“If we could increase our revenue collection to GDP (Gross Domestic Product) by just about 3 per cent, I am sure that will give us almost an additional Sh400 billion. That will sort out a lot of our problems, bridge the budget deficit, and get the country moving forward,” he said.

Former Treasury CS Njuguna Ndung'u cautioned Mbadi about the current financial challenges, highlighting high tax expenditures which he said stood at 2.94 per cent as well as liquidity issues which affected payroll processing.

“The tax expenditures, which we wanted to address this fiscal year, stands at 2.94 per cent. Reducing these tax expenditures by even 2 per cent would significantly boost revenues,” Ndung'u said.

He also noted the impact of short-term debt on liquidity, which has delayed payroll clearance. He decried that the short-term debt, especially bills and bonds, has created a massive liquidity challenge.

“That is why sometimes we took up to three weeks to clear the payroll because of that liquidity problem, but it is not a solvency problem,” he said.

Ndung'u advised Mbadi to develop strategies to address these liquidity constraints and prevent solvency issues.

“What I would encourage my friend CS John Mbadi, this liquidity constraint requires strategic options to avoid creating solvency challenges. This requires a very strong signalling approach,” he said.

Top Stories Today