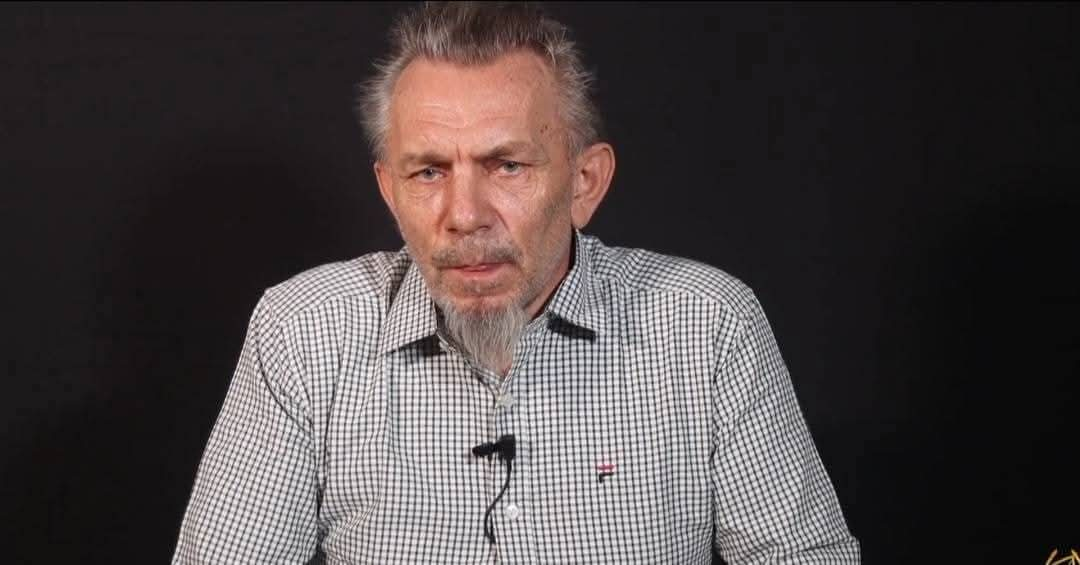

Court grants permission for Equity Bank to auction Moses Kuria's Kiambu property over Sh54m loan

The former Investments and Trade Cabinet Secretary did not contest the loan but explained that he had been unable to complete construction of the houses due to the Covid-19 pandemic.

The High Court has allowed Equity Bank to go ahead with the planned auction of property belonging to President William Ruto’s senior economic adviser, Moses Kuria, after dismissing his attempt to block the sale.

The court on Monday ruled that Kuria had failed to meet the legal requirements for stopping the auction.

More To Read

- Voters challenge Mbeere North MP Wamuthende’s victory over electoral name discrepancy

- KNEC under fire as High Court rebukes CEO over withheld student exam results

- How circuit, mobile courts expanded justice to underserved communities - report

- Koome reports historic 104 per cent case clearance rate, hails milestone for justice access

- Judiciary rolls out staff census in push for data-driven reforms

- Supreme Court to begin year-end recess on December 21

Justice Aleem Visram found that Equity Bank had followed the correct legal procedures in pursuing the Sh54 million loan recovery, and there was no valid reason to restrain the sale.

Kuria had taken the loan from the bank in 2018 to build five-storey rental apartments.

The judge noted that although Kuria admitted to owing the debt, he had not complied with repayment terms and previous attempts to renegotiate the loan had not yielded results.

“Further, it is evident that all efforts to renegotiate the terms of repayment and to handle the matter in an amicable manner have failed. There is, therefore, no valid ground upon which the bank ought to be restrained from exercising its statutory power of sale,” said Justice Visram.

Court documents show that Kuria used three properties in Kiambu as security for the loan. He had agreed to a nine-month moratorium on principal repayment, after which he would make 111 monthly instalments covering both principal and interest.

The former Investments and Trade Cabinet Secretary did not contest the loan but explained that he had been unable to complete construction of the houses due to the Covid-19 pandemic.

He cited the rising cost of building materials and a personal accident that left him hospitalised, which disrupted his financial plans.

Kuria told the court that the houses had since been completed, and he had initiated talks with the bank to resume payments.

However, records showed that loan servicing had stopped as of June 2022, with the outstanding amount standing at Sh54.3 million.

Following his failure to honour the loan agreement, the bank began issuing notices for the sale of the properties through Garam Investments Auctioneers.

Kuria had moved to court seeking an injunction to stop the auction, arguing that he had paid Sh733,000 towards settling the arrears.

The bank, on the other hand, said Kuria had initially agreed in January this year to pay Sh850,000 per month but failed to meet the terms.

“However, I take note that the said payment is less than the sum agreed to be paid between the parties, and based on the record, to date, no such appropriate payments have been made in accordance with the various agreement of the parties, prompting the Respondent to issue instructions to the 2nd Defendant (Garam) to sell the subject properties,” the judge ruled.

While acknowledging Kuria’s health issues, the court said they did not amount to legal justification for granting an injunction.

“I am satisfied, in light of the above, that the relevant statutory notices were duly served on the applicant and that the Bank’s statutory powers of sale have crystallised in accordance with the law,” said Justice Visram.

Top Stories Today