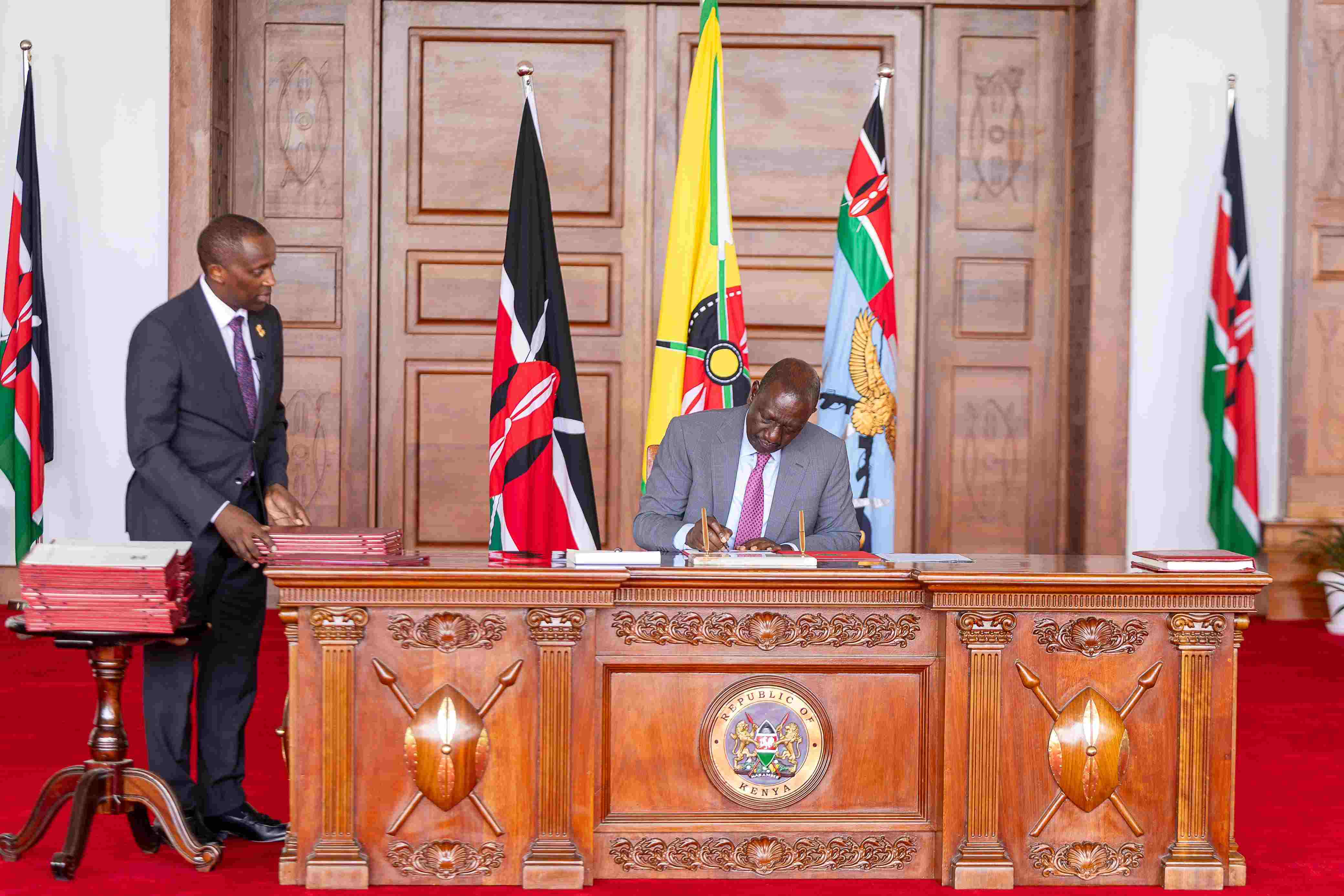

Content creators to pay taxes on monetised earnings under new law

Ruto said the government had successfully negotiated agreements with platforms like TikTok and Facebook to allow Kenyan creators to monetise their content.

Content creators in Kenya will now be taxed on income earned through the monetisation scheme introduced in April 2024.

This follows President William Ruto's signing of the Tax Laws (Amendment) Bill, 2024, into law.

More To Read

- TikTok removes over 590,000 videos in Kenya for violating guidelines

- Ruto amplifies Africa’s voice, calls for justice and inclusion at Doha summit

- President Ruto urges global unity to fight poverty, inequality at Doha summit

- Kenyans to replace lost IDs for free as Government gazettes six-month waiver on fees charged

- WhatsApp rolls out per-chat storage management, profile cover photos like Facebook

- Raila Odinga mastered the art of political compromise for the good of Kenya

The new initiative aims to establish a fair taxation system for all, recognising the significant revenue generated by Kenyan creators through digital platforms.

Speaking at the Kenya Private Sector Alliance’s 20th Anniversary celebrations in Nairobi, President Ruto highlighted the importance of taxing the digital content sector.

He noted that the government had successfully negotiated agreements with platforms like TikTok and Facebook to allow Kenyan creators to monetise their content.

"I negotiated with TikTok and Facebook, making Kenya one of only four countries where creators can monetise their accounts," Ruto said.

He added that some creators earn as much as Sh1 million from their content. "Someone earning Sh20,000 or Sh30,000 pays tax. If you earn Sh1 million, isn't it correct to contribute something to the tax kitty, especially when we've enabled you to achieve that? I think that makes sense, at least to me."

The Tax Laws (Amendment) Bill, 2024, includes provisions to incorporate digital operators into the tax framework. The bill has undergone public participation and is set for its Second Reading in Parliament.

In April, the government signed agreements with Google, Meta, and TikTok to facilitate content monetisation for Kenyan creators. President Ruto emphasised the potential of the country’s youth in various creative sectors, including music, theatre, digital animation, and emerging fields like virtual and augmented reality.

"Our highly talented youth are capable of creative excellence in such diverse fields as music, theatre and drama, graphic design and digital animation, fashion and craft, as well as new and emerging fields like virtual and augmented reality," he said.

However, Ruto’s claim that Kenya is one of only four countries where creators can monetise content has drawn scrutiny. Google’s policies reveal that 12 African countries, including Kenya, are part of YouTube's monetised markets.

These countries include Morocco, Nigeria, South Africa, Tunisia, Uganda, Zimbabwe, Egypt, Algeria, Ghana, and Libya.

Meta, on the other hand, has been offering monetisation options for content creators, albeit limited to brands and sponsored campaigns.

Top Stories Today