Audit exposes Sh332 billion in dormant assets held by banks, insurers

Public bodies are among the most non-compliant, with about 12,460 institutions identified as holding unclaimed assets. Although some hold detailed contact information, the lack of a legal obligation to share it has stalled recovery efforts.

Kenya’s Unclaimed Financial Assets Authority (UFAA) is facing intense scrutiny after a new audit revealed that over Sh332 billion in financial assets are yet to be recovered from institutions meant to surrender them.

The report exposes systemic weaknesses that have left many Kenyans disconnected from funds they legally own.

More To Read

- Audit flags leadership vacuum at Garissa University since 2022

- Auditor General calls for penalties on officers who ignore audit recommendations

- Auditor General Nancy Gathungu warns of pension losses as government delays remittances

- Revenue gaps, budget misalignments hurting service delivery, warns Auditor General

- Auditor General warns Kenya Railways’ Sh569 billion loan default could burden taxpayers

- Audit uncovers Sh13 billion irregularities in Ketraco wayleave payments

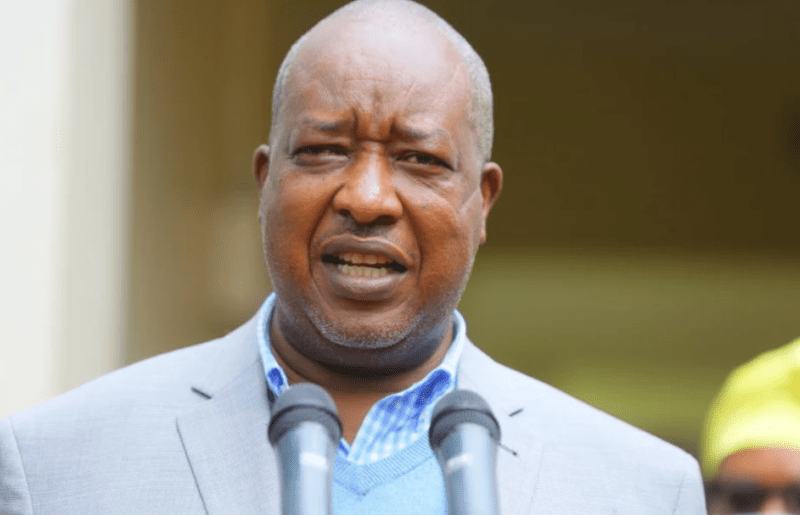

The audit, conducted by Auditor General Nancy Gathungu and covering 2018 to 2024, shows that the authority is struggling to enforce compliance, manage assets, and return them to rightful owners due to limited capacity, legal barriers, and operational inefficiencies.

Findings indicate that while a 2018 survey estimated unclaimed assets at Sh397 billion, UFAA has only managed to secure Sh65 billion by August 2024, representing just 16.4 per cent of the total.

“This indicates a relatively low compliance rate among holders in surrendering unclaimed assets,” Gathungu said.

The unclaimed wealth includes dormant bank accounts, unpaid dividends, insurance payouts, forgotten utility deposits, court bails, caution money from universities, shares, and items in safe deposit boxes.

Many assets remain unreported due to deaths, outdated contact information, or a simple lack of awareness.

Despite efforts to educate the public, interviews revealed that 59 per cent of sampled institutions were unaware of their duty to remit assets to UFAA.

To uncover hidden funds, the authority conducted 134 compliance audits and identified Sh12.2 billion that should have been handed over. Recovery, however, has been minimal.

Auditors also found that the fines imposed on non-compliant holders often exceed the value of the assets themselves. For instance, Carbacid Investments faced a Sh30.8 million penalty for unclaimed assets worth only Sh1 million, a rate of 2,870 per cent.

“Such punitive measures have discouraged holders from coming forward, leaving audits unresolved and assets unrecovered,” the report notes.

Public bodies are among the most non-compliant, with about 12,460 institutions identified as holding unclaimed assets. Although some hold detailed contact information, the lack of a legal obligation to share it has stalled recovery efforts.

Even for assets already in UFAA’s custody, reunification is slow. As of June 2024, the authority held Sh29.6 billion in cash and 1.2 billion shares. Assets worth Sh307 million had missing or incomplete information, making it nearly impossible to identify owners.

The audit also highlights the costly and cumbersome claims process. For example, to claim Sh100, a person must hire a lawyer to commission forms at around Sh500 and visit the original holder for confirmation.

The findings underscore the urgent need for reforms to ensure the authority can recover, safeguard, and return assets while preventing financial loss to Kenyans and the state.

Top Stories Today