MPs halt consideration of Bill on unclaimed assets over vague amendments

Lack of consultation prompted concerns from lawmakers about the potential for misuse of the proposed amendments.

The National Assembly's Departmental Committee on Finance and National Planning has suspended the consideration of the Unclaimed Financial Assets (Amendment) Bill, 2023, following concerns raised about the clarity and intent of the proposed amendments.

The Unclaimed Financial Assets Authority (UFAA), which would be responsible for implementing the amendment, failed to provide sufficient details on how the changes would address issues in the original Unclaimed Financial Assets Act.

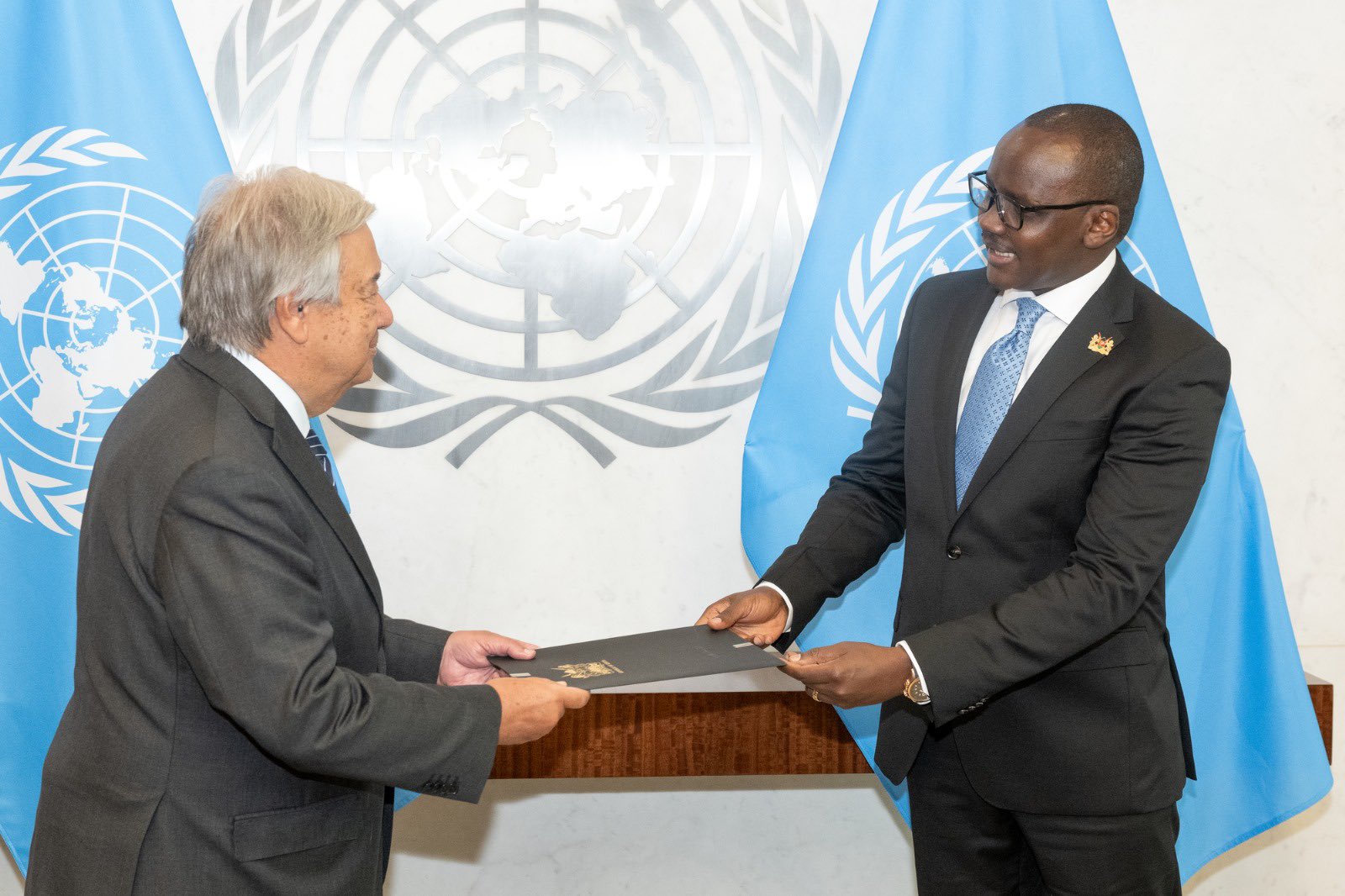

The committee, led by Molo MP Kuria Kimani, put UFAA's acting CEO Caroline Chirchir to task after she revealed that the authority had not fully discussed the Bill with the Ministry of National Treasury and Economic Planning.

This lack of consultation prompted concerns from lawmakers about the potential for misuse of the proposed amendments.

Committee Chairperson Benjamin Langat (Ainamoi) expressed his concerns, asking the UFAA to explain the challenges that led to the amendment.

He noted that the changes could have serious implications.

In response, Chirchir confirmed that while the UFAA agreed with the Bill's general objective, more time was needed for discussions with the parent ministry.

However, this explanation did not satisfy the committee, with Kesses MP Julius Rutto questioning how the UFAA could be unaware of the Bill's objectives while being tasked with its implementation.

"We shall not allow ourselves to make a law to suit the interests of others," he said.

Further scrutiny was raised by Kitui Rural MP David Mboni, who questioned the lack of safeguards in the proposed amendment, which could lead to potential abuse.

"What happens when the designated beneficiary passes on before filing the claim?" he asked, highlighting the risks of hasty approval.

Additional concerns were raised about the process of disposing of assets when beneficiaries are untraceable.

Members sought clarity on how the UFAA determines if a next of kin can be identified before transferring or selling unclaimed assets.

UFAA's corporation secretary assured the committee that no unclaimed assets had been transferred yet, and any such action would be done in accordance with the law and in the public interest.

Given the confusion surrounding the Bill, Langat directed the UFAA to harmonise its position with the National Treasury and return to the committee in two weeks for further discussions.

Other Topics To Read

The committee also expressed concerns over the treatment of interest accrued on unclaimed assets, suggesting that beneficiaries should be entitled to a share of the interest upon claiming their assets.

The Bill, which seeks to amend Sections 28 and 45 of the Unclaimed Financial Assets Act (2011), would allow claimants to designate another person to receive the proceeds of their unclaimed assets.

The Bill, sponsored by the Leader of the Majority, was introduced in March 2024 and has passed the first reading. It was then referred to the committee for further consideration.

Top Stories Today